New York Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

How to fill out Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

If you intend to collect, acquire, or print official document templates, utilize US Legal Forms, the largest range of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and locations, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Use US Legal Forms to retrieve the New York Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Obtain button to locate the New York Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your correct city/state.

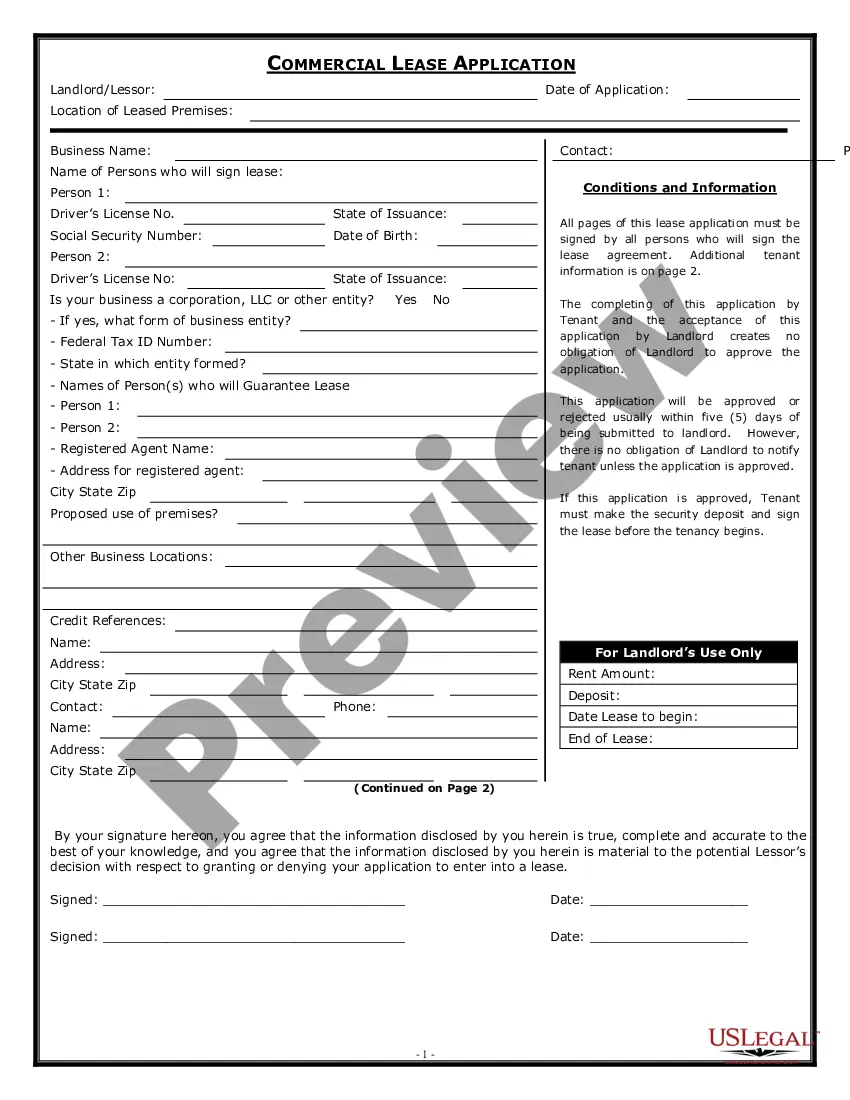

- Step 2. Use the Preview option to view the form’s details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions in the legal form format.

Form popularity

FAQ

ANSWER: Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401(k) plan offers one or more annuity forms of distribution. Here is a summary of these rules and the way many 401(k) plans avoid spousal consents.

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

A qualified pre-retirement survivor annuity (QPSA) is a death benefit that is paid to the surviving spouse of a deceased employee.

A qualified joint and survivor annuity (QJSA) provides a lifetime payment to an annuitant and spouse, child, or dependent from a qualified plan. QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits.

A Spouse has an interest in your 401k and before that interest is given up -- as with a beneficiary change or withdrawal -- they must agree. Spousal consent rules with respect to qualified plans stem from the Retirement Equity Act of 1984 (REA).

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

A married participant is required to obtain written spousal consent if she chooses to name a primary beneficiary other than her spouse. This rule is in effect for all qualified retirement plans, regardless of whether they are subject to the REA or designed as an REA safe harbor plan.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A spousal consent is a document signed by the spouse of a member in a limited liability company that has an operating agreement amongst the members or a shareholder in a corporation that has a shareholders agreement amongst the shareholders.

Spouse must consent to the waiver of the annuity to receive a cash distribution of RMDs. Otherwise the RMD must be an annuity payment. Usually, the participant and spouse waive the annuity before RBD and the RMD is paid in cash.