Full text of legislative history behind the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

New York Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History

Description

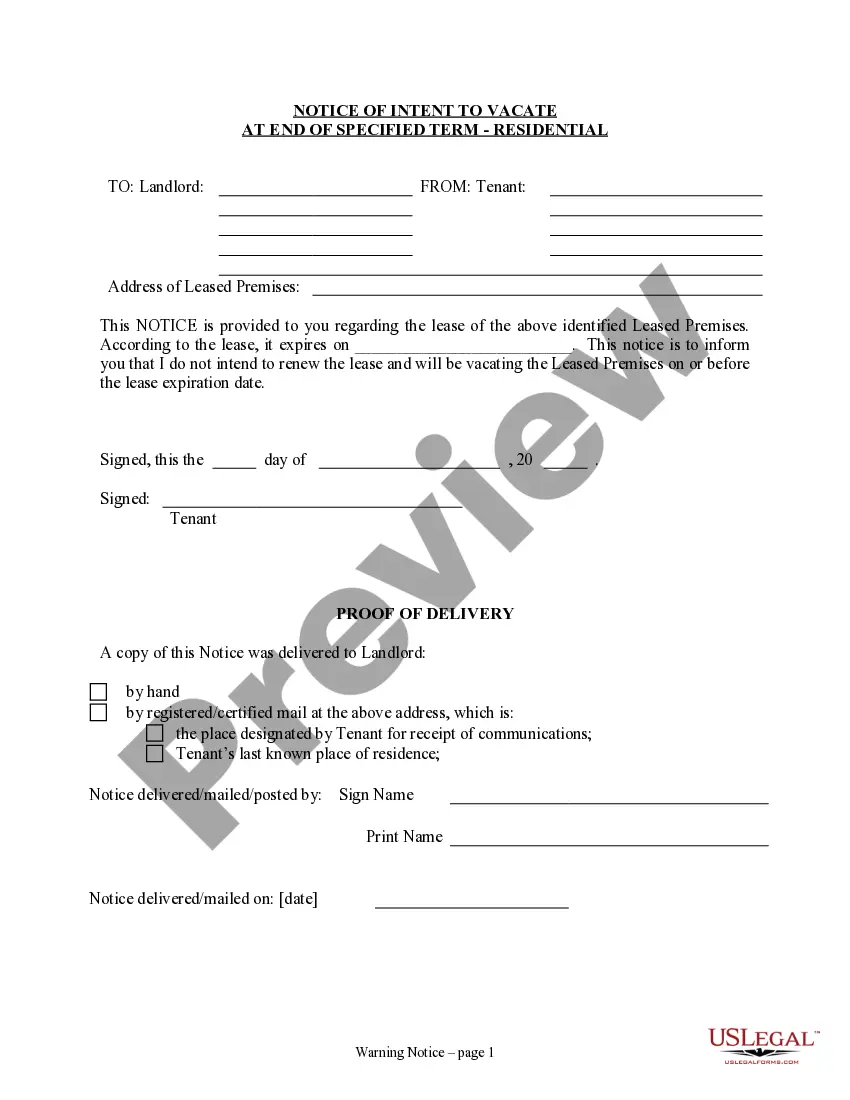

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act Legislative History?

Discovering the right legitimate file design can be quite a have a problem. Obviously, there are tons of templates available on the Internet, but how will you discover the legitimate develop you will need? Use the US Legal Forms internet site. The service offers 1000s of templates, such as the New York Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History, which can be used for enterprise and personal requirements. All of the kinds are checked out by experts and satisfy federal and state demands.

If you are previously authorized, log in to your profile and click on the Down load key to get the New York Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History. Make use of your profile to check through the legitimate kinds you have ordered in the past. Proceed to the My Forms tab of your respective profile and acquire one more duplicate of your file you will need.

If you are a new user of US Legal Forms, listed here are straightforward guidelines that you can adhere to:

- Initial, be sure you have chosen the appropriate develop for your area/state. It is possible to look over the shape using the Review key and read the shape information to ensure it is the right one for you.

- In the event the develop does not satisfy your requirements, take advantage of the Seach area to obtain the appropriate develop.

- When you are certain that the shape is acceptable, click the Acquire now key to get the develop.

- Opt for the pricing strategy you want and enter the essential info. Create your profile and buy the order using your PayPal profile or charge card.

- Select the submit formatting and acquire the legitimate file design to your gadget.

- Comprehensive, edit and printing and signal the obtained New York Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History.

US Legal Forms is the most significant catalogue of legitimate kinds in which you can discover numerous file templates. Use the company to acquire professionally-manufactured paperwork that adhere to condition demands.

Form popularity

FAQ

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

Are all policies fully protected? Life Insurance Net Cash Surrender$100,000 per insured lifeLife Insurance Death Benefit$300,000 per insured lifeDeferred Annuity Net Cash Surrender$250,000 per contract ownerAnnuity in Benefit$300,000 per contract owner2 more rows

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

For purposes of administration and assessment, the Association must maintain 2 accounts: (1) The life insurance and annuity account, which includes the following subaccounts: (a) Life Insurance Account; (b) Annuity account, which shall include annuity contracts owned by a governmental retirement plan (or its trustee) ...

§56-12-205 For purposes of administration and assessment, the association shall maintain two (2) accounts: (1) The life insurance and annuity account, which includes the following subaccounts: (A) Life insurance account; and (B) Annuity account, excluding unallocated annuities; and (2) The health account.

For purposes of administration and assessment, the association shall be divided into three separate accounts: A. The workers' compensation insurance account; B. The automobile insurance account; and C.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.