New York Notice of Meeting of LLC Members To Consider the Resignation of the Manager of the Company and Appoint a New Manager

Description

How to fill out Notice Of Meeting Of LLC Members To Consider The Resignation Of The Manager Of The Company And Appoint A New Manager?

Are you currently in a position where you require documentation for both business or personal purposes nearly every day? There are numerous legal document templates available online, but finding forms you can trust isn’t easy.

US Legal Forms offers a vast array of form templates, including the New York Notice of Meeting of LLC Members To Consider the Resignation of the Manager of the Company and Appoint a New Manager, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the New York Notice of Meeting of LLC Members To Consider the Resignation of the Manager of the Company and Appoint a New Manager template.

Find all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the New York Notice of Meeting of LLC Members To Consider the Resignation of the Manager of the Company and Appoint a New Manager at any time if needed. Just access the required form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and ensure it is for the correct city/state.

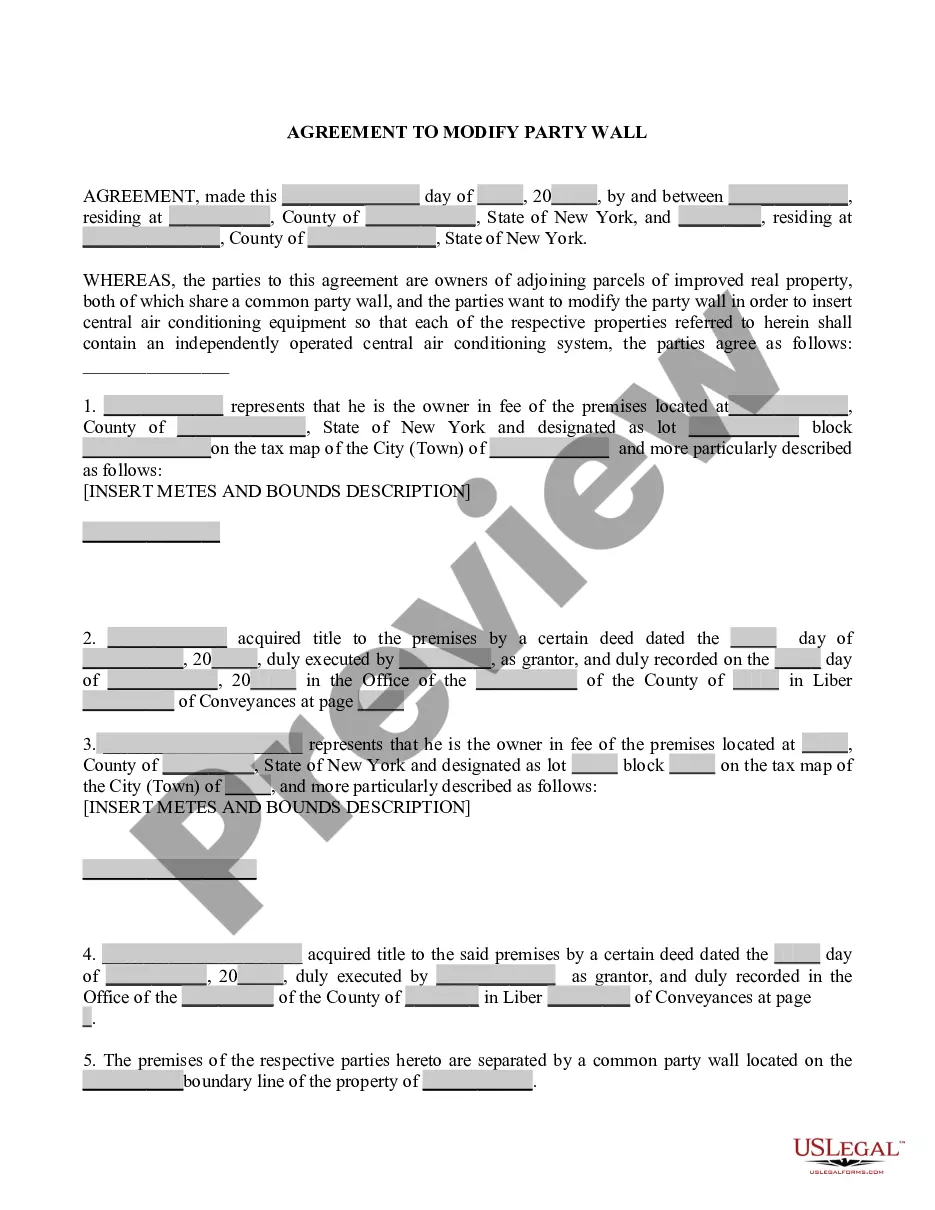

- Use the Preview button to review the form.

- Check the details to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the right form, click Purchase now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient format and download your copy.

Form popularity

FAQ

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Generally, shareholders are not personally liable for the debts of the corporation. Creditors can only collect on their debts by going after the assets of the corporation. Shareholders will usually only be on the hook if they cosigned or personally guaranteed the corporation's debts.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

LLC owners are generally called members. Many states don't restrict ownership, meaning anyone can be a member including individuals, corporations, foreigners, foreign entities, and even other LLCs.

LLC owners are referred to as members, and ownership can include only one member or many members, with members comprising individual people, other business entities or both.

This consent approves, adopts, and authorizes organizing actions of the LLC, such as ratifying actions of the organizer, adopting the operating agreement, electing the initial officers, and authorizing the opening of bank accounts.

"Piercing the corporate veil" refers to a situation in which courts put aside limited liability and hold a corporation's shareholders or directors personally liable for the corporation's actions or debts. Veil piercing is most common in close corporations.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.