New York Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders

Description

How to fill out Resolution Of Directors To Dissolve Corporation With Submission Of Proposition To Stockholders?

It is possible to devote hours on the web searching for the legal document template that meets the state and federal demands you will need. US Legal Forms gives 1000s of legal types that are examined by pros. It is possible to download or print out the New York Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders from my services.

If you currently have a US Legal Forms profile, you may log in and click on the Down load switch. Next, you may comprehensive, change, print out, or indication the New York Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders. Every single legal document template you get is your own eternally. To obtain one more copy of any obtained type, visit the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site initially, keep to the easy directions beneath:

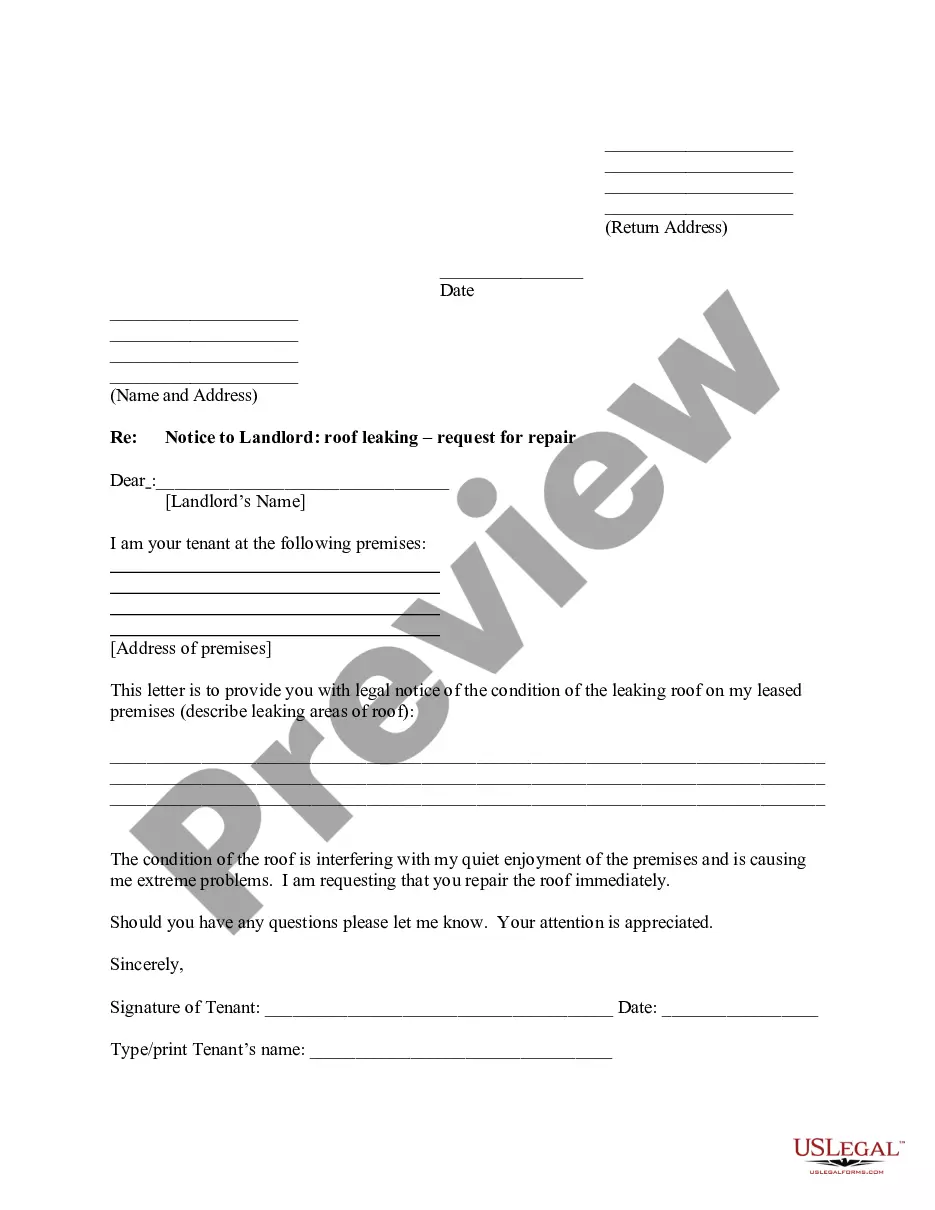

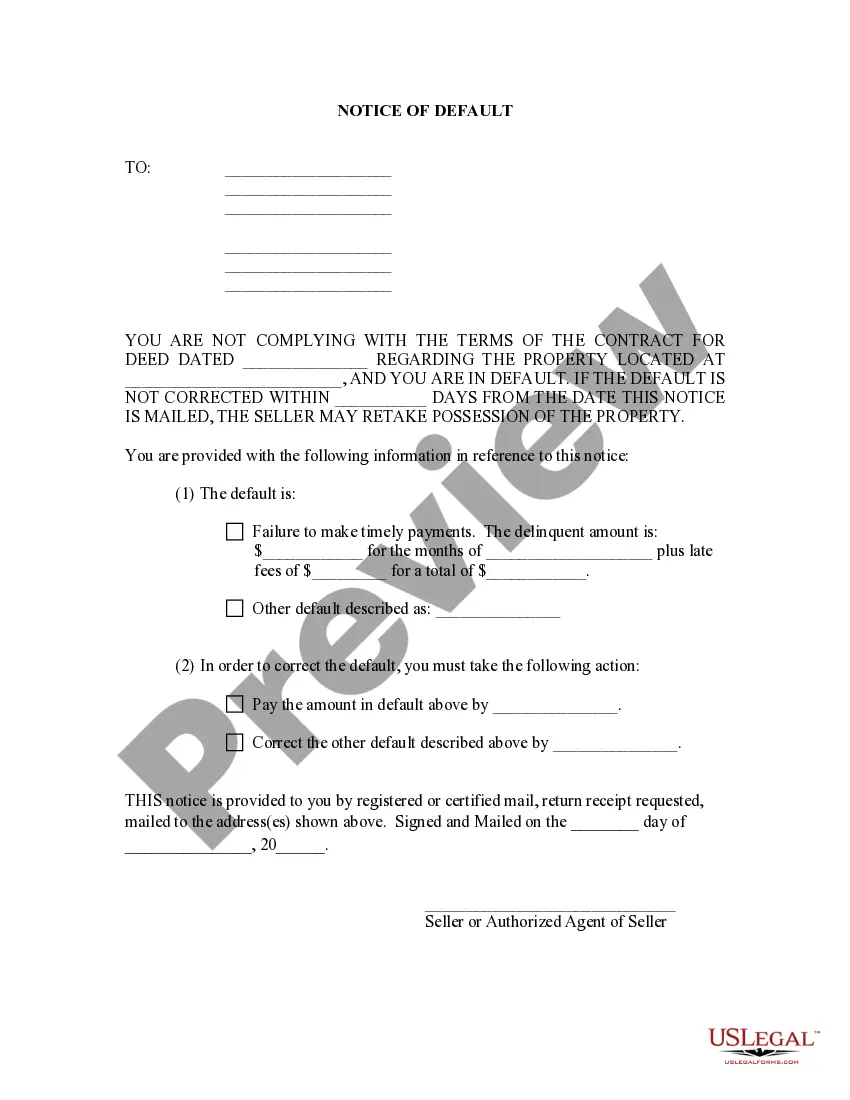

- Initial, make sure that you have selected the right document template for the state/city of your liking. Read the type outline to ensure you have picked the proper type. If available, take advantage of the Review switch to check through the document template also.

- If you wish to get one more version in the type, take advantage of the Search industry to obtain the template that suits you and demands.

- After you have identified the template you need, click Get now to continue.

- Select the prices prepare you need, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal profile to pay for the legal type.

- Select the structure in the document and download it to your device.

- Make alterations to your document if needed. It is possible to comprehensive, change and indication and print out New York Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders.

Down load and print out 1000s of document themes making use of the US Legal Forms Internet site, which offers the most important variety of legal types. Use expert and status-certain themes to handle your organization or person requirements.

Form popularity

FAQ

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.

In general, the majority vote of the shareholders or members of a closely-held company can elect corporate dissolution. It may then be left to the officers or directors of the company to execute on winding down the company and distributing assets.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.

Complete the process by filing with the New York Department of State written consent from the Tax Department (Form TR-960, Consent to Dissolution of a Corporation); one Certificate of Dissolution; and. a check for $60 payable to the New York Department of State.

Some taxpayers are selected regularly because of their size, sales volume, or the complexity of their returns. Others may be chosen because of a specific event. For example, closing a store in a particular location, bankruptcy, or the dissolution of the business may trigger an audit.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

The directors must formally agree to close down the company, either by passing a resolution at a board meeting or by written board resolution. You can then complete and file Companies House Form DS01.

Notify creditors and make payment arrangements for all debts. Close bank accounts and pay federal, state and local taxes along with filing the appropriate returns. Relevant permits should be canceled along with assumed names. Sell any remaining business property and distribute the appropriate funds to shareholders.