New York Private Client General Asset Management Agreement

Description

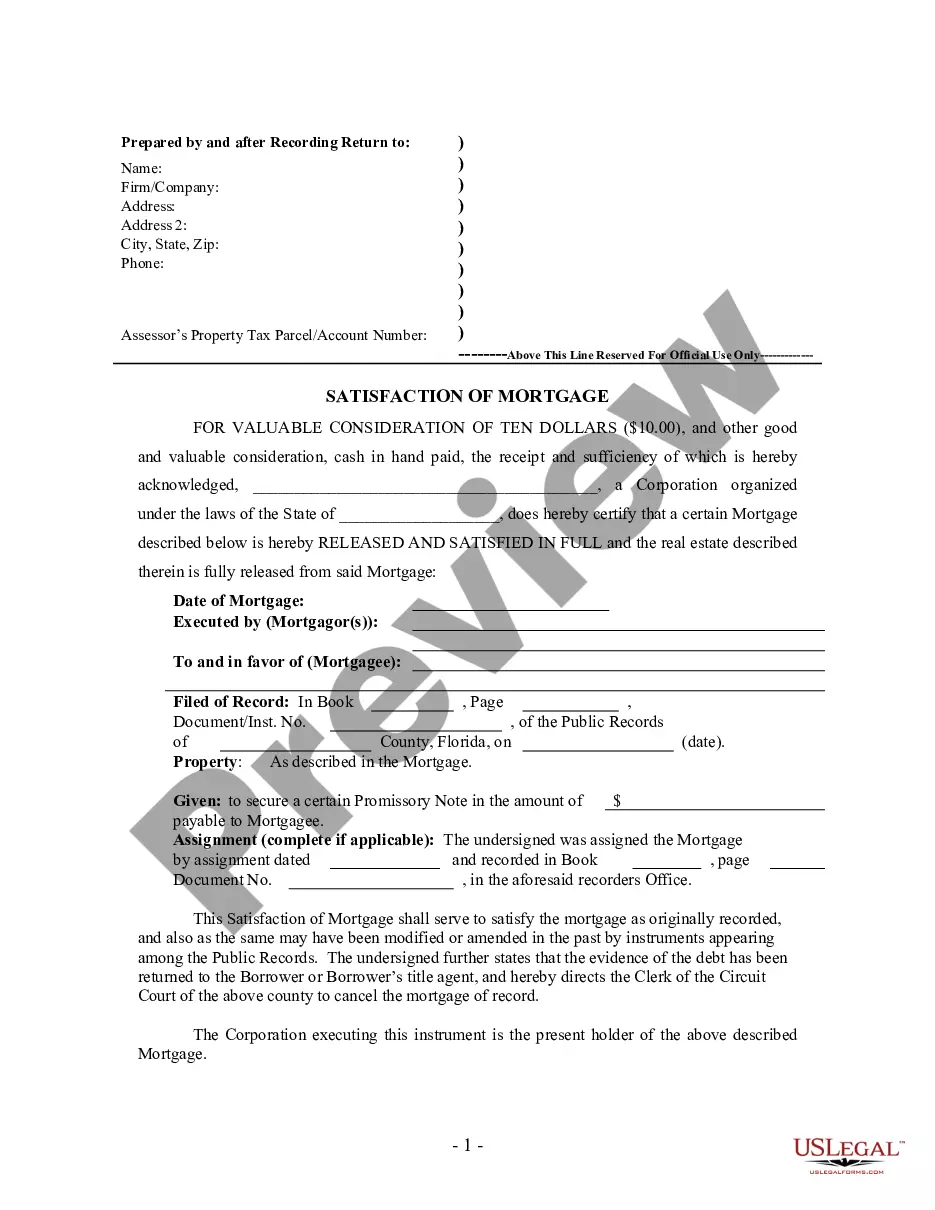

How to fill out Private Client General Asset Management Agreement?

US Legal Forms - one of the largest collections of lawful documents in the USA - provides a variety of legal document templates that you can download or create.

While using the website, you can find thousands of forms for business and personal purposes, organized by type, state, or keywords. You can quickly locate the latest forms such as the New York Private Client General Asset Management Agreement.

If you already have a monthly subscription, Log In and download the New York Private Client General Asset Management Agreement from the US Legal Forms library.

Examine the form summary to confirm that you have selected the right document.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents tab of your account.

- To use US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the form’s content.

Form popularity

FAQ

If you lack experience in asset management, focus on building your knowledge through online courses, financial certifications, or networking events. Look for entry-level positions or internships that allow you to learn on the job. A New York Private Client General Asset Management Agreement can serve as a guide to client expectations, helping you gain practical insights even without prior experience.

To enter asset management, begin by developing a strong educational foundation in finance or a related field. Search for internships and entry-level positions that provide practical experience. Familiarizing yourself with a New York Private Client General Asset Management Agreement can give you insight into the profession and help you understand client requirements, setting you apart from the competition.

Starting a career in asset management involves gaining a solid education in finance, business, or economics. Seek internships and networking opportunities, as practical experience is invaluable. Additionally, review resources such as a New York Private Client General Asset Management Agreement to understand how asset management works and what clients expect, enhancing your knowledge as you begin your career journey.

Breaking into institutional asset management often requires a strong finance background and relevant internships or entry-level positions. Firms generally look for candidates with a clear understanding of capital markets and investment strategies. Utilizing tools like a New York Private Client General Asset Management Agreement can streamline your learning curve by clarifying institutional client needs and expectations.

To obtain an asset management license, you typically need to complete required exams, such as the Series 7 and Series 63. These licenses verify your knowledge and approve you for managing client investments. A New York Private Client General Asset Management Agreement can help you understand the essentials of your roles and responsibilities, positioning you for success as you pursue your license.

Entering the asset management field can be competitive, but it is manageable with the right approach and resources. Many positions require a solid understanding of finance and investment strategies. However, a New York Private Client General Asset Management Agreement can provide clarity on client expectations and services, making it easier to navigate your entry. Focus on building relevant skills and networking within the industry to enhance your opportunities.

Asset managers typically attract clients through networking, referrals, and showcasing their expertise in investment strategies. They may also utilize targeted marketing efforts to reach potential clients. By presenting the benefits of a well-structured New York Private Client General Asset Management Agreement, asset managers can demonstrate the value of their services to prospective clients.

Asset management focuses on growing and preserving a client’s wealth through strategic investing. This involves analyzing market conditions, selecting appropriate investment vehicles, and managing risks. The New York Private Client General Asset Management Agreement ensures that clients receive personalized services tailored to their unique financial situations.

Asset management clients are individuals or entities that seek professional management of their investment portfolios. They usually require expert guidance to make informed financial decisions and ensure the growth of their assets. The New York Private Client General Asset Management Agreement helps establish a formal relationship, clarifying the services provided and the expectations of both parties.

To effectively structure an investor agreement, start by outlining the roles and responsibilities of both parties. Include details about investment strategies, fees, and the duration of the agreement. Utilizing the New York Private Client General Asset Management Agreement can provide a solid framework for these terms, ensuring clarity and mutual understanding.