New York Partnership Agreement for Profit Sharing

Description

How to fill out Partnership Agreement For Profit Sharing?

Have you ever been in a situation where you needed documentation for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms provides a vast collection of form templates, including the New York Partnership Agreement for Profit Sharing, which are designed to comply with state and federal regulations.

Choose a payment plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New York Partnership Agreement for Profit Sharing template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct area/county.

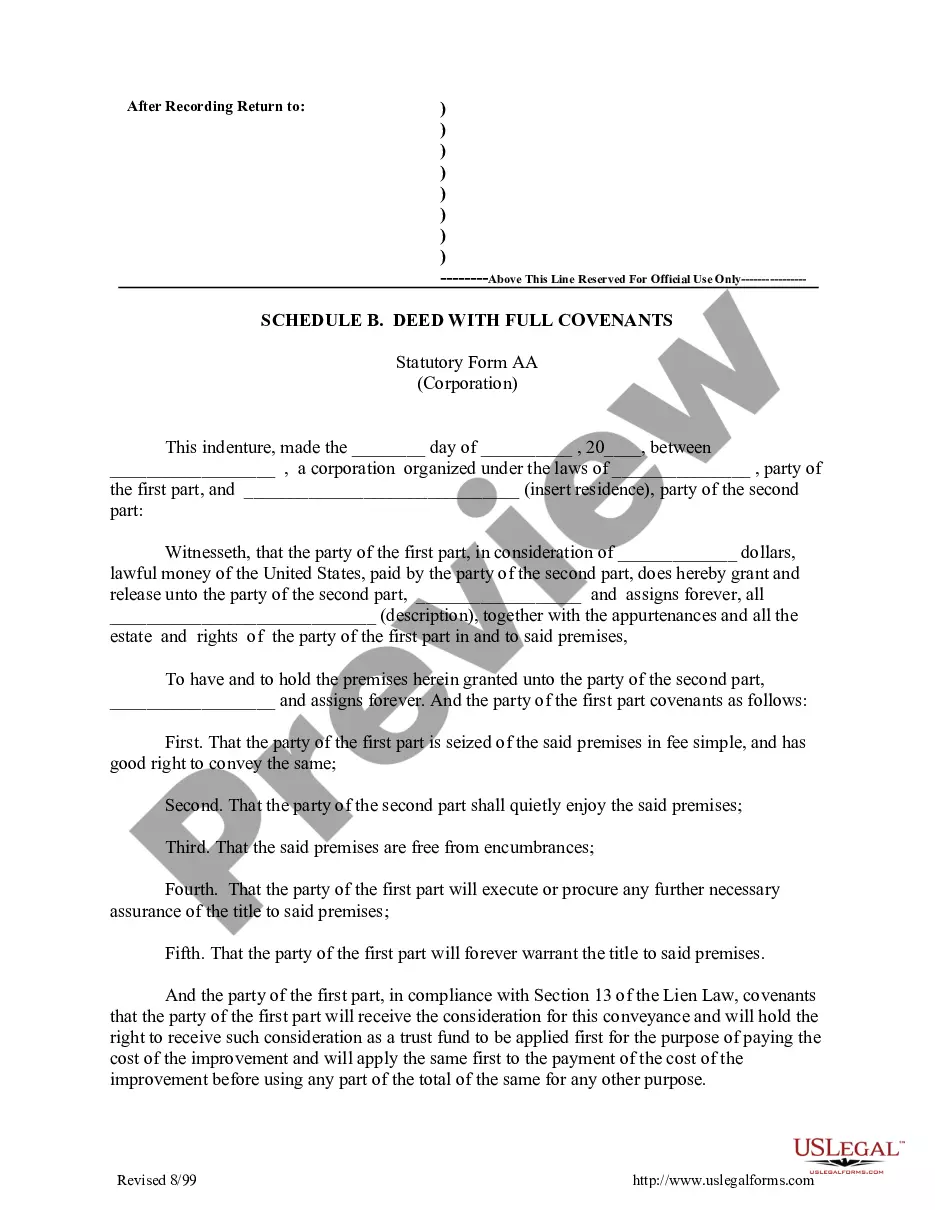

- Use the Review button to inspect the form.

- Check the details to make sure you have selected the right template.

- If the template is not what you're looking for, use the Search section to find the form that suits your needs and requirements.

- Once you have found the correct template, click Purchase now.

Form popularity

FAQ

There's no right or wrong way to split partnership profits, only what works for your business. You can decide to pay each partner a base salary and then split any remaining profits equally, or assign a percentage based on the time and resources each person contributes to the company.

How to Write a Profit-Sharing Agreement?Introduction. The document should start with a title, it will help to express the nature of the document.Nature of the Relationship.The Subject.Parties' Rights and Responsibilities.Governing Law.Contact Information.Signatures.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Multiply the total income the partnership decides to share out to partners by the accounting ratio of each worker. For instance, if the total income to be shared out is set at $100,000 and you have an accounting ratio of 0.1, or 10 percent, your profit share would be $10,000.

When forming a partnership, the business owners have the option of creating an agreement that dictates how profits or losses pass through to members of the partnership. Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified.

This means that in a partnership there is more than one owner, and the profit is shared between the owners. In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

There's no right or wrong way to split partnership profits, only what works for your business. You can decide to pay each partner a base salary and then split any remaining profits equally, or assign a percentage based on the time and resources each person contributes to the company.

In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio. The residual profit is the amount of profit remaining after taking into account the fact that the partners will be entitled to a proportion of the profit under the terms of the partnership agreement.