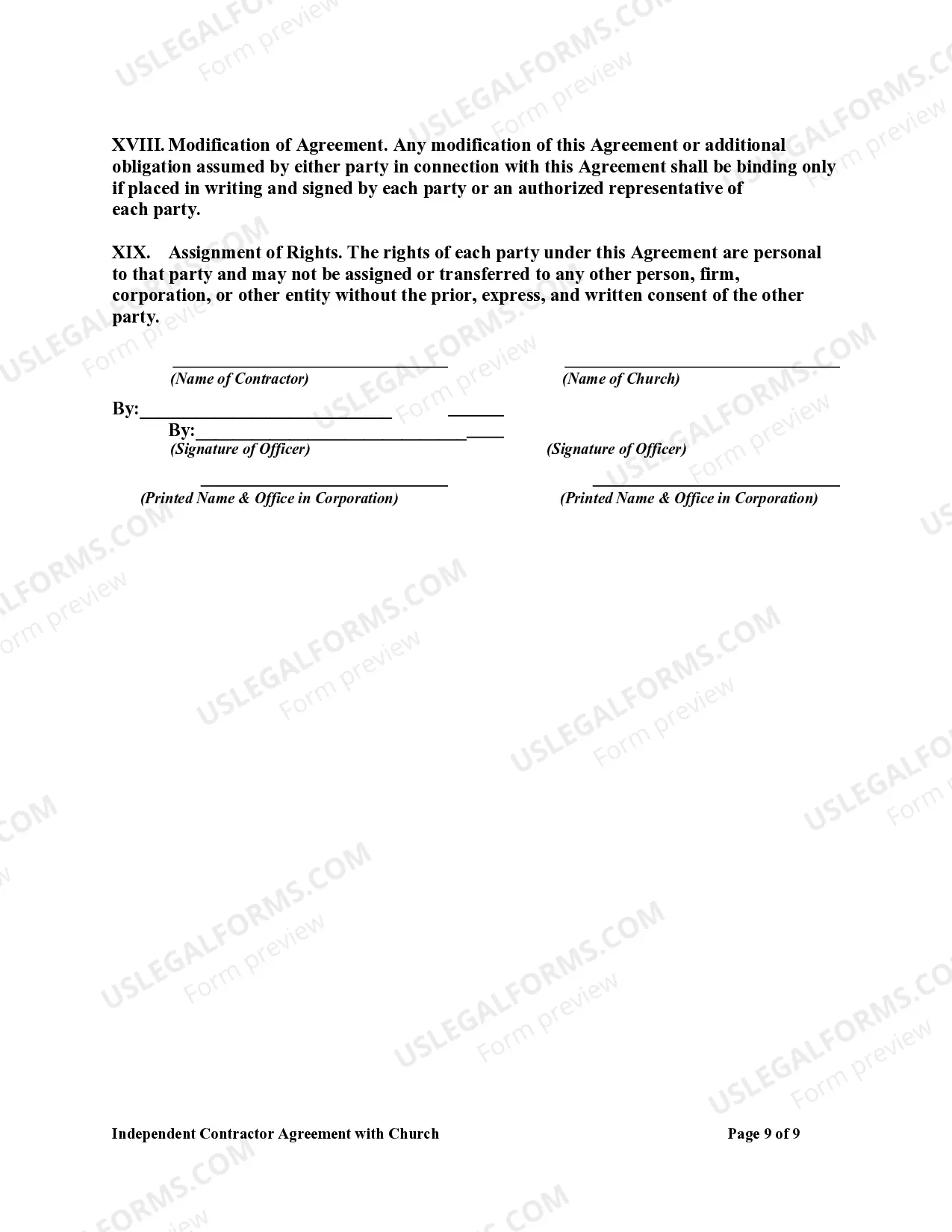

New York Independent Contractor Agreement with Church

Description

How to fill out Independent Contractor Agreement With Church?

Are you in a situation where you need documents for either business or personal purposes constantly? There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the New York Independent Contractor Agreement with Church, that are designed to comply with both state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New York Independent Contractor Agreement with Church template.

- Obtain the form you need and confirm it is for the correct city/county.

- Use the Review button to examine the form.

- Read the description to ensure you have selected the proper form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you want, complete the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Nonprofits typically issue W-2 forms to employees and 1099 forms to contractors. This reflects the nature of the work agreement. If a nonprofit enters into a New York Independent Contractor Agreement with Church, it should follow these guidelines. Clear documentation keeps financial practices transparent and lawful.

Generally, church employees receive W-2 forms, while independent contractors get 1099 forms. This classification determines how taxes are handled for both parties. Utilizing a New York Independent Contractor Agreement with Church makes the terms clear for independent contractors. Understanding these distinctions is important for all parties involved.

Yes, a church can receive 1099 forms, especially if it pays independent contractors. These forms report earnings that exceed $600 within a tax year. When entering into a New York Independent Contractor Agreement with Church, ensure proper documentation for these payments. It keeps your financial records clear and compliant.

Most church employees are classified as W-2 workers. This means the church takes care of taxes, and employees receive standard benefits. However, contract workers, such as teachers or musicians, may operate under a New York Independent Contractor Agreement with Church. This distinction impacts both taxation and benefits.

Church musicians often receive payments as independent contractors, leading to 1099 forms. This classification helps the church avoid payroll taxes. When you enter into a New York Independent Contractor Agreement with Church, it clarifies the financial relationship. Thus, it is essential to consult a professional for your specific situation.

Whether a church musician is an employee or independent contractor depends on their work arrangement. If they have autonomy and a contractual agreement defining their work, they are likely independent contractors. A solid New York Independent Contractor Agreement with Church is essential to clarify this status and avoid potential legal issues.

The 2-year contractor rule refers to specific guidelines and regulations that may impact how long a contractor can operate without being reclassified as an employee. Understanding this rule is crucial for both parties involved. A detailed New York Independent Contractor Agreement with Church can assist in ensuring compliance and delineating project timelines.

The new federal rule aims to simplify the classification of independent contractors, making it clearer who qualifies under this designation. It emphasizes the importance of control and independence in the working relationship. Churches and related organizations can benefit from a comprehensive New York Independent Contractor Agreement with Church to align with these federal guidelines.

Many music artists work as independent contractors, particularly when they have the autonomy to choose their venues and contracts. This allows them to manage their business operations while engaging with multiple clients or churches. A structured New York Independent Contractor Agreement with Church can further delineate the expectations and rights of both parties.

To be classified as an independent contractor, a person must meet specific criteria, such as controlling how their work is performed and having the freedom to take on multiple clients. Typically, independent contractors work under a contract that outlines their scope of work. Utilizing a New York Independent Contractor Agreement with Church can help clearly define these aspects.