New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the largest collections of authentic documents in the USA - offers a wide range of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent editions of forms such as the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in just seconds.

If you already possess a subscription, Log In and download the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from your US Legal Forms library. The Download button is available on every form you view. You can access all previously saved forms in the My documents section of your profile.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Each format added to your account is yours indefinitely, so if you wish to download or print another copy, just head to the My documents section and click on the form you need. Access the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with US Legal Forms, the most comprehensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- To utilize US Legal Forms for the first time, follow these straightforward steps.

- Ensure you have selected the correct form for your area/state.

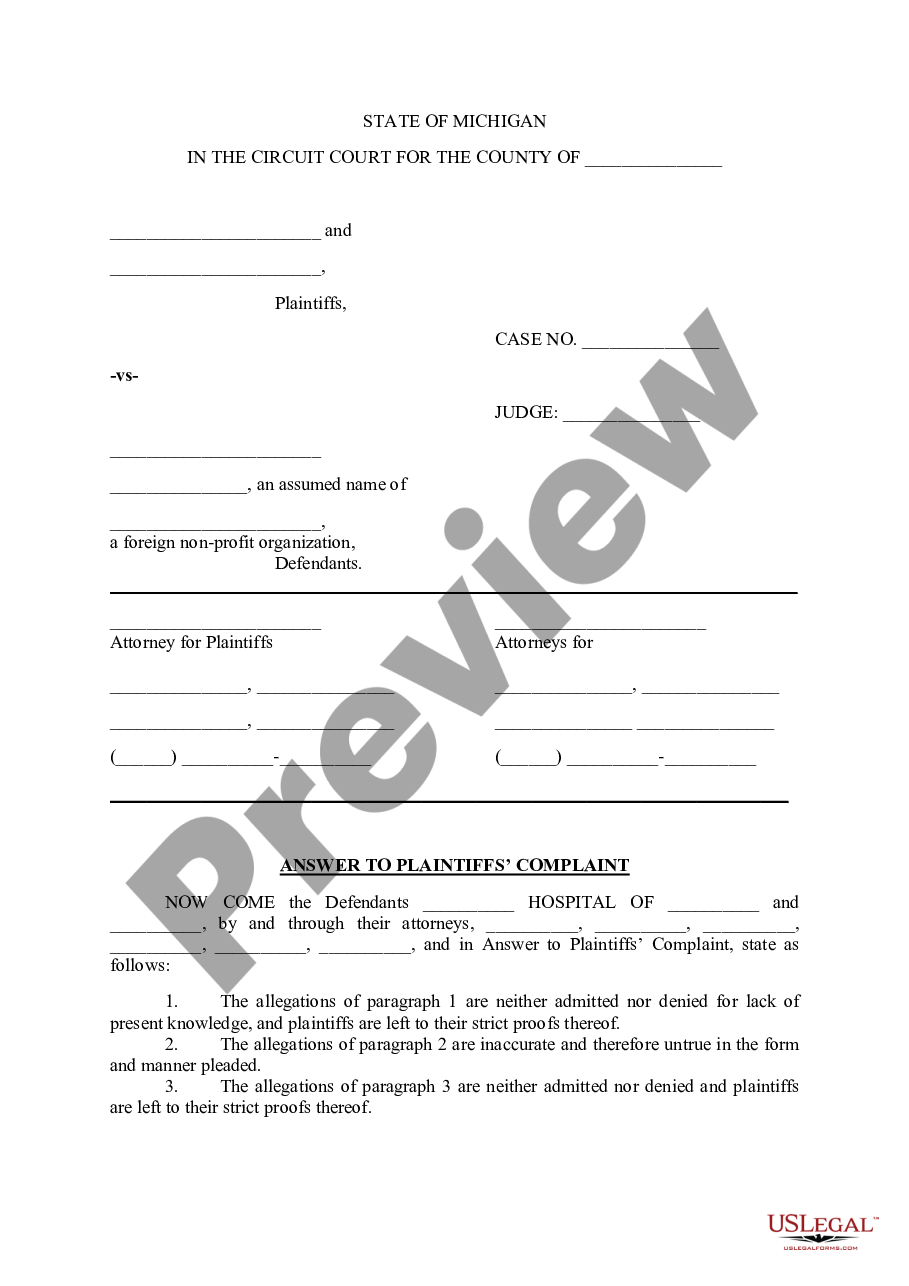

- Click the Review button to examine the form's content.

- Check the form summary to ensure you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, choose your preferred payment plan and provide your details to sign up for an account.

Form popularity

FAQ

You do not always receive a 1099-S when selling your house. Only transactions that meet certain criteria trigger this reporting requirement. If your sale qualifies for the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, it’s possible you may not receive a 1099-S. Always review your specific circumstances with a qualified professional.

The State of New York does have a 4% state sales tax and permits local authorities to obtain a 4.875% local choice sales tax. There are 640 local tax authorities in the state, with a median local tax of 4.254%.

In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.

The only way to minimize the transfer tax for sellers is through the use of a purchase CEMA, which is also known as a splitter.

The NY transfer tax rate is computed at two dollars for every $500 of consideration. If the property sale price is $1 million or more, an additional tax of 1% of the sale price is applied. This is often referred to as a mansion tax. The seller pays NY transfer tax in a sale transaction.

Generally, however, the taxes are 15% for residents of the United States who live in New York State. In addition, approximately 10% is added for city taxes. Some individuals will be able to qualify for not having to pay Capital Gains.

As far as the effect the length of time you've owned a home is concerned, any real estate in New York that is purchased and sold within a year is subject to being taxed as ordinary income at the applicable 35% rate.

Estimated Income Tax Payment Form. For use on sale or transfer of real property by a nonresident of New York State.

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada). 2.