New York Sample Letter for Assets and Liabilities of Decedent's Estate

Description

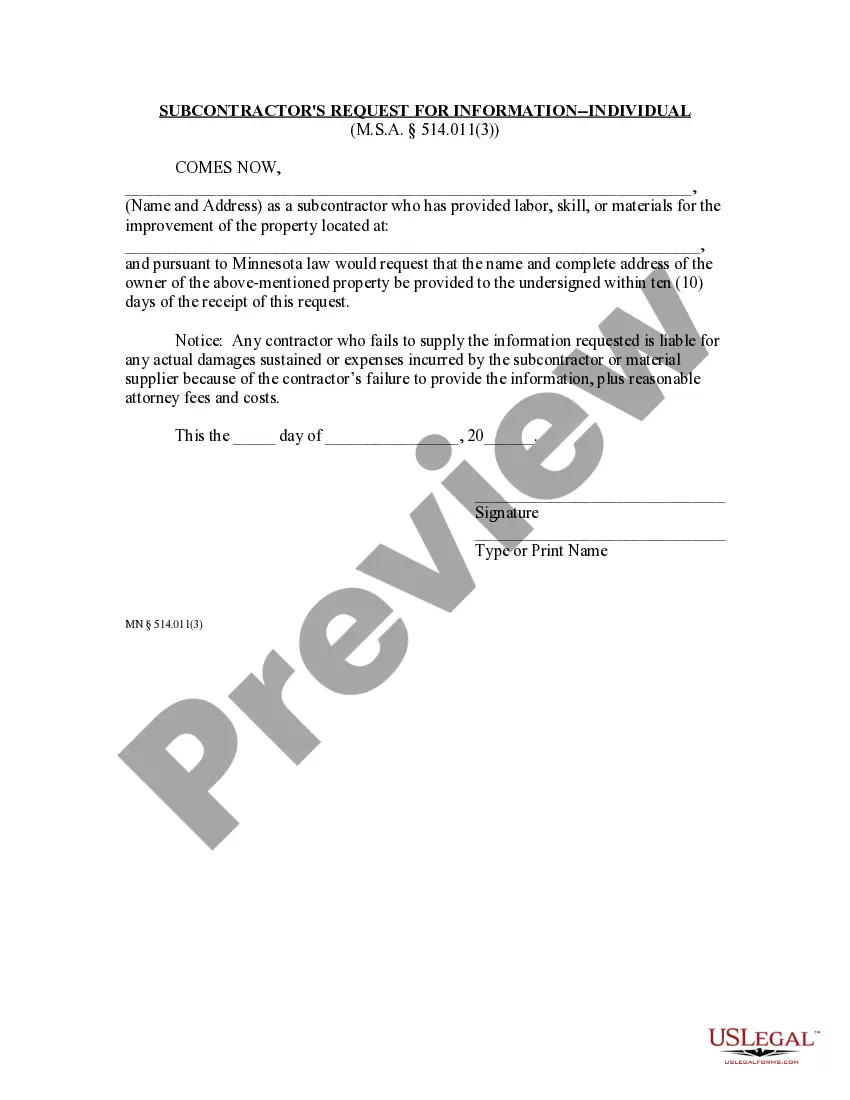

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

If you have to complete, down load, or printing legitimate document themes, use US Legal Forms, the biggest assortment of legitimate forms, that can be found online. Take advantage of the site`s basic and convenient look for to discover the papers you require. Numerous themes for business and specific purposes are sorted by categories and claims, or keywords. Use US Legal Forms to discover the New York Sample Letter for Assets and Liabilities of Decedent's Estate with a number of click throughs.

Should you be already a US Legal Forms customer, log in to your accounts and click on the Down load key to obtain the New York Sample Letter for Assets and Liabilities of Decedent's Estate. Also you can accessibility forms you previously saved within the My Forms tab of your respective accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for that proper city/nation.

- Step 2. Utilize the Review choice to look through the form`s content material. Don`t neglect to learn the explanation.

- Step 3. Should you be unsatisfied together with the form, take advantage of the Look for discipline on top of the screen to find other variations from the legitimate form web template.

- Step 4. Upon having found the form you require, click the Get now key. Opt for the costs program you like and add your credentials to sign up for an accounts.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Select the formatting from the legitimate form and down load it on your own device.

- Step 7. Complete, change and printing or indicator the New York Sample Letter for Assets and Liabilities of Decedent's Estate.

Every single legitimate document web template you get is your own for a long time. You might have acces to every single form you saved with your acccount. Click the My Forms area and select a form to printing or down load again.

Remain competitive and down load, and printing the New York Sample Letter for Assets and Liabilities of Decedent's Estate with US Legal Forms. There are millions of professional and status-particular forms you may use for the business or specific requires.

Form popularity

FAQ

Estate Management is the process of dealing with someone's estate once they have died. Usually the executor of the estate needs to administer the estate in ance with the will & the law, so that the deceased persons assets are distributed to the prescribed beneficiaries.

Administration of an estate means the management of the assets and liabilities of someone who has died. When a person has not designated a personal representative by will to deal with their estate upon death, the court will appoint an administrator to manage the estate of the deceased.

This inventory must include all of the decedent's (i) personal estate under your supervision and control, (ii) interest in any multiple party account (which is defined in Part 2) in any financial institution, (iii) real estate over which you have a power of sale, and (iv) other real estate that is an asset of the ...

If a person dies leaving a valid will, and the will names a person who is to execute the will and administer the estate, this person is called an executor. However, when the person in charge of administering the estate is not named in a will, that person is called an administrator.

In terms of content, an Estate distribution letter should include: the deceased's personal details; a detailed and complete list of all assets and liabilities; the Beneficiary names and the details of their respective inheritances; any details on debt settlement and creditor communication;

Guide to Administration of an Estate the assets of the deceased are collected in. any gifts set out in the deceased's will (if there is one) are paid. any debts, tax, funeral expenses and costs to do with the administration are paid. and what is left over is distributed to the beneficiaries entitled to it.