This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

New York Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Are you currently in a scenario where you need documentation for either organizational or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the New York Supplemental Needs Trust for Third Party - Disabled Beneficiary, that are designed to comply with federal and state regulations.

When you find the appropriate form, click on Get now.

Choose the pricing plan you want, fill in the necessary details to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the New York Supplemental Needs Trust for Third Party - Disabled Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these procedures.

- Select the form you need and ensure it is for the correct city/region.

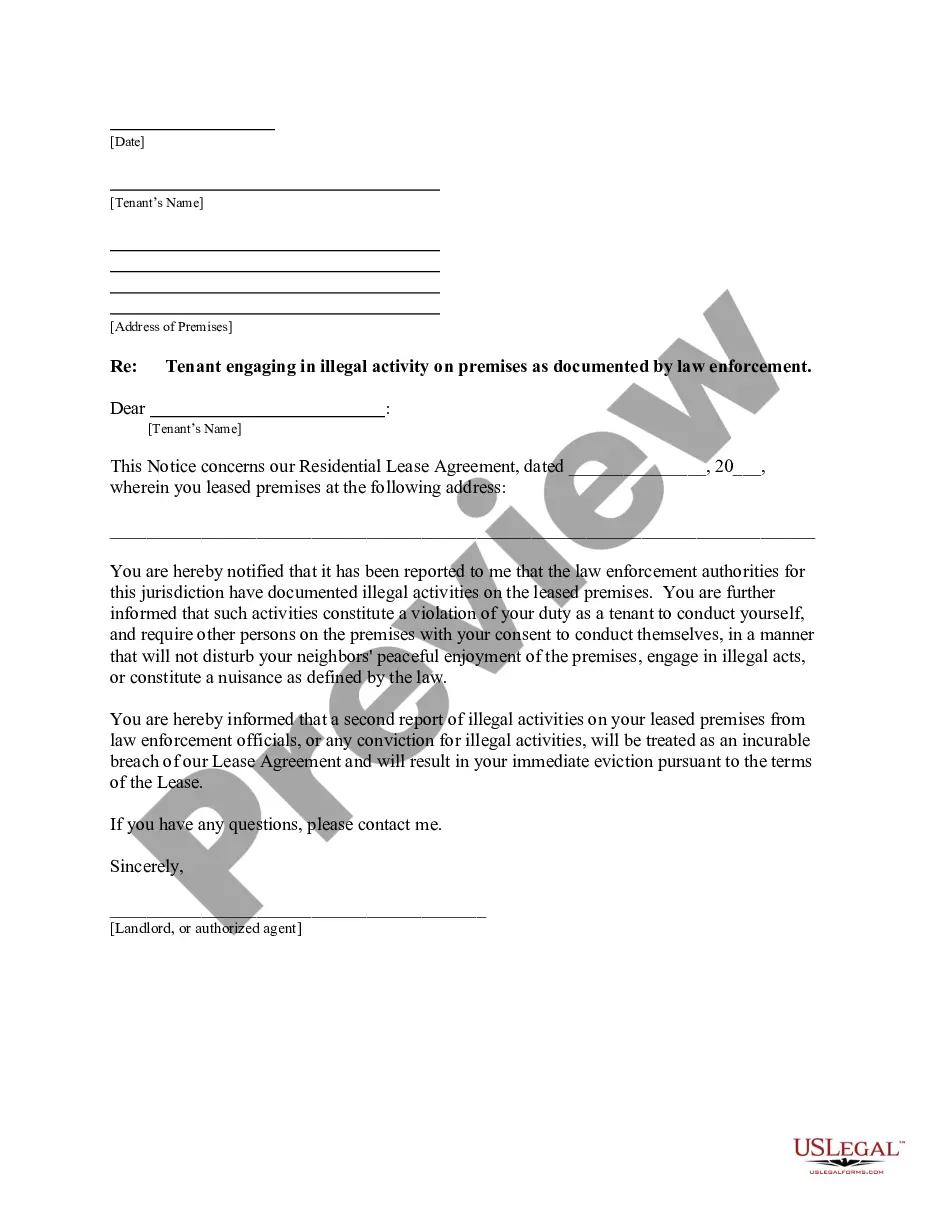

- Utilize the Preview option to examine the form.

- Review the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that matches your needs.

Form popularity

FAQ

The beneficiary of a supplemental needs trust is typically an individual with disabilities who is the recipient of benefits such as Medicaid or Supplemental Security Income (SSI). Specifically, for a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary, the trust is created to enhance the quality of life for the disabled person without impacting their eligibility for government support. This distinction is vital for families wanting to provide financial security for their loved ones.

A qualified disability trust is an estate planning tool that allows individuals with disabilities to manage their finances while maintaining eligibility for government benefits. In the context of a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary, these trusts help secure funds for the beneficiary's supplemental care and support without jeopardizing their public assistance. Understanding this can help you make informed decisions about your loved one's financial future.

While a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary offers many advantages, it also has potential downsides. One key concern is the complexity involved in setting it up, which may require professional assistance. Additionally, there can be fees associated with the trust management and ongoing reporting requirements. It's essential to weigh these factors before deciding if this option is right for you.

A disabled trust, often referring to a supplemental needs trust, is designed to hold assets for the benefit of an individual with disabilities. This arrangement ensures that the beneficiary can receive financial support without losing government benefits. By establishing a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary, families can help their loved ones achieve financial stability while meeting their unique needs.

Yes, a third-party special needs trust can be established to benefit a person with disabilities without compromising their eligibility for essential government programs. This type of trust is typically funded by relatives or friends instead of the disabled person’s own assets. A New York Supplemental Needs Trust for Third Party - Disabled Beneficiary is ideal for those looking to provide ongoing financial support to a loved one while ensuring they maintain access to necessary assistance programs.

The best trust for a disabled person typically includes a supplemental needs trust, as it helps protect their government benefits while providing financial support. This type of trust allows funds to be used for additional needs, enhancing the individual’s quality of life without affecting their eligibility for public assistance. By using a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary, families can ensure that the financial needs of their loved one are met appropriately.

Choosing the right trustee for a special needs trust is crucial for managing the trust's assets properly. Ideally, the best trustee should have experience with managing funds and a deep understanding of the needs of the disabled beneficiary. Many families prefer to have a trusted family member or a professional fiduciary take on this responsibility, as they can ensure that the funds are used correctly. A knowledgeable trustee can effectively manage a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary to maximize its benefits.

In New York, a supplemental needs trust provides financial support for individuals with disabilities without disqualifying them from government assistance programs. It can cover expenses such as medical care, education, and recreational activities not funded by government benefits. This ensures that beneficiaries can enjoy a better quality of life while still receiving essential support. A New York Supplemental Needs Trust for Third Party - Disabled Beneficiary can be set up to guarantee that the funds are used for supplementary needs.

A special disability trust, often referred to as a supplemental needs trust, is a financial arrangement designed to benefit individuals with disabilities. It allows them to receive funds without jeopardizing their eligibility for government benefits. This type of trust can be instrumental for families looking to secure a stable financial future for their disabled loved ones. Utilizing a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary ensures that the beneficiary can access essential services while maintaining their benefit status.

For a disabled beneficiary, a third-party special needs trust is often the best option. This allows for the management of assets without jeopardizing eligibility for public assistance. Establishing a New York Supplemental Needs Trust for Third Party - Disabled Beneficiary can ensure that the beneficiary receives support while meeting their unique needs.