28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

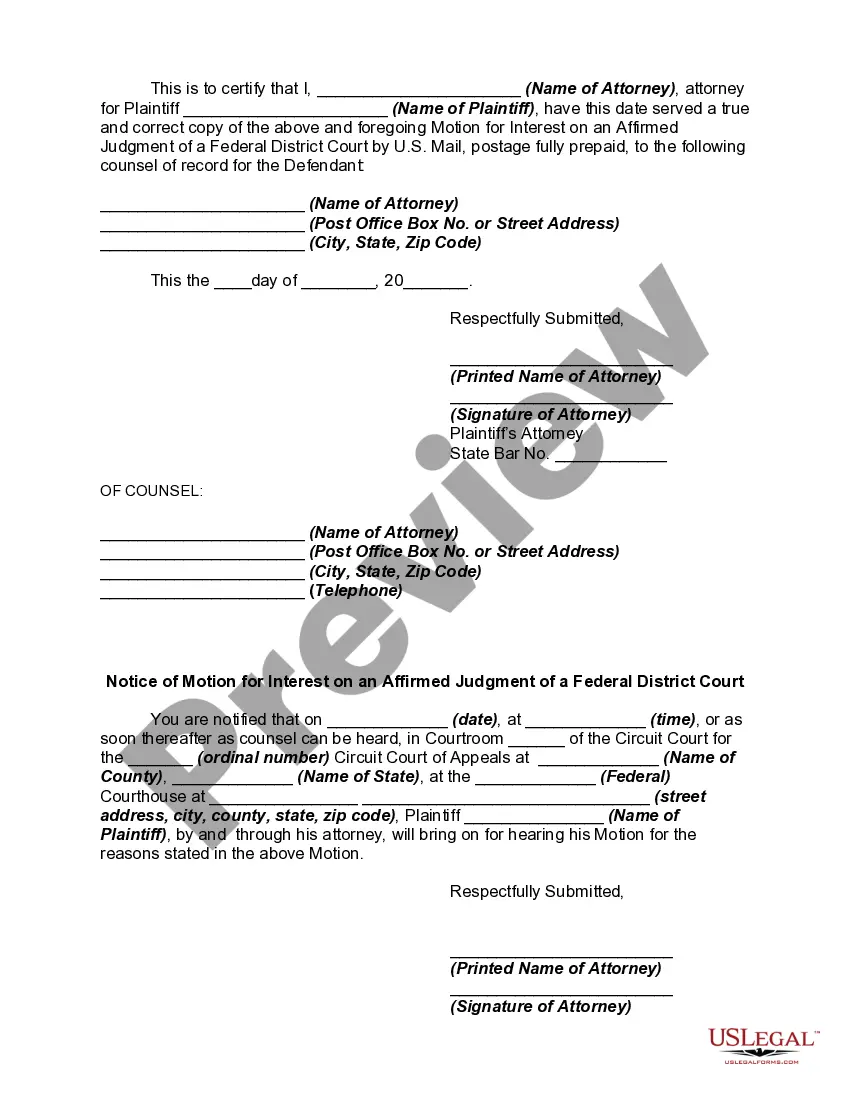

New York Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

US Legal Forms - one of the greatest libraries of authorized forms in the United States - gives a variety of authorized document themes you may download or printing. Using the site, you will get a huge number of forms for business and personal purposes, categorized by categories, states, or keywords and phrases.You will find the most up-to-date models of forms such as the New York Motion for Interest on an Affirmed Judgment of a Federal District Court within minutes.

If you already possess a registration, log in and download New York Motion for Interest on an Affirmed Judgment of a Federal District Court from your US Legal Forms catalogue. The Acquire key will appear on every develop you perspective. You have accessibility to all in the past delivered electronically forms inside the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are easy directions to help you started out:

- Make sure you have chosen the correct develop to your city/state. Select the Review key to analyze the form`s articles. Look at the develop description to ensure that you have selected the proper develop.

- If the develop doesn`t satisfy your requirements, use the Research industry near the top of the display screen to find the one which does.

- When you are content with the shape, affirm your selection by visiting the Get now key. Then, choose the rates program you favor and provide your references to register for the profile.

- Approach the transaction. Make use of Visa or Mastercard or PayPal profile to finish the transaction.

- Pick the format and download the shape on the gadget.

- Make modifications. Complete, revise and printing and sign the delivered electronically New York Motion for Interest on an Affirmed Judgment of a Federal District Court.

Every single format you included in your money does not have an expiration date and is yours eternally. So, if you would like download or printing an additional backup, just visit the My Forms segment and click on about the develop you will need.

Get access to the New York Motion for Interest on an Affirmed Judgment of a Federal District Court with US Legal Forms, probably the most comprehensive catalogue of authorized document themes. Use a huge number of specialist and status-specific themes that meet up with your organization or personal demands and requirements.

Form popularity

FAQ

Prejudgment interest. Prejudgment interest is calculated from the date the reason for the court case (called the ?cause of action?) happens until the date the court makes an order about the money you should receive.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

New York State Pre- and Post-Judgment Rates ing to the New York Civil Practice Law and Rules (CPLR), the interest rate on a pre- or post-judgment is 9% per annum (year).

In New York, the maximum rate of interest on a loan is 16% per annum. If a lender charges more than that, it may be liable for civil usury. Interest that is higher than 25% constitutes criminal usury.

This is because prejudgment interest can add up, particularly as cases can often take a year or two or longer to get through trial. For example, a one million dollar judgment would accrue $100,000 in interest every year at the "legal rate" of 10%.

To calculate your own pre-judgment interest, count the number of days between the 180th day after you notified your defendant of a pending lawsuit or the date you filed the lawsuit, and multiply the number of days by the appropriate rate.

Ing to the New York Civil Practice Law and Rules (CPLR), the interest rate on a pre- or post-judgment is 9% per annum (year). But under a new law, starting April 30, 2022, this 9% interest rate will drop to 2% if the judgment debtor (defendant) is an individual who owes a consumer debt.

Interest on Judgment. (a) When the Court Affirms. Unless the law provides otherwise, if a money judgment in a civil case is affirmed, whatever interest is allowed by law is payable from the date when the district court's judgment was entered.