New York Demand Promissory Note

Description

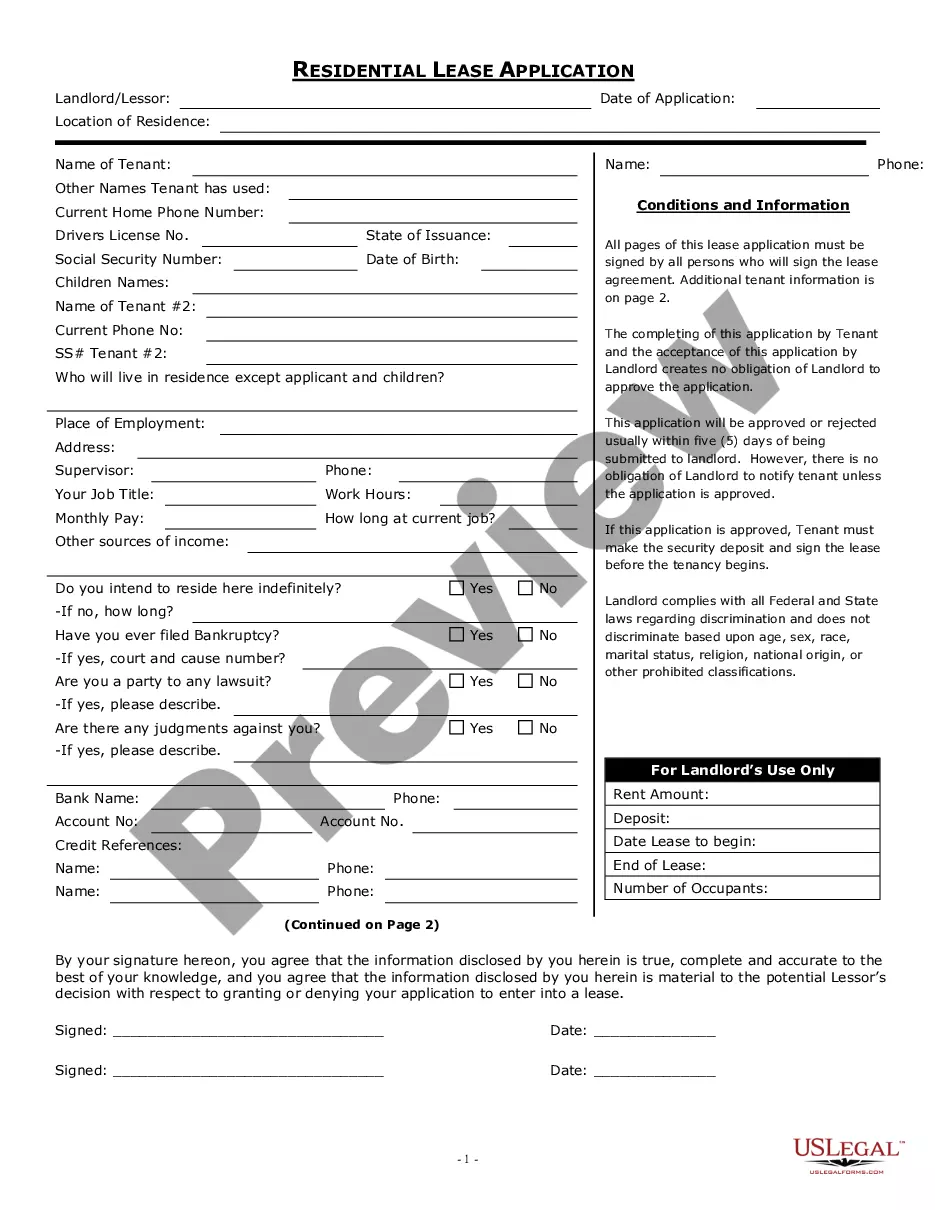

How to fill out Demand Promissory Note?

If you intend to finish, download, or print legal document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Take advantage of the website's straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the New York Demand Promissory Note in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the New York Demand Promissory Note.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

'On demand' in a promissory note means that the payment is due as soon as the lender requests it. For those utilizing a New York Demand Promissory Note, this adds urgency and clarity to the repayment process. Understanding this term helps borrowers prepare for the possibility of immediate repayment requests, making effective financial planning essential.

Yes, a promissory note can serve as a demand instrument when it allows the lender to request payment immediately. A New York Demand Promissory Note offers lenders this advantage, making it a useful tool for ensuring timely payments. It provides clear rights for lenders, emphasizing the importance of understanding the terms before entering into such an agreement.

Yes, a promissory note can be payable on demand, which means the lender can request payment at any time. In the context of a New York Demand Promissory Note, this provides flexibility for the lender. Borrowers should understand that demand notes require payment without any prior notice, making it crucial to manage repayment timelines.

To report a New York Demand Promissory Note on your taxes, include any interest payments you received as income on Schedule B of Form 1040. If you experienced a loss from the note becoming uncollectible, document it properly as a bad debt deduction. Understanding these requirements can help you stay compliant and manage your tax liabilities effectively.

When you hold a New York Demand Promissory Note, you need to report any interest income received as taxable income on your tax return. Additionally, if you write off a bad debt associated with the note, you may need to file a separate form to report that loss. Consulting a tax professional can help ensure your filings comply with IRS regulations.

Yes, you can write off a promissory note under certain conditions, typically when it becomes uncollectible. If the borrower defaults on a New York Demand Promissory Note, you may classify the loss as a business expense. It's vital to maintain detailed records and follow IRS guidelines to accurately reflect the loss on your tax returns.

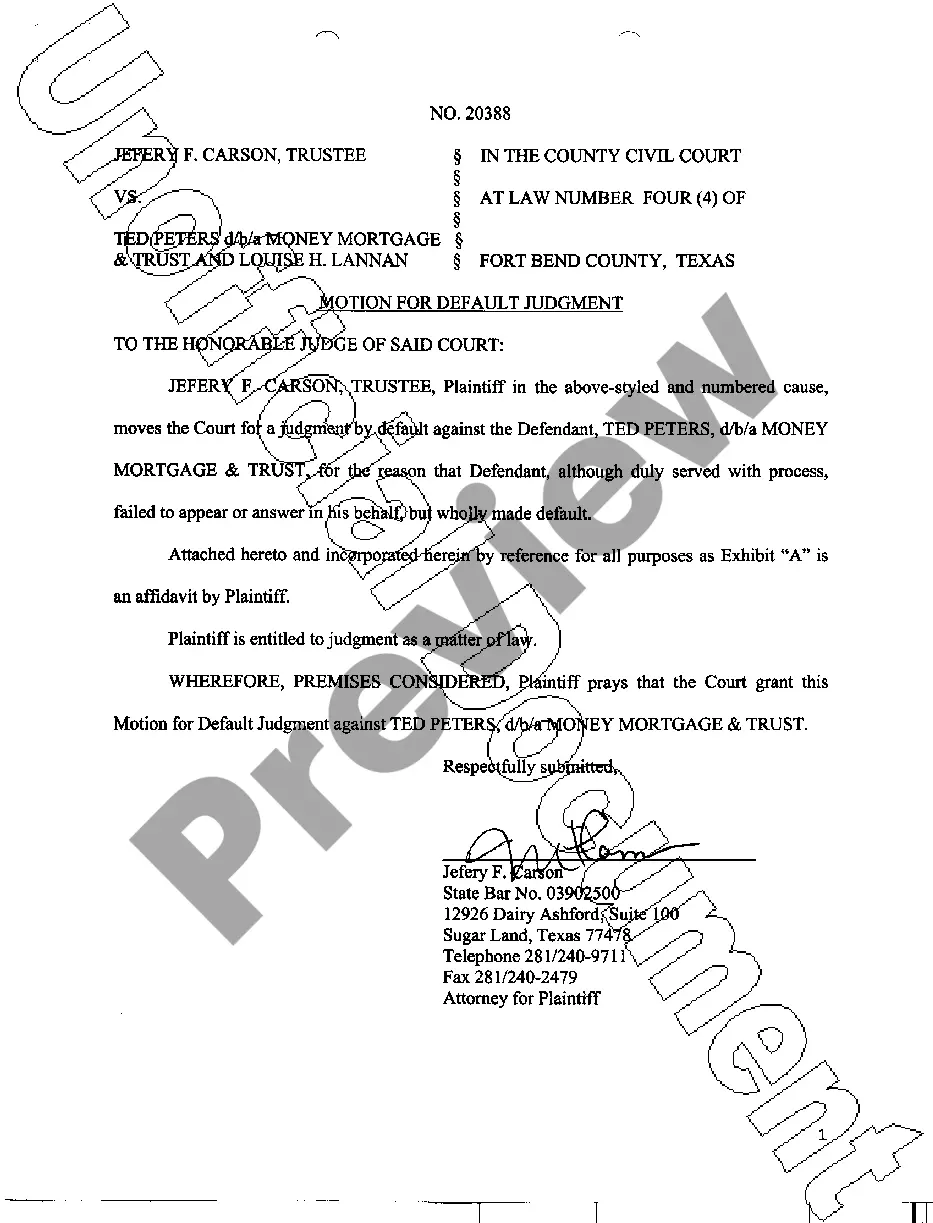

The primary difference between a standard promissory note and a demand promissory note lies in the payment terms. A standard promissory note specifies a repayment schedule, while a demand promissory note allows repayment at the lender's request. Understanding these distinctions is crucial, especially when considering options like the New York Demand Promissory Note for tailored lending solutions that meet your financial needs.

Filling out a demand promissory note requires providing specific information such as the borrower's name, lender's name, the amount borrowed, and any interest terms. It's essential to clearly state that the payment is on demand, ensuring there is no confusion later on. By using a template from uslegalforms, you can ensure you include all necessary details for a New York Demand Promissory Note, offering you peace of mind and security.

Yes, a promissory note can indeed be payable on demand, which means the lender has the right to request payment at any moment after its creation. This feature makes the New York Demand Promissory Note particularly useful for lenders who may need immediate access to funds. Such flexibility is beneficial in various financial situations, whether personal or business-related.

A straightforward example of an on demand promissory note would be a scenario where a friend lends you $1,000 with a note that states you will repay the amount whenever they ask. In this case, the document clearly outlines the amount, the lender's details, and the borrower's commitment to repay on demand. Using a New York Demand Promissory Note formalizes this agreement and provides security for both parties involved.