New York Assignment of Website Creator

Description

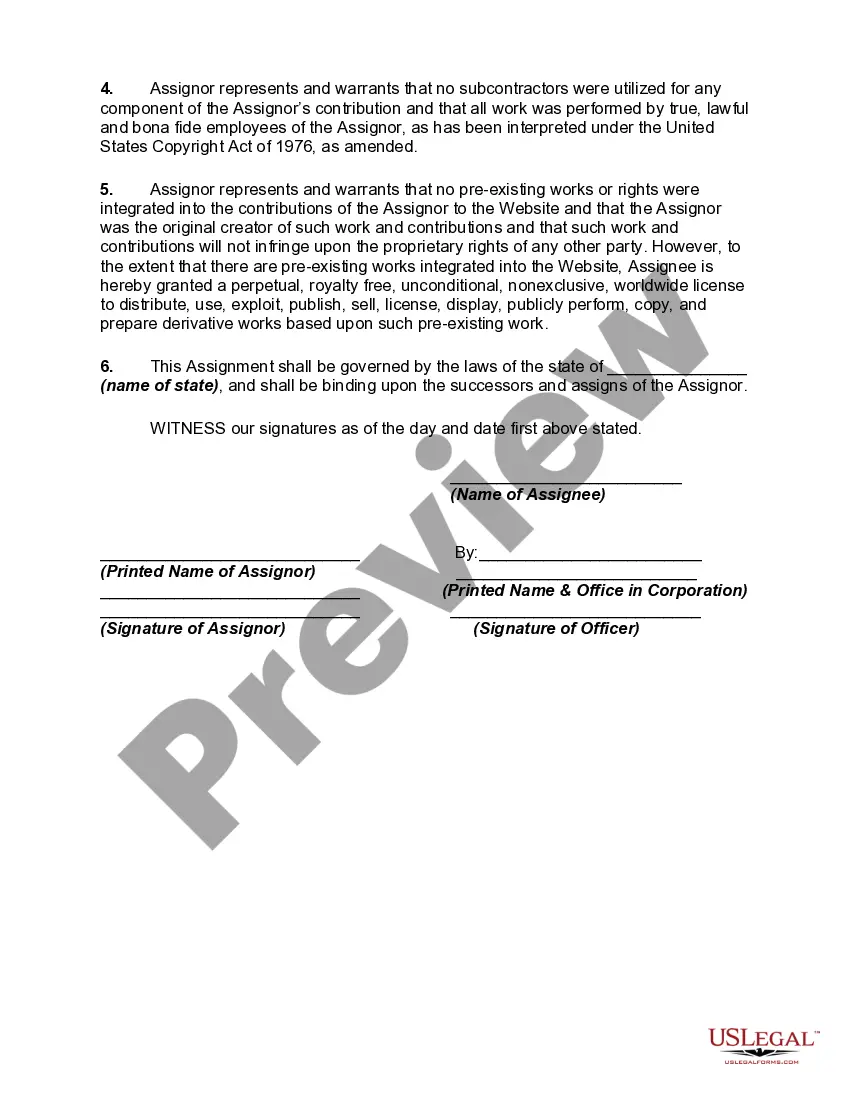

How to fill out Assignment Of Website Creator?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document samples that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the New York Assignment of Website Creator in just seconds.

Read the form description to confirm that you have selected the correct document.

If the form does not fit your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the New York Assignment of Website Creator from your US Legal Forms collection.

- The Download button will appear on each document you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your area/state.

- Click on the Review button to examine the form's content.

Form popularity

FAQ

To file a biennial statement in New York, you must collect information about your business, including its name and registered address. This filing is essential for maintaining your business's good standing, especially if you operate as a New York Assignment of Website Creator. You can file online or via paper forms, and resources from USLegalForms can simplify the process for you. Staying compliant solidifies your business’s foundation.

Filling out a certificate of publication in New York requires specific details related to your business entity. You must confirm your business name, address, and the newspapers in which the notice appeared. If you’re navigating the establishment of your business as a New York Assignment of Website Creator, USLegalForms can provide templates and guidance. This ensures that you meet publication requirements without hassle.

If you received income from New York sources but do not reside there, you need to file a New York nonresident tax return. This applies to many professionals, including those working as a New York Assignment of Website Creator. Filing this return is crucial to report your income accurately and fulfill your tax obligations. Platforms like USLegalForms can streamline this process for you.

If you earn income from New York while living abroad, you must file New York State taxes. This includes income related to your work as a New York Assignment of Website Creator. However, you may qualify for certain deductions or credits under the Foreign Earned Income Exclusion. Consulting a tax professional can provide clarity for your specific situation.

Yes, a non-resident who earns income from New York sources must file a New York State income tax return. This includes income generated from work done as a New York Assignment of Website Creator. Filing correctly ensures you remain compliant with state tax laws, helping avoid issues down the road. Be aware of the specific forms you need to complete based on your residency status.

Avoiding NYC city tax involves ensuring you are classified correctly as a nonresident. If you can establish that your primary workplace or clients are outside the city, you may not owe these taxes. Utilizing services like USLegalForms can help you navigate the intricacies of filing as a New York Assignment of Website Creator. They offer reliable resources to help you manage your tax obligations effectively.

Individuals who earn income in New York State must file a tax return, even if they do not reside there. If you have earned income as a New York Assignment of Website Creator, filing is essential for compliance. Nonresidents and part-year residents must also file if they meet the income threshold. Keeping your taxes in order ensures you avoid unexpected penalties.

To fill out a Certificate of Amendment to the Articles of Organization, you need to provide the LLC's name, the specific amendments, and the date they were adopted. Ensure that all changes comply with New York regulations and are documented correctly. The New York Assignment of Website Creator can guide you through the necessary steps to ensure proper filing. Keeping your business records updated is crucial for legal compliance.

Ignoring New York's LLC publication requirement can result in adverse effects on your business, including suspension of your LLC's operating authority. This suspension can hinder your ability to enter contracts or file lawsuits. Completing the New York Assignment of Website Creator helps you navigate these legal requirements effectively. It's best to tackle this task promptly to avoid complications.

To file a Certificate of Publication in New York, you need to complete the certificate form and submit it along with the required fees to the Department of State. Make sure to double-check all information for accuracy before submission. Utilizing the New York Assignment of Website Creator streamlines this process by offering step-by-step support. Timely filing is crucial for keeping your LLC compliant.