New York Assignment of Assets

Description

How to fill out Assignment Of Assets?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, however obtaining forms you can trust isn't easy.

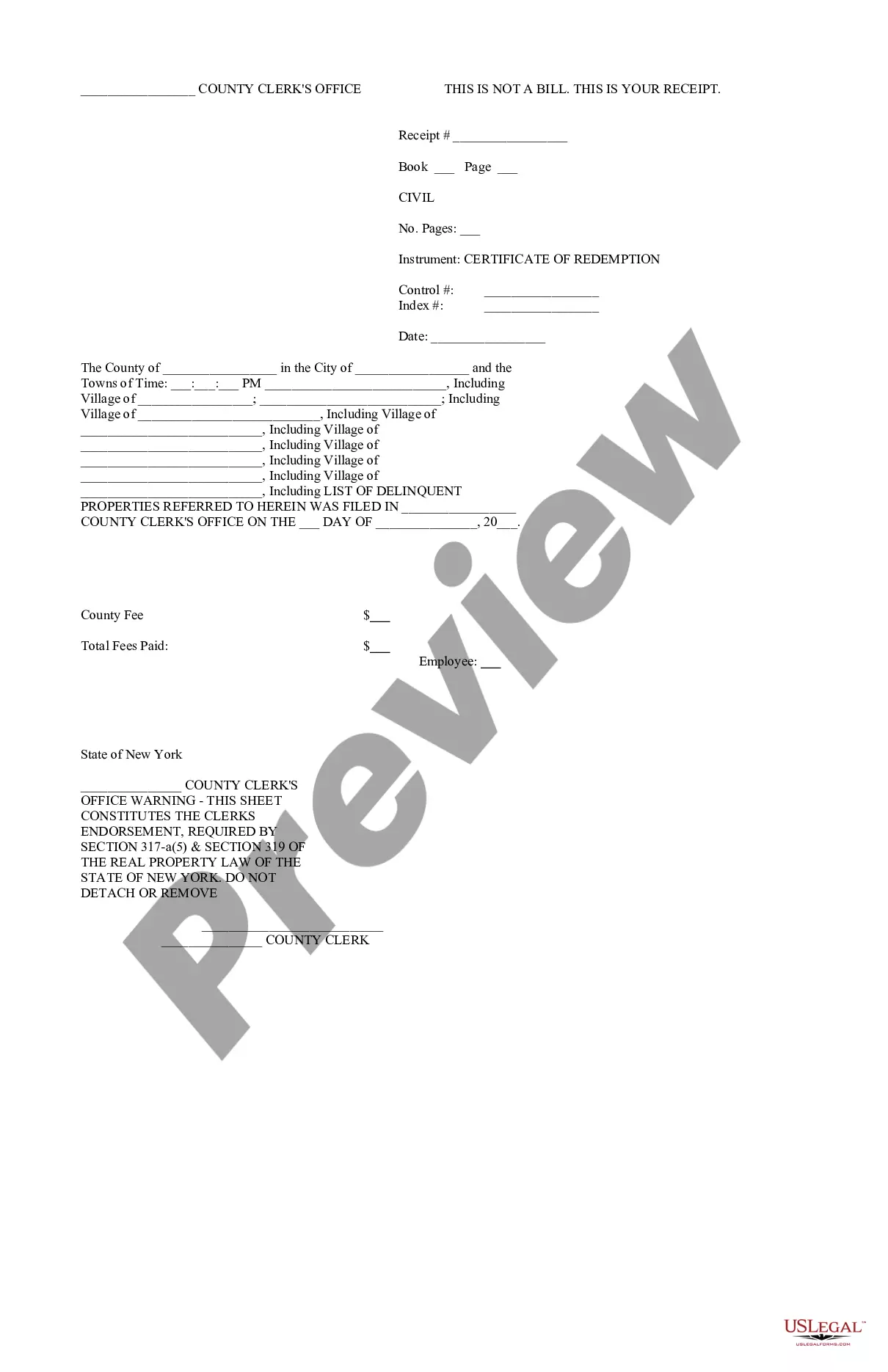

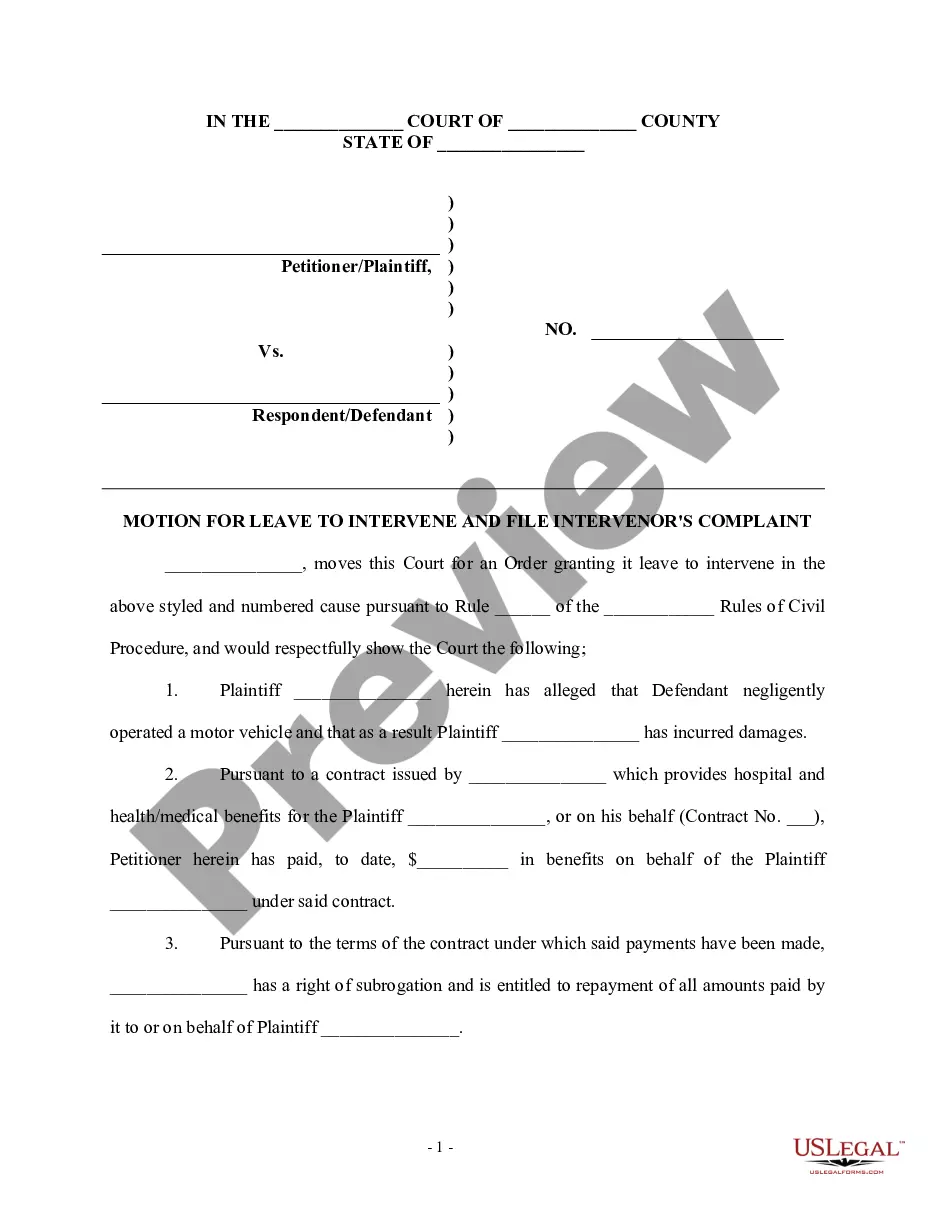

US Legal Forms offers a wide range of template forms, including the New York Assignment of Assets, which are designed to comply with federal and state regulations.

Once you have found the right form, click Buy now.

Choose the pricing plan you wish, provide the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New York Assignment of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your correct city/state.

- Utilize the Review option to examine the document.

- Read the description to confirm that you have chosen the correct form.

- If the form isn't what you're looking for, use the Search section to find the form that suits your needs and requirements.

Form popularity

FAQ

An assignment of assets is a legal agreement where a debtor assigns their assets to another party, typically for settling debts with creditors. This strategy can allow for more manageable debt resolutions and serves as a protective measure for the debtor's remaining assets. By utilizing a New York Assignment of Assets, you can navigate financial challenges with greater ease.

Individuals often place assets in a trust to protect their wealth and ensure it is distributed according to their wishes after they pass away. Trusts can also provide tax benefits and offer privacy concerning asset management. Therefore, understanding New York Assignment of Assets can help you consider all your options for asset protection.

The term general assignment means the transfer of an individual's rights and properties to a specific person or entity, aimed at settling debts. This legal action can provide an orderly way to manage outstanding financial obligations. Exploring a New York Assignment of Assets can clarify how this process operates effectively.

A general assignment of assets is a legal action where an individual transfers all their assets to a trustee or third party for the benefit of creditors. This process helps streamline debt repayment and can prevent asset liquidation under unfavorable circumstances. Utilizing New York Assignment of Assets can strongly influence the outcome of your financial situation.

In New York, certain assets are protected from creditors, including retirement accounts, life insurance policies, and some types of trust assets. These protections can provide peace of mind when facing financial difficulties. Understanding your rights under New York Assignment of Assets can help you safeguard your essential assets.

A general assignment in estate planning involves transferring all of your assets to a designated party, usually for the purpose of managing your estate after your passing. This strategy can simplify the distribution of your assets and may help avoid probate delays. It's essential to understand how a New York Assignment of Assets can facilitate this process efficiently.

New York Assignment of Assets refers to the legal procedure where a debtor transfers their assets to a third party for the benefit of their creditors. This helps to settle outstanding debts and may prevent further financial consequences. By understanding this process, individuals can better manage their financial obligations.

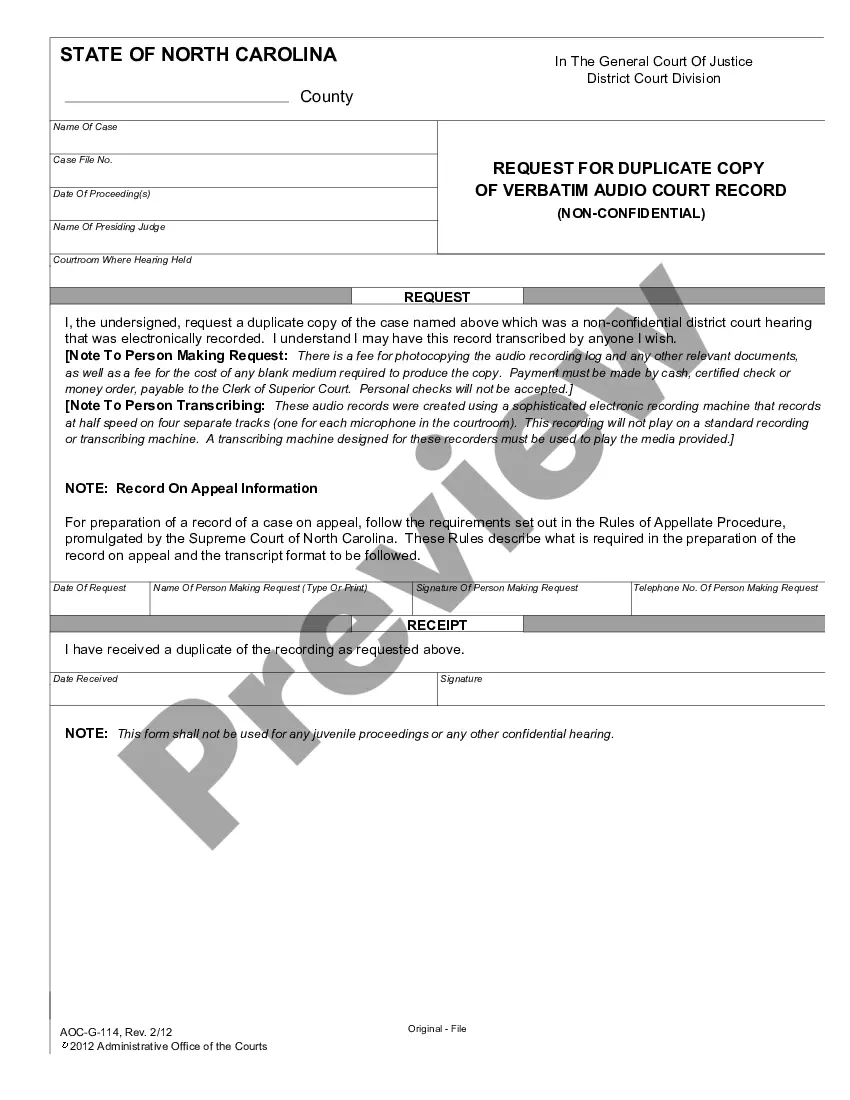

The processing time for a New York State certificate of Authority typically ranges from one to two weeks. However, this may vary depending on the volume of applications received. To expedite the process, ensure that your application is complete and accurate. For businesses managing a New York Assignment of Assets, having your certificate promptly can help streamline your operations.

To obtain a certificate of Authority in New York, you must file an application with the New York Department of State. This process includes completing necessary forms and paying the required fees. Once approved, your business can legally operate within the state. If you're thinking about asset management and New York Assignment of Assets, this certificate is essential for safeguarding your business.

No, a certificate of Authority and an EIN are not the same. A certificate of Authority allows businesses to operate legally in New York, while an EIN is a unique identifier for tax purposes. Both are crucial for business operations, but they serve different functions. If you're working on a New York Assignment of Assets, understanding these documents can help you maintain compliance.