New York General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a range of legal document templates that can be downloaded or printed.

By using the website, you can find thousands of templates for business and personal purposes, categorized by categories, states, or keywords. You will be able to discover the latest versions of documents like the New York General Form of Factoring Agreement - Assignment of Accounts Receivable in moments.

If you already have a subscription, Log In and download the New York General Form of Factoring Agreement - Assignment of Accounts Receivable from your US Legal Forms library. The Download button will be visible on each form you encounter. You can access all previously acquired templates in the My documents section of your account.

Retrieve the document and download the form onto your device. Make alterations. Fill out, edit, print, and sign the acquired New York General Form of Factoring Agreement - Assignment of Accounts Receivable.

Each form you added to your account never expires and belongs to you indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New York General Form of Factoring Agreement - Assignment of Accounts Receivable with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

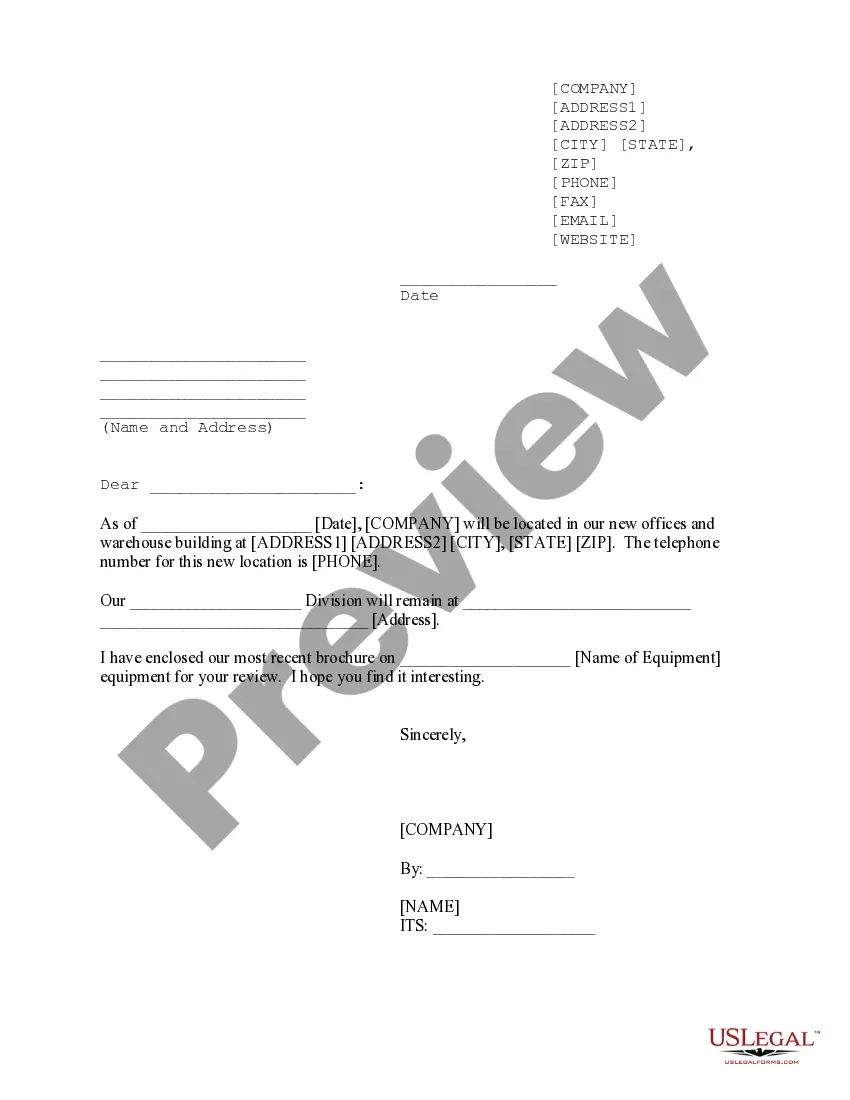

- Ensure you have selected the correct form for your city/state. Click the Preview button to examine the form's content.

- Review the description of the form to confirm you have chosen the right one.

- If the form does not meet your requirements, utilize the Search section at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Accounts receivable factoring begins when you enter a New York General Form of Factoring Agreement - Assignment of Accounts Receivable with a factoring company. After the agreement is in place, you submit your eligible customer invoices to the factor. They will then advance you funds based on the invoices, provide ongoing support, and handle collection on your behalf.

The general assignment of receivables refers to the legal transfer of rights to collect on receivables to another party, usually a lender or factoring company. This agreement allows the assigned party to receive payments directly from customers. The New York General Form of Factoring Agreement - Assignment of Accounts Receivable clarifies the terms and conditions of this assignment, enhancing transparency for all parties involved.

Consent to assignment of receivables is the agreement from the debtor acknowledging that their account has been assigned to a factor. This consent can be critical in preventing any payment disputes down the line. In accordance with the New York General Form of Factoring Agreement - Assignment of Accounts Receivable, obtaining this consent ensures smooth transitions during the factoring process and fosters relationships between all parties involved.

A Notice of Assignment (Noa) in factoring serves as an official document informing debtors of the assignment of receivables to a factor. This notification is essential for ensuring that payments are directed to the factor instead of the original creditor. In the context of the New York General Form of Factoring Agreement - Assignment of Accounts Receivable, a properly executed Noa helps secure the factor's rights over the accounts receivable and minimizes disputes.

While both accounts receivable assignment and factoring involve the use of invoices for financing, they differ in structure. In accounts receivable assignment, you retain ownership of the receivables but grant a lender rights to collect payments. Factoring involves selling those receivables to a third party, transferring ownership. Understanding these differences through the New York General Form of Factoring Agreement - Assignment of Accounts Receivable can help optimize your financing strategy.

Factoring allows companies to immediately build up their cash balance and pay any outstanding obligations. Therefore, factoring helps companies free up capital. that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor.

Step by step factoring process in QuickbooksCreate an account for factored invoices. In your Chart of Account, create a liabilities account just for factored invoices.Create an account for factoring fees.Create an invoice.Record a deposit.Record the fee.Record the received payment.Apply payment to loan.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.