New York Affidavit of Domicile

Description

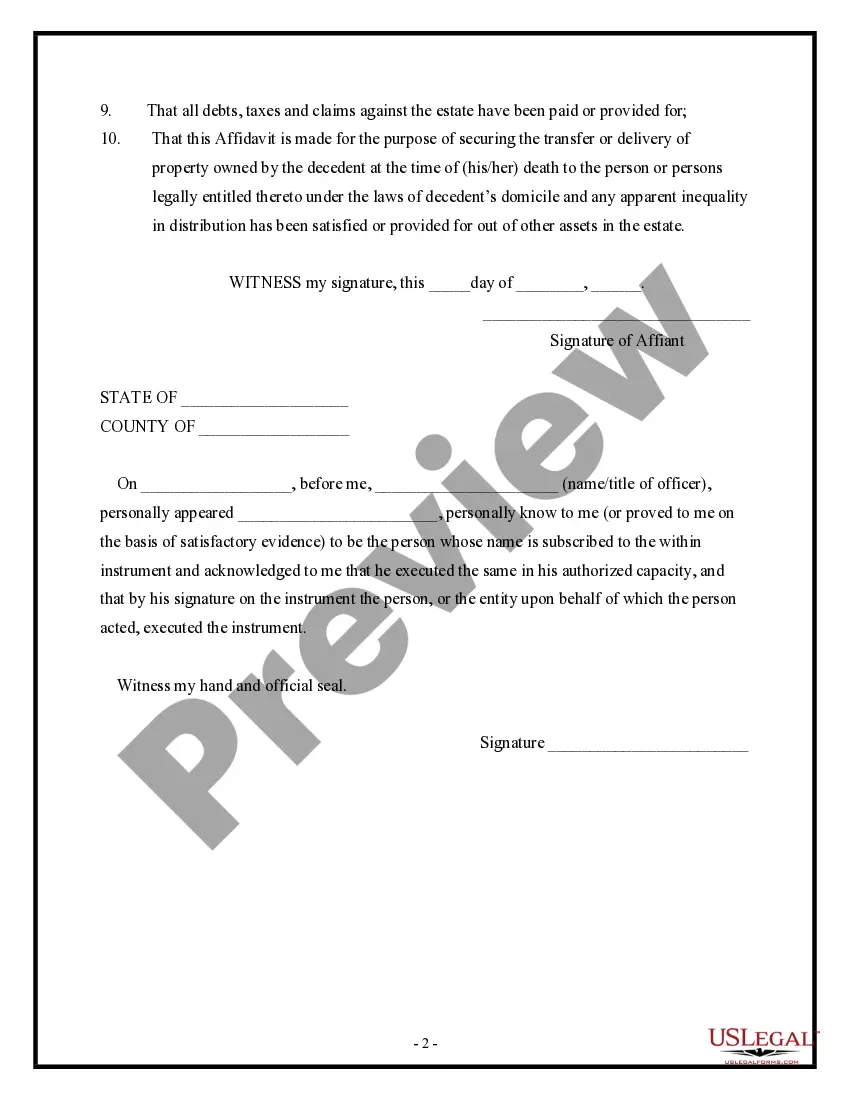

How to fill out Affidavit Of Domicile?

It is possible to commit hrs on-line attempting to find the legal papers format that meets the state and federal requirements you will need. US Legal Forms gives a large number of legal kinds that happen to be evaluated by specialists. It is possible to obtain or print the New York Affidavit of Domicile from my services.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Obtain button. Next, you are able to full, revise, print, or indicator the New York Affidavit of Domicile. Each legal papers format you get is your own eternally. To obtain yet another copy associated with a purchased develop, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms internet site initially, follow the simple instructions under:

- Very first, be sure that you have selected the best papers format for your area/town of your choice. Look at the develop information to ensure you have selected the proper develop. If available, use the Review button to appear throughout the papers format as well.

- If you wish to discover yet another model in the develop, use the Search area to find the format that suits you and requirements.

- After you have discovered the format you desire, click on Buy now to continue.

- Find the rates strategy you desire, enter your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal accounts to cover the legal develop.

- Find the structure in the papers and obtain it to your gadget.

- Make adjustments to your papers if required. It is possible to full, revise and indicator and print New York Affidavit of Domicile.

Obtain and print a large number of papers layouts utilizing the US Legal Forms Internet site, which provides the largest collection of legal kinds. Use professional and express-specific layouts to handle your organization or personal requirements.

Form popularity

FAQ

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

The requirements to be a New York City resident are the same as those needed to be a New York State resident. You are a New York City resident if: your domicile is New York City; or. you have a permanent place of abode there and you spend 184 days or more in the city.

It shall be presumptive evidence that a person who maintains a place of abode in this state for a period of at least ninety days is a resident of this state." To live in a house, a home, an apartment, a room or other similar place in NY State for 90 days is considered "presumptive evidence" that you are a resident of ...

Use Form ET-85 when. ? The estate is not required to file a New York State estate tax return (see filing requirements below), and either an executor or administrator has not been appointed, or if appointed, nine months has passed since the date of death. ? The estate is required to file a New York State estate tax.

Residents Who Spend More than 183 Days in New York Any individual who maintains a permanent place of abode in New York must keep adequate records showing he or she did not spend more than 183 days in New York during the tax year.

Both the PPA test and the 183-day rule must be satisfied in determining statutory residency. Any part of a day spent within New York counts as a day toward the 183-day rule except in cases where your presence is incidental to travel or for medical treatment.

For the purposes of the 183-equivalent-day requirement, any part of a day the individual is present in the United States during the current calendar year counts as a full day; each day in the preceding year counts as one-third of a day; and each day in the second preceding year counts as one-sixth of a day.

You spend 184 days or more in New York State during the taxable year. Any part of a day is a day for this purpose, and you do not need to be present at the permanent place of abode for the day to count as a day in New York.