An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

New York Marital Deduction Trust - Trust A and Bypass Trust B

Description

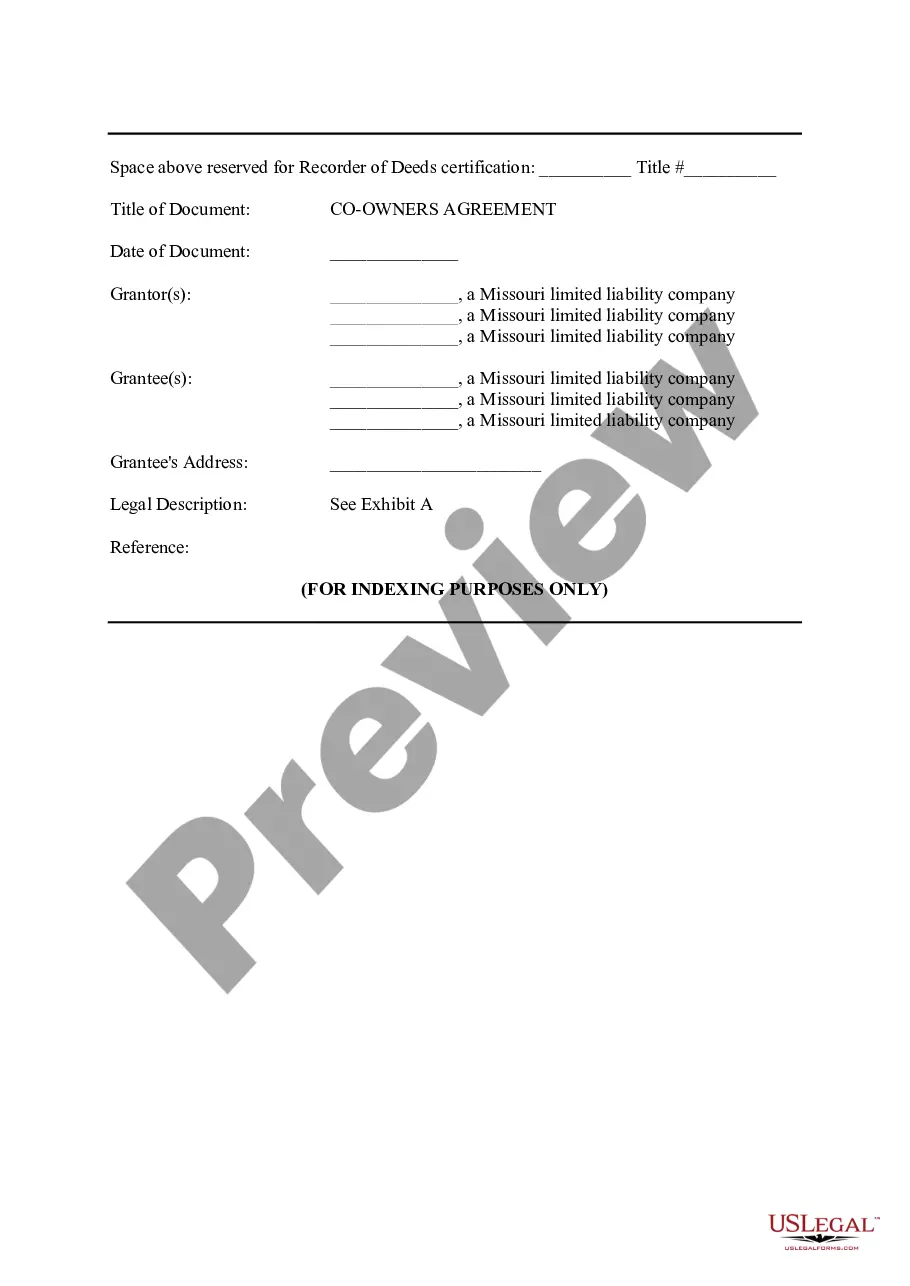

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

You might spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast collection of legal forms that can be reviewed by professionals.

You can easily download or print the New York Marital Deduction Trust - Trust A and Bypass Trust B from the service.

If you wish to find another version of the form, use the Search field to discover the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or endorse the New York Marital Deduction Trust - Trust A and Bypass Trust B.

- Every legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your county/region of choice. Check the form details to confirm you've made the right selection.

- If available, use the Review button to examine the document template as well.

Form popularity

FAQ

A marital trust, referred to as Trust A in the New York Marital Deduction Trust, allows the surviving spouse to benefit from the assets held in the trust during their lifetime. After the surviving spouse passes away, the trust assets are then distributed according to the terms set by the deceased spouse. This type of trust can help in minimizing estate taxes while ensuring that the surviving spouse has access to necessary financial resources.

While a bypass trust offers significant tax benefits, it also has some drawbacks. One concern is the potential for high administrative costs, as these trusts require ongoing management and tax filings. Additionally, once the trust is established, flexibility may be limited, and future changes could involve legal complexities.

Setting up a bypass trust, or Trust B, typically involves creating a trust document that outlines the beneficiaries and the terms of the trust. You will need to work with an estate planning attorney to ensure that it complies with New York laws and integrates smoothly with your overall estate plan. Platforms like uslegalforms can provide templates and resources to assist you in drafting a bypass trust that meets your needs.

The primary advantage of a bypass trust, or Trust B in the New York Marital Deduction Trust framework, is its ability to preserve the deceased spouse's estate tax exemption. This means that the assets placed in the bypass trust are not included in the surviving spouse's estate, thereby reducing potential estate taxes. Additionally, it can provide the surviving spouse with income and control over assets while maintaining a tax-efficient strategy.

The New York Marital Deduction Trust consists of two parts: Trust A and Trust B. Trust A is often referred to as the marital trust, which benefits the surviving spouse during their lifetime. On the other hand, Trust B, known as the bypass trust, is designed to minimize estate taxes by keeping certain assets outside the surviving spouse's estate.

A Bypass Trust and a marital trust are not the same, although they may work together in an estate plan. A marital trust benefits the surviving spouse, allowing them to access the trust assets during their lifetime, whereas a Bypass Trust is designed to protect certain assets from estate taxes by bypassing the surviving spouse’s estate. Utilizing the New York Marital Deduction Trust - Trust A and Bypass Trust B can help you leverage both types for optimal estate management. This collaboration can be key to effective wealth preservation.

The three primary types of trusts are revocable trusts, irrevocable trusts, and testamentary trusts. Revocable trusts can be altered or revoked by the grantor during their lifetime, while irrevocable trusts cannot be easily changed once established. Testamentary trusts come into effect after a person’s death, serving specific purposes for the beneficiaries. The New York Marital Deduction Trust - Trust A and Bypass Trust B often incorporates these elements to provide a well-rounded estate planning framework tailored to your needs.

Yes, a Bypass Trust must file a tax return if it generates income that exceeds the IRS threshold set for trust taxation. The income earned within the trust is usually taxable to the beneficiaries who receive distributions from the trust. Understanding this aspect of the New York Marital Deduction Trust - Trust A and Bypass Trust B is vital for managing your tax responsibilities effectively. Engaging with professionals can help simplify this process and ensure compliance with tax laws.

Trust A is designed to provide support and financial benefits to a surviving spouse while utilizing the estate tax marital deduction. Trust B, or the Bypass Trust, aims to secure assets for children or other beneficiaries while removing those assets from the surviving spouse’s taxable estate. This combination, known as the New York Marital Deduction Trust - Trust A and Bypass Trust B, allows for a strategic approach to estate management. By using these trusts wisely, you can protect your family’s financial future.

The Bypass Trust starts with B, and it is a crucial part of effective estate planning. This type of trust allows assets to be excluded from the surviving spouse's estate, thus avoiding estate taxes upon their death. It works in conjunction with the New York Marital Deduction Trust - Trust A and Bypass Trust B to optimize tax benefits. Choosing a Bypass Trust can enhance your financial strategy and protect your inheritance.