In this form, the Buyer is assuming the indebtedness on a loan used to purchase a vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness

Description

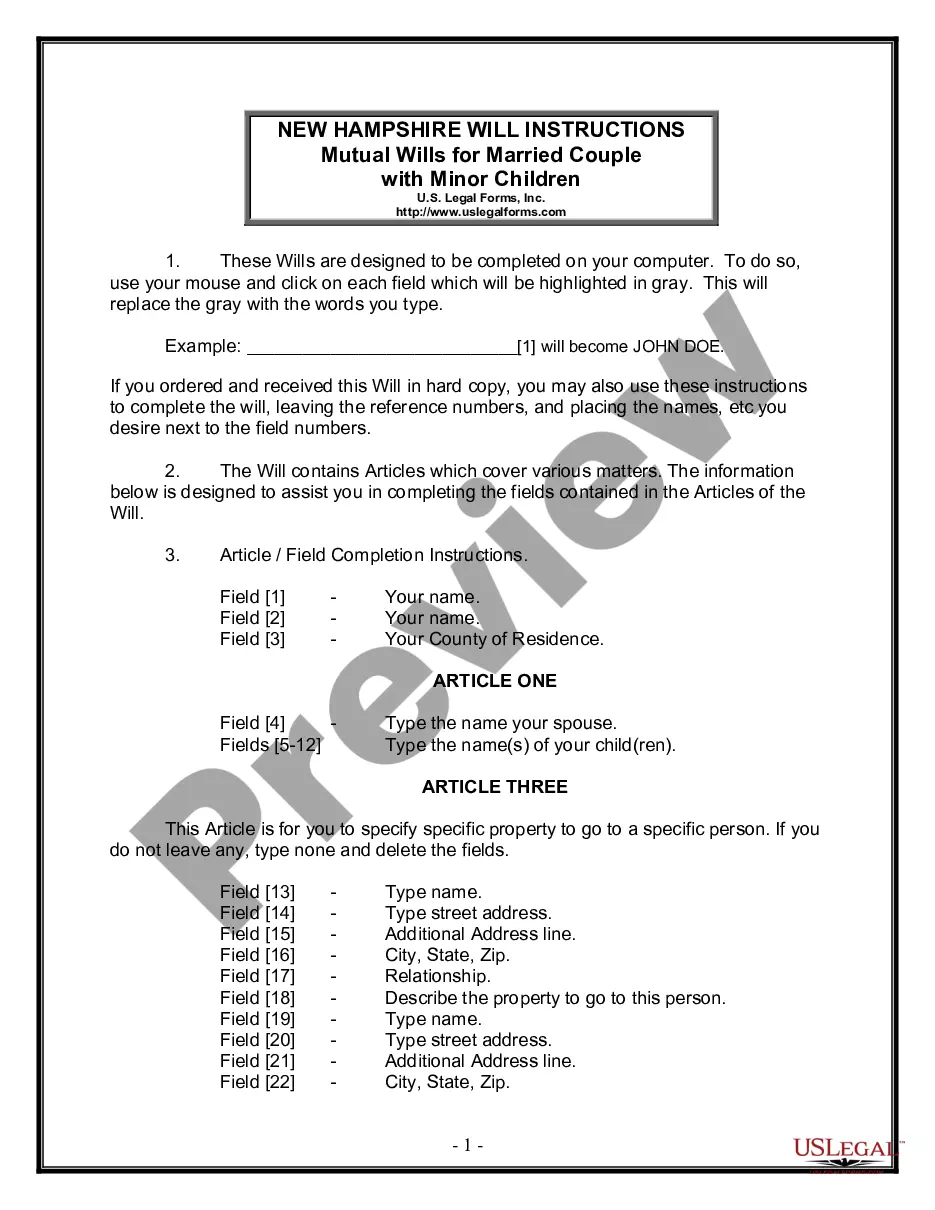

How to fill out Conditional Sales Agreement Of Automobile Between Individuals And Assumption Of Outstanding Indebtedness?

Have you ever found yourself in a situation where you require documentation for either professional or personal purposes nearly every day.

There are numerous legal document templates accessible online, but identifying ones you can trust is not straightforward.

US Legal Forms offers a wide array of form templates, such as the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Debt, which are crafted to comply with state and federal regulations.

Once you discover the correct form, simply click Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Debt template.

- In case you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you require and ensure it pertains to the correct city/region.

- Utilize the Review button to evaluate the form.

- Examine the details to confirm that you have selected the appropriate form.

- If the form is not what you are searching for, use the Search section to locate the form that fulfills your needs and specifications.

Form popularity

FAQ

A conditional sales agreement is a contract that allows a buyer to take possession of an item while the seller retains ownership until conditions, usually payment, are fulfilled. This type of agreement is common in transactions involving vehicles, such as the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. Such agreements often help facilitate vehicle financing among individuals, providing clarity and legal backing for both parties.

A deed of conditional sale is a legal document that details the terms of a conditional sale. It specifies the rights and responsibilities of both parties involved. In the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, this deed ensures that the seller's interests are protected until the buyer meets all contractual obligations.

A condition of sale outlines specific requirements that must be met for a transaction to be completed. In the context of a New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, these conditions often include timely payments, insurance coverage, and vehicle maintenance. Understanding these conditions can protect both the buyer and seller from potential disputes.

A conditional sale occurs when a buyer acquires an item, such as an automobile, but the seller retains ownership until the buyer fulfills certain conditions, typically payment in full. For instance, in a New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, a buyer may drive the car while making installment payments. This arrangement is beneficial as it allows individuals to acquire vehicles without immediate full payment.

An example of a conditional contract is a lease-to-own agreement for a car, where the buyer can use the vehicle while making payments, with ownership transferring once the final payment is received. This type of contract often involves the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness to protect both parties involved. Always ensure these agreements are clearly outlined for mutual understanding.

Yes, a seller can pull out of a conditional contract, but there may be legal implications. If the conditions stipulated in the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness are not met, the seller has the right to terminate the agreement. However, it is important for the seller to fully understand these obligations before making any decisions.

An example of a conditional bill of sale might specify that the buyer can use the car while paying in installments, but ownership of the vehicle will not transfer until all payments are complete. This safeguards the seller's interests while providing flexibility to the buyer. Many individuals utilize the framework of the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness to formalize such agreements.

In a credit sale, the buyer receives immediate ownership of the vehicle but repays the seller over time, often with interest. Conversely, a Conditional Sale results in ownership transferring only after the buyer completes all payments, often making it a safer option regarding debt resolution. When navigating your options, understanding the New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness will clarify your responsibilities and protections. Always review your agreement to ensure it aligns with your financial plan.

The primary difference between a true lease and a Conditional Sale involves ownership and payment structure. In a true lease, the lessee does not own the asset and must return it after the lease term, while a Conditional Sale leads to ownership once payment is complete. If you opt for a New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, you work towards owning the vehicle outright. Each option has its benefits, so consider your financial goals.

At the end of a New York Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, the buyer typically gains full ownership of the vehicle after fulfilling all payment obligations. It's vital to ensure that all terms of the agreement have been met before the final transfer. If any debt remains, the agreement may dictate additional steps to settle outstanding amounts. Clarifying these details within your agreement helps prevent confusion later.