Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

New York Declaration of Cash Gift with Condition

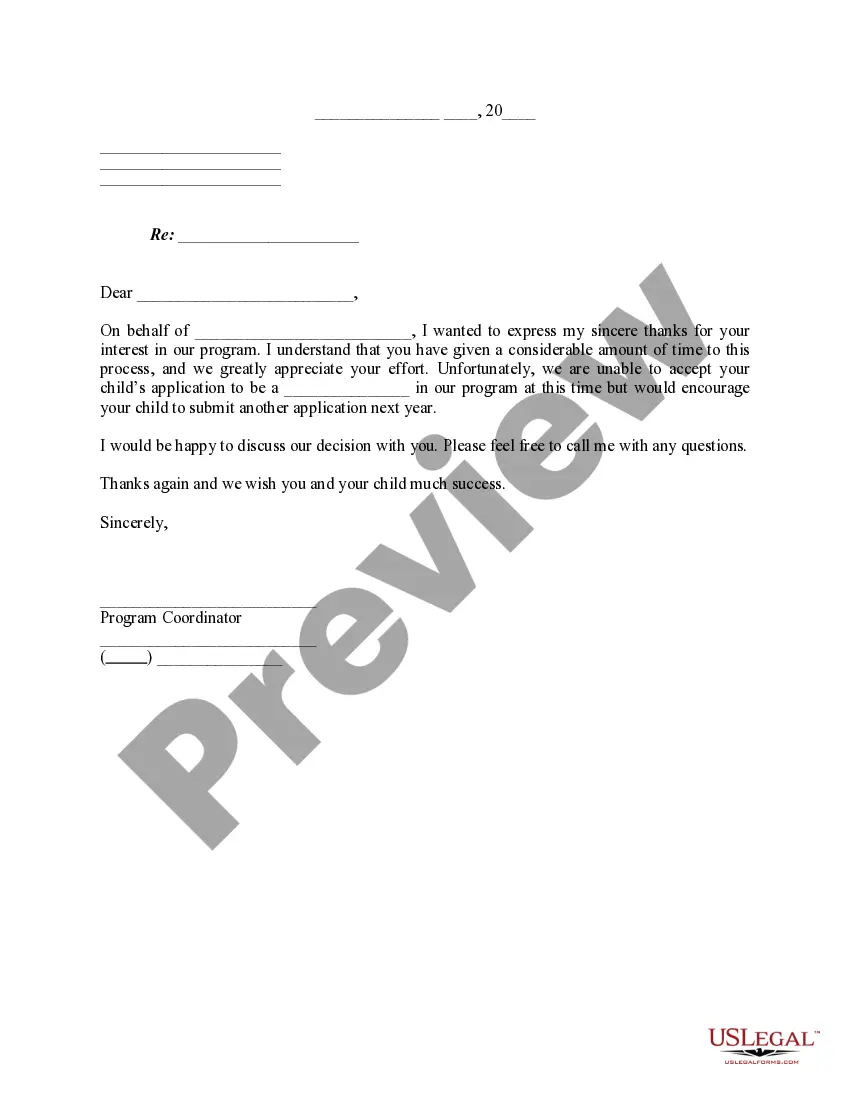

Description

How to fill out Declaration Of Cash Gift With Condition?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse selection of legal paper templates which you can download or print.

While navigating the website, you will find an extensive collection of forms for business and personal purposes, categorized by type, state, or keywords. You can quickly find the latest versions of forms such as the New York Declaration of Cash Gift with Condition in mere seconds.

If you already have an account, Log In and obtain the New York Declaration of Cash Gift with Condition from the US Legal Forms library. The Download button will be available on each form you view. You can access all previously downloaded documents in the My documents section of your account.

Select the format and download the form to your device.

Make edits. Fill out, modify, print, and sign the downloaded New York Declaration of Cash Gift with Condition. Every template added to your account does not expire and is yours indefinitely. So, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the New York Declaration of Cash Gift with Condition via US Legal Forms, one of the most extensive collections of legal document templates. Take advantage of a vast array of professional and state-specific templates that cater to your business or personal needs.

- If this is your first time using US Legal Forms, here are straightforward steps to help you get started.

- Ensure you have chosen the correct form for your area/region. Use the Preview button to review the contents of the form.

- Read the form description to confirm that you’ve selected the right document.

- If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find a more suitable one.

- Once you are happy with the form, confirm your selection by clicking on the Buy now button. Then, choose your preferred pricing option and provide your details to create an account.

- Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

If you give more than $15,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you need to file a gift tax return. That doesn't mean you have to pay a gift tax. It just means you need to file IRS Form 709 to disclose the gift.

You do not pay tax on a cash gift, but you may pay tax on any income that arises from the gift for example bank interest. You are entitled to receive income in your own right no matter what age you are. You also have your own personal allowance to set against your taxable income and your own set of tax bands.

For 2020 the annual gift tax exclusion remains at $15,000. This means that an individual can give away $15,000 to any person in a calendar year ($30,000 for a married couple) without having to file a federal gift tax return.

Understanding the Gift TaxYou can give any individual a gift up to the federal gift tax exclusion amount without having to file a gift tax return to report the gift. For the 2020 and 2021 tax years, the annual exclusion amount is $15,000. The exclusion applies per person, not to the total of gifts given.

Gift tax is not an issue for most people The person gifting files the gift tax return, if necessary, and pays any tax. If someone gives you more than the annual gift tax exclusion amount ($15,000 in 2020), the giver must file a gift tax return. That still doesn't mean they owe gift tax.

You do not pay tax on a cash gift, but you may pay tax on any income that arises from the gift for example bank interest. You are entitled to receive income in your own right no matter what age you are. You also have your own personal allowance to set against your taxable income and your own set of tax bands.

WASHINGTON -- If you give any one person gifts valued at more than $10,000 in a year, it is necessary to report the total gift to the Internal Revenue Service. You may even have to pay tax on the gift. The person who receives your gift does not have to report the gift to the IRS or pay gift or income tax on its value.

Generally, the answer to do I have to pay taxes on a gift? is this: the person receiving a gift typically does not have to pay gift tax. The giver, however, will generally file a gift tax return when the gift exceeds the annual gift tax exclusion amount, which is $15,000 per recipient for 2019.

For 2018, 2019, 2020 and 2021, the annual exclusion is $15,000. For 2022, the annual exclusion is $16,000.

Cash gifts up to $16,000 per year don't have to be reported. Excess gifts require a tax form but not necessarily a tax payment. Gift reporting and taxes are required of the donor, not the recipient. Noncash gifts that have appreciated in value may be subject to capital gains tax.