New York Release of Lien for Real Estate

Description

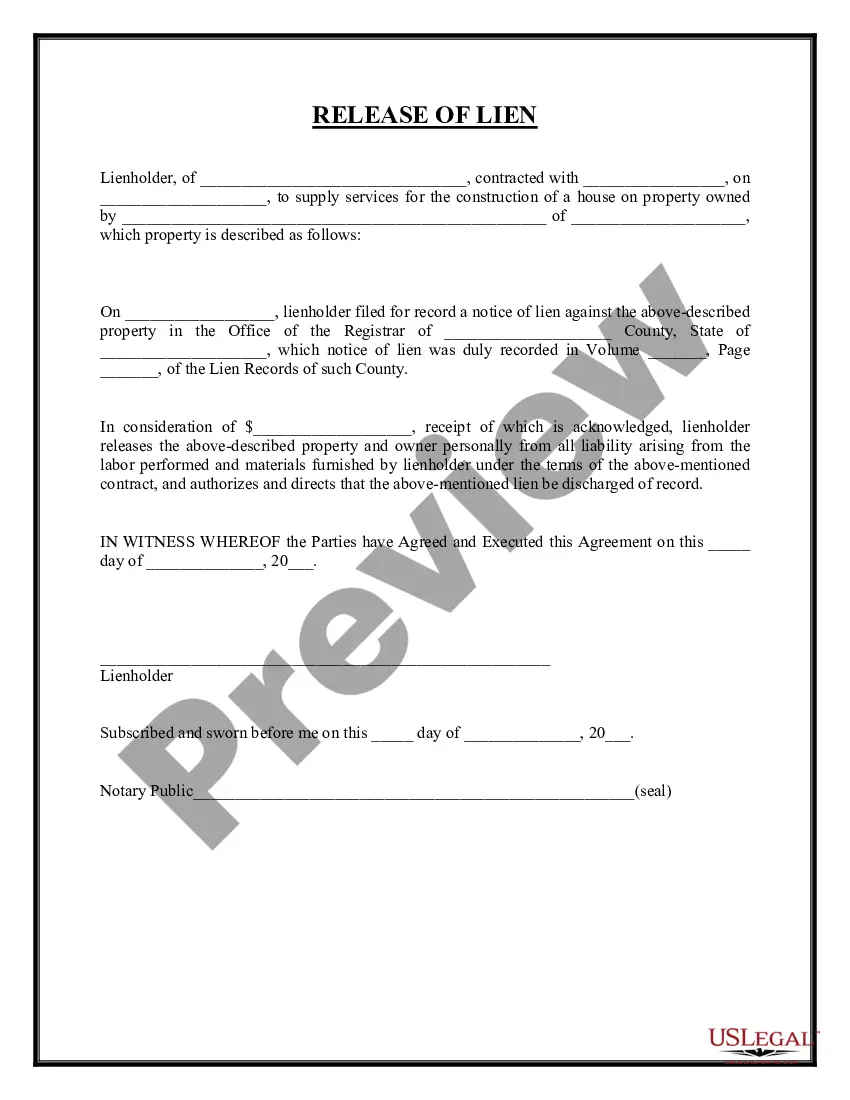

How to fill out Release Of Lien For Real Estate?

If you wish to full, download, or print legal record themes, use US Legal Forms, the biggest assortment of legal forms, that can be found on the web. Make use of the site`s basic and hassle-free search to obtain the documents you will need. Different themes for business and individual functions are categorized by types and suggests, or keywords. Use US Legal Forms to obtain the New York Release of Lien for Real Estate in a number of click throughs.

In case you are currently a US Legal Forms customer, log in to the bank account and then click the Obtain switch to have the New York Release of Lien for Real Estate. Also you can access forms you previously downloaded within the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for your right area/country.

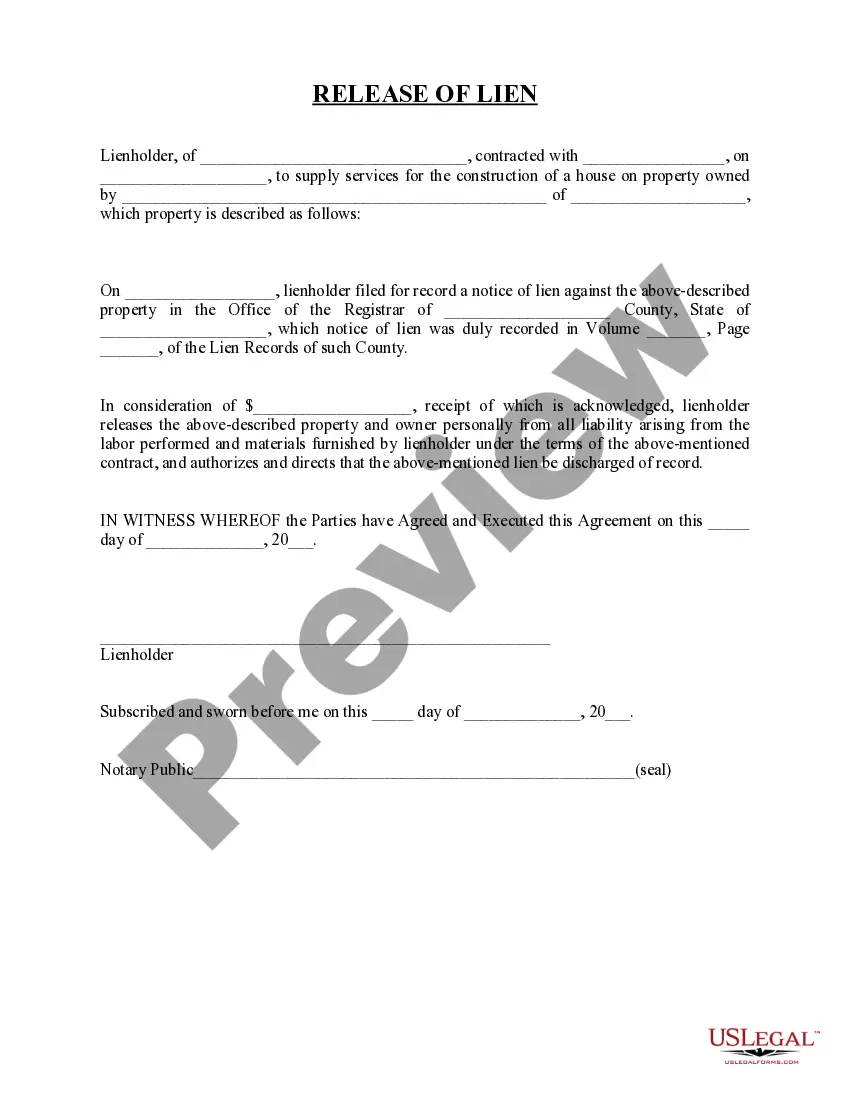

- Step 2. Utilize the Review solution to look over the form`s content. Never forget about to see the outline.

- Step 3. In case you are not happy using the type, use the Look for area towards the top of the display to discover other models in the legal type design.

- Step 4. Upon having found the form you will need, click the Get now switch. Choose the prices strategy you prefer and add your references to sign up for an bank account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Choose the structure in the legal type and download it in your product.

- Step 7. Total, edit and print or indication the New York Release of Lien for Real Estate.

Each and every legal record design you buy is yours permanently. You have acces to every type you downloaded in your acccount. Select the My Forms section and select a type to print or download again.

Contend and download, and print the New York Release of Lien for Real Estate with US Legal Forms. There are thousands of professional and condition-certain forms you can utilize for your personal business or individual requires.

Form popularity

FAQ

Use Form ET-85 when. ? The estate is not required to file a New York State estate tax return (see filing requirements below), and either an executor or administrator has not been appointed, or if appointed, nine months has passed since the date of death. ? The estate is required to file a New York State estate tax.

An original judgment lien is valid for 10 years. If the judgment isn't paid by the end of the first 10 years, then the judgment creditor can seek a renewal judgment on the lien that would be valid for another 10 years.

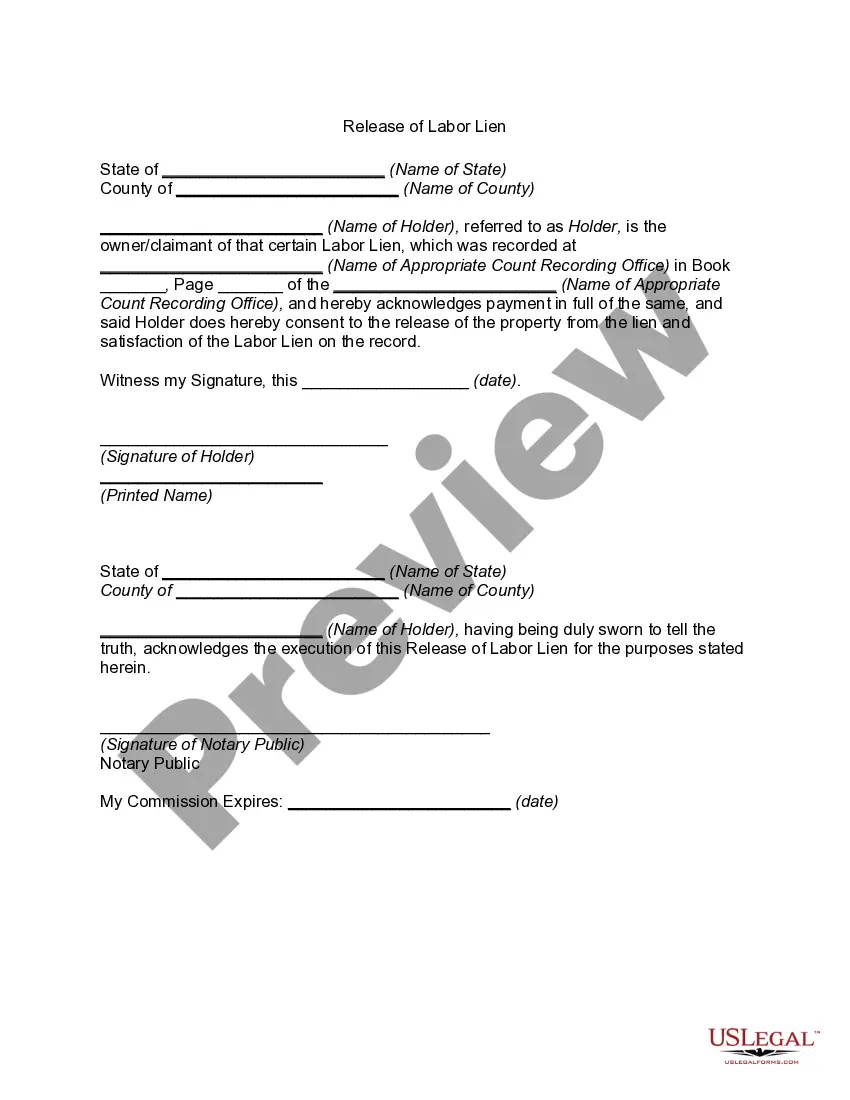

Request a Release-of-Lien Form ? After paying off the balance of your debt in full, the creditor will file a release-of-lien form. This will act as evidence that the debt has been paid and will formally release the lien from your property.

Under certain circumstances, New York State may grant you a release of lien or subordination of lien if you are unable to pay your warranted balance in full. A release of lien is a document that releases New York State's interest in a specific piece of property so it can be transferred to a new owner.

While it is possible to sell a house with a lien attached, the ideal situation is to attempt to have it removed or satisfy the debt before listing. It is very unlikely that a buyer on the open market is going to want to take over a house with a lien on it.

Use Form ET-14, Estate Tax Power of Attorney, when you want to give one or more individuals the authority to obligate, bind, or appear on your behalf before the New York State Department of Taxation and Finance (the department) with respect to estate tax matters.

Once payment has been received, a contractor has a duty to remove any lien that was filed against the property. Failure to do so allows the property owner to file a lawsuit against the contractor to compel the lien's removal. It should be noted that a lien release is not the same as a lien waiver.

Removing an NYS Tax Lien requires a resolution Pay in full ? Pay the debt off and the liens come off. Payment Plan ? Once paid in full, the liens will be released. Offer In Compromise ? Debt is settled for less than you owe. Hard to get if you have valuable property though.