New York Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

Selecting the appropriate official document template may pose a challenge. Naturally, there is an abundance of templates accessible online, but how can you acquire the official form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the New York Option of Remaining Partners to Purchase, suitable for both business and personal needs. All forms are evaluated by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the New York Option of Remaining Partners to Purchase. Use your account to browse through the official forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you require.

Select the file format and download the official document template to your device. Complete, edit, print, and sign the received New York Option of Remaining Partners to Purchase. US Legal Forms is the largest repository of official forms where you can find numerous document templates. Leverage the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your locality/region.

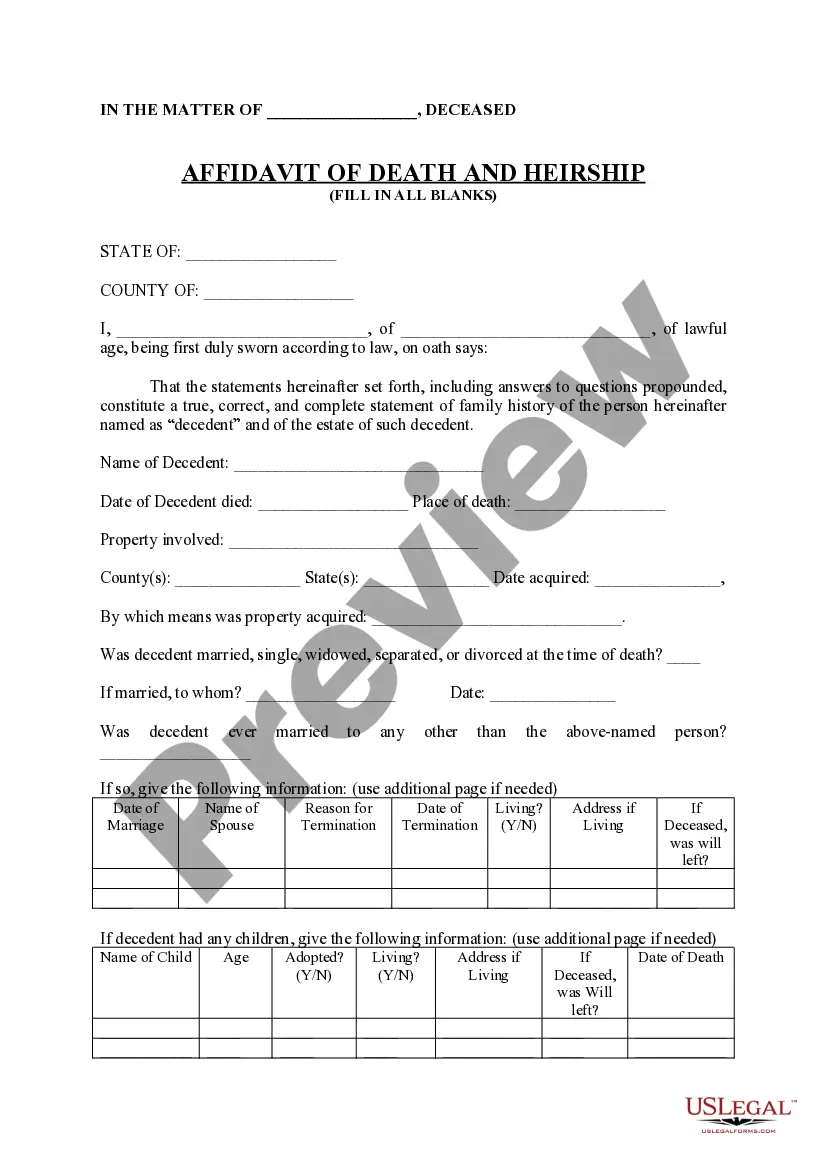

- You can preview the form using the Preview button and review the form description to verify it is suitable for you.

- If the form does not meet your specifications, utilize the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy now button to purchase the form.

- Select the payment plan that you wish to use and provide the required information.

- Create your account and process the payment using your PayPal account or credit card.

Form popularity

FAQ

You are entitled to this nonrefundable credit if you: cannot be claimed as a dependent on another individual's federal income tax return, and.

Qualified taxpayers are eligible to claim a nonrefundable credit for the amount of tax paid on the qualified taxpayers' pro rata or distributive share and guaranteed payments included in the qualified entity's qualified net income. Unused credits can be carried over for up to 5 years.

If the amount of the PTET credit allowable for any taxable year exceeds the tax due for the year, the excess is treated as an overpayment, to be credited or refunded without interest.

A common misperception is that using company cash to buy out a partner is an expense. A partnership interest is generally considered an asset although an intangible one. Purchasing your partner's business share is therefore simply trading one asset for another money for a partnership interest.

Having a partnership change in ownership can mean adding or withdrawing partners. Partners can agree to add new partners in two different ways. The partner who's new could buy out part or all of the interest of the current partner or partners.

The tax basis for the departing partner's payment is the sum of their initial investment, any additional capital contributions made during their tenure as a partner, and their share of business income during that time, all reduced by their percentage of any business losses and distributions.

Buyouts are included as an item of gross income and are considered as fully taxable income under IRS tax laws. Section 451(a) of the Internal Revenue Code provides that the amount of any item of gross income must be included in the gross income for the taxable year in which it is received by the taxpayer.

That have resident partners Submit a Form IT-204-IP for each Article 22 resident partner (you do not have to submit Form IT-204-IP for nonresident partners) and for each partner that is a partnership or LLC. Submit a Form IT-204-CP for each corporate partner that is taxable under Article 9-A.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.