New York Revocable Trust for House

Description

How to fill out Revocable Trust For House?

US Legal Forms - one of the most significant collections of legal forms in the United States - provides a variety of legal document templates you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can locate the most recent versions of forms such as the New York Revocable Trust for Property within minutes.

Review the form description to ensure you have selected the appropriate form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already possess a subscription, Log In and download the New York Revocable Trust for Property from the US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are a first-time user of US Legal Forms, here are straightforward instructions to get you started.

- Ensure you have chosen the correct form for your area/county.

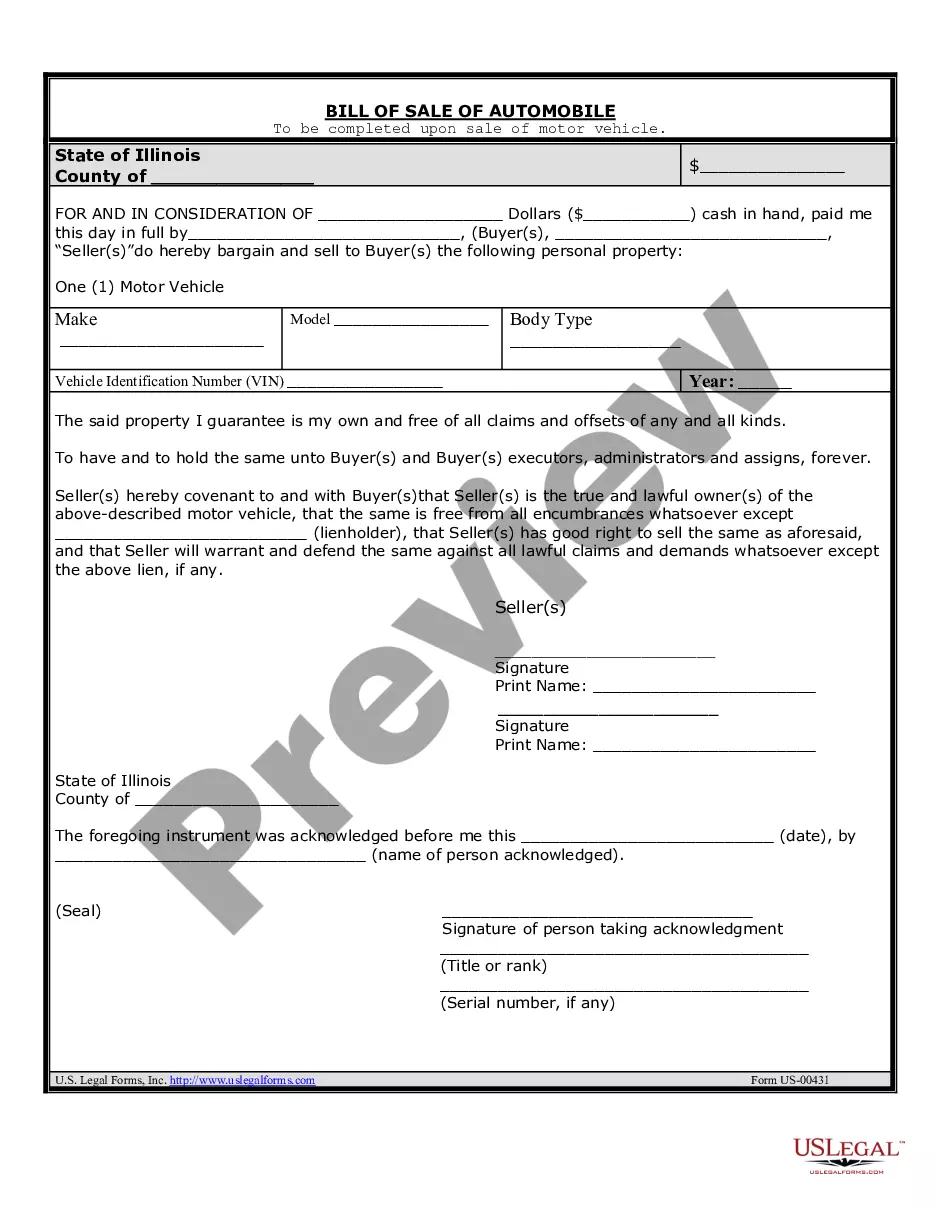

- Click the Preview button to examine the form's content.

Form popularity

FAQ

While there are advantages, disadvantages include potential legal costs associated with establishing the trust and ongoing management duties. A New York Revocable Trust for House does not offer creditor protection, meaning your home could still be vulnerable in lawsuits. Additionally, if the trust is not properly funded, its benefits may be lost.

You may choose to place your house in a New York Revocable Trust for House to simplify the transfer process upon your death, helping your beneficiaries avoid probate. This leads to quicker access to the property and aligns with your estate planning goals. It provides peace of mind, knowing your wishes regarding the property will be respected.

The benefits of a New York Revocable Trust for House include avoiding probate, maintaining privacy regarding estate distribution, and providing clear directives for asset management. It also allows for flexibility, as you can amend or revoke the trust as your circumstances change. Additionally, it can streamline the transfer process for your heirs.

In general, a nursing home can attempt to claim assets from a trust to cover care costs, but the house in a New York Revocable Trust for House is not automatically subject to these claims. If property is properly placed in trust, it can provide some level of protection. However, it is vital to consult with an attorney for personalized advice on asset protection.

One downfall of having a trust is the potential lack of flexibility after its establishment. Changes to the trust may require significant legal processes, especially if you have a New York Revocable Trust for House. Furthermore, assets held in trust may not be accessible in emergencies if not properly managed.

If your parents want to ensure that their assets are smoothly transferred to heirs, a trust may be beneficial. A New York Revocable Trust for House allows them to retain control while simplifying the inheritance process. This can also safeguard against challenges from creditors and provide privacy that a will cannot offer.

Placing your house in a New York Revocable Trust for House simplifies the transfer of property upon your death, avoiding the costly and lengthy probate process. This setup helps to ensure your wishes are followed regarding property distribution. Moreover, it provides greater control over your assets during your lifetime.

One disadvantage of a family trust is the potential for complications during its administration. Disputes may arise among family members regarding trust management or distribution of assets. Additionally, a New York Revocable Trust for House does not shield assets from creditors, which can be a significant concern.

Yes, you can place your house into a New York Revocable Trust for House, even if you have an existing mortgage. It's important to understand that the mortgage will still remain in effect, and you must continue to make your mortgage payments. Banks generally allow this transfer because a revocable trust can be altered or dissolved by the grantor at any time. Using a revocable trust can provide benefits such as avoiding probate and ensuring a smooth transfer of ownership upon your passing.

A common mistake parents make when establishing a trust fund is not clearly defining their intentions or the rules for fund distribution. This lack of clarity can lead to confusion and disputes among beneficiaries. Clearly outline your goals and consult with professionals who can help guide you in creating a comprehensive New York Revocable Trust for House to avoid these pitfalls.