New York Revocable Trust for Married Couple: A Comprehensive Guide In New York, a revocable trust serves as an essential estate planning tool for married couples. It allows spouses to retain control over their assets during their lifetime while facilitating a smooth transfer of wealth to beneficiaries upon their death. This article provides a detailed description of the New York Revocable Trust for Married Couples, outlining its key features, benefits, and types. Key Features of New York Revocable Trust for Married Couple: 1. Control and Flexibility: A revocable trust enables married couples to maintain full control over their assets held within the trust. They can freely modify or revoke the trust, manage the trust property, and make amendments as per their changing circumstances or wishes. 2. Probate Avoidance: The trust assets bypass the often lengthy and costly probate process, ensuring a faster distribution of assets. By avoiding probate, the trust safeguards the privacy of the couple's financial affairs, as probate proceedings are a matter of public record. 3. Asset Management: Should either spouse become incapacitated, the trust provisions would govern how the trust assets are managed, ensuring uninterrupted financial management and avoiding the need for court intervention. 4. Estate Tax Planning: Through proper estate planning strategies, a revocable trust for a married couple can help maximize estate tax exemptions, reduce potential liability, and minimize estate taxes for their beneficiaries, preserving wealth for future generations. Types of New York Revocable Trusts for Married Couples: 1. Joint Revocable Trust: A joint revocable trust allows both spouses to establish a single trust agreement, merging their assets into a unified trust entity. This type of trust ensures simplified administration and a unified approach to managing the marital estate. 2. Separate Revocable Trusts: Alternatively, spouses may choose to create separate revocable trusts. Each spouse establishes an individual trust, managing and controlling their respective assets. This approach offers greater flexibility for estate planning purposes, facilitating tailored provisions for each spouse's specific needs or wishes. 3. Testamentary Trust: This type of revocable trust is established through a will and becomes effective upon the death of the testator. For married couples, a testamentary trust can ensure the preservation and management of assets for the surviving spouse's benefit and subsequent distribution to designated beneficiaries. 4. Irrevocable Life Insurance Trust: Although not strictly a revocable trust, this type of trust can be crucial for married couples looking to preserve their assets from estate taxes. By placing life insurance policies within an irrevocable trust, the death benefits can be excluded from the couple's taxable estate, ensuring a more efficient wealth transfer to their beneficiaries. In conclusion, the New York Revocable Trust for Married Couples offers various advantages, including control over assets, probate avoidance, streamlined asset management, and estate tax planning. Understanding the different types of trusts, such as joint revocable trusts, separate revocable trusts, testamentary trusts, and irrevocable life insurance trusts, can help couples choose the most suitable option to meet their specific goals and protect their assets for future generations.

New York Revocable Trust for Married Couple

Description

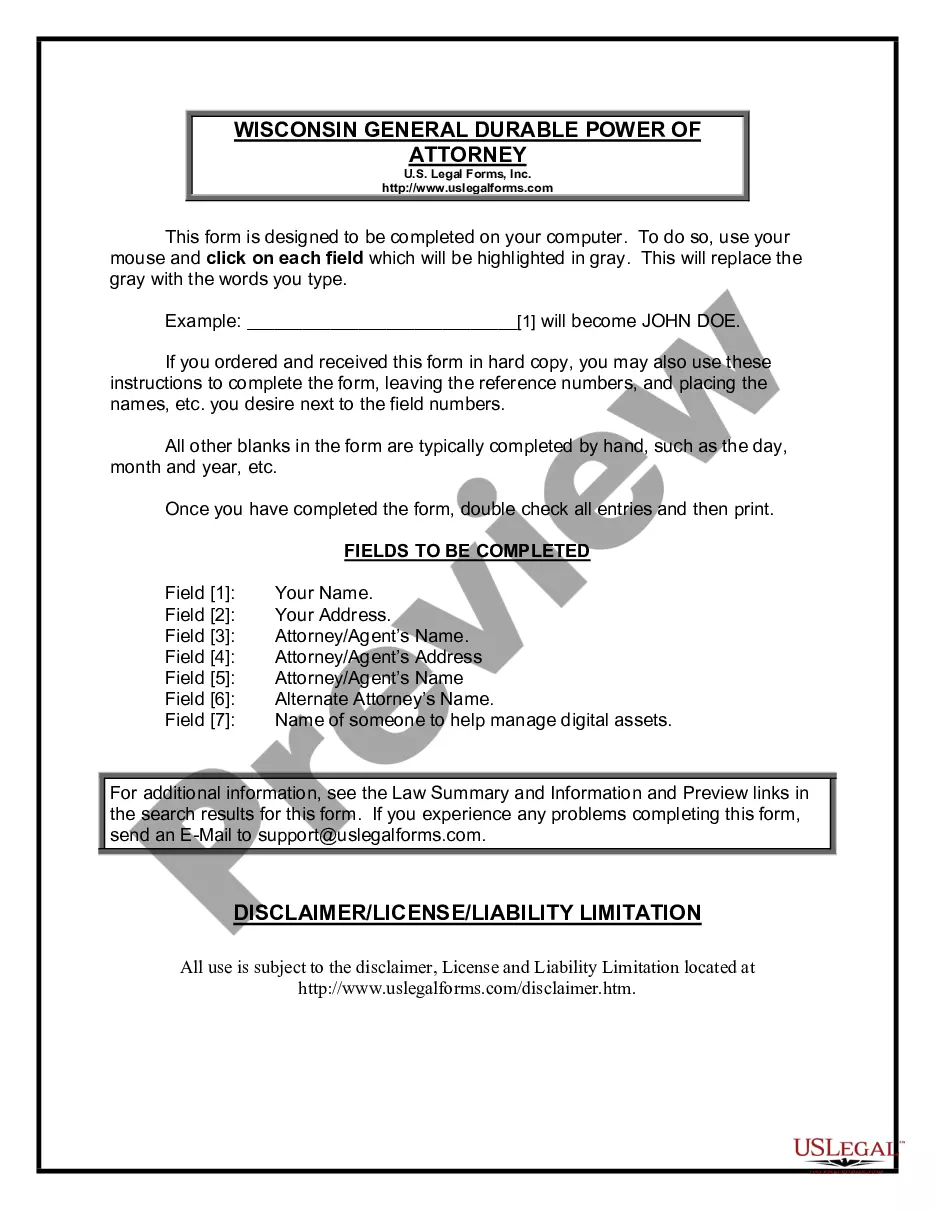

How to fill out Revocable Trust For Married Couple?

If you aim to complete, acquire, or print valid document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you require.

Many templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you download is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and choose a form to print or download again.

Compete and obtain, and print the New York Revocable Trust for Married Couple with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to discover the New York Revocable Trust for Married Couple in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to access the New York Revocable Trust for Married Couple.

- You can also find forms you previously downloaded in the My documents tab of your account.

- Step 1. Make sure you have selected the form for the correct area/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you wish and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New York Revocable Trust for Married Couple.

Form popularity

FAQ

Indeed, a revocable trust avoids probate in New York. By establishing a New York Revocable Trust for Married Couple, you ensure that your assets are transferred to your heirs efficiently and without the delays and expenses associated with the probate process. This simplicity further underscores the importance of careful estate planning.

Yes, a revocable trust does avoid probate in New York. When you create a New York Revocable Trust for Married Couple, the assets placed in the trust will pass directly to your heirs, bypassing the need for court intervention. This feature significantly speeds up the distribution process, offering peace of mind to you and your loved ones.

In New York, certain assets are exempt from probate, including life insurance proceeds, retirement accounts with designated beneficiaries, and jointly owned properties. Moreover, funds held in a New York Revocable Trust for Married Couple also avoid probate. It's crucial to review your estate plan to maximize these exemptions.

A revocable trust in New York state operates by allowing the trust creator, or grantor, to retain control over their assets while they are alive. You can modify, withdraw, or revoke the trust at any time. Upon your passing, the assets in the New York Revocable Trust for Married Couple pass directly to your beneficiaries, avoiding the probate court.

The best type of trust to avoid probate is the New York Revocable Trust for Married Couple. This trust allows you and your spouse to manage your assets during your lifetime and specify how they will be distributed after your passing. By using this trust, you can ensure a smoother transition of your estate to your beneficiaries without the lengthy probate process.

A marital trust is designed to provide income and support for the surviving spouse, while a survivor's trust comes into play after one partner passes away. With a New York Revocable Trust for Married Couples, the surviving spouse can manage and control the trust assets, which helps maintain financial stability. In contrast, a survivor's trust specifically benefits the surviving spouse and may include specific provisions for children or other heirs.

A New York Revocable Trust for Married Couple is an excellent choice for those entering a second marriage. This type of trust allows both spouses to retain control over their assets while providing clear instructions for asset distribution. It helps protect assets from potential claims by previous partners, ensuring both you and your new spouse are secure. Additionally, it simplifies the estate planning process, making it easier for your loved ones when the time comes.

The best type of trust for a married couple is often a revocable trust, as it allows for flexibility and control over assets during their lifetime. A New York Revocable Trust for Married Couple can be adjusted as life changes occur, providing peace of mind for both partners. This type of trust facilitates smoother transitions in asset management and distribution, making it a popular choice.

The least expensive way to set up a trust typically involves using online platforms that provide trust templates without the need for extensive legal intervention. With solutions like UsLegalForms, you can create a New York Revocable Trust for Married Couple efficiently and affordably. Always ensure that the chosen method aligns with your financial and familial needs to avoid costly mistakes later.

Remarried couples often benefit from separate trusts to safeguard individual assets and provide clarity for children from previous marriages. A New York Revocable Trust for Married Couple can be tailored to include specific provisions that address the unique circumstances of blended families. This setup helps ensure fair treatment and clear directives for asset distribution.

More info

The health care trust is a legal entity to safeguard the family members' joint and separate assets and can be used to provide health insurance coverage to family members who are not spouses. This article will assume that the reader has some understanding of the definition of “Sole Ownership” and the financial concept that the value of assets (income) is the same as the value of the assets (expenses). A health care trust is designed to protect the interests of the participants and beneficiaries of the legal relationship formed in the process of acquiring and maintaining their joint health care assets as outlined in the Health Care Trust Act, which governs the trust. The health care trust has two primary purposes that will be explored in greater detail. The first use of a health care trust is to provide health coverage to the participants to be supported with their jointly owned joint and separate assets.