New York Secured Promissory Note

Description

How to fill out Secured Promissory Note?

If you wish to be thorough, acquire, or print licensed document templates, utilize US Legal Forms, the largest selection of legal templates available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours permanently. You have access to all forms you downloaded in your account. Visit the My documents section and select a document to print or download again.

Compete and acquire, and print the New York Secured Promissory Note with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to obtain the New York Secured Promissory Note with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the New York Secured Promissory Note.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

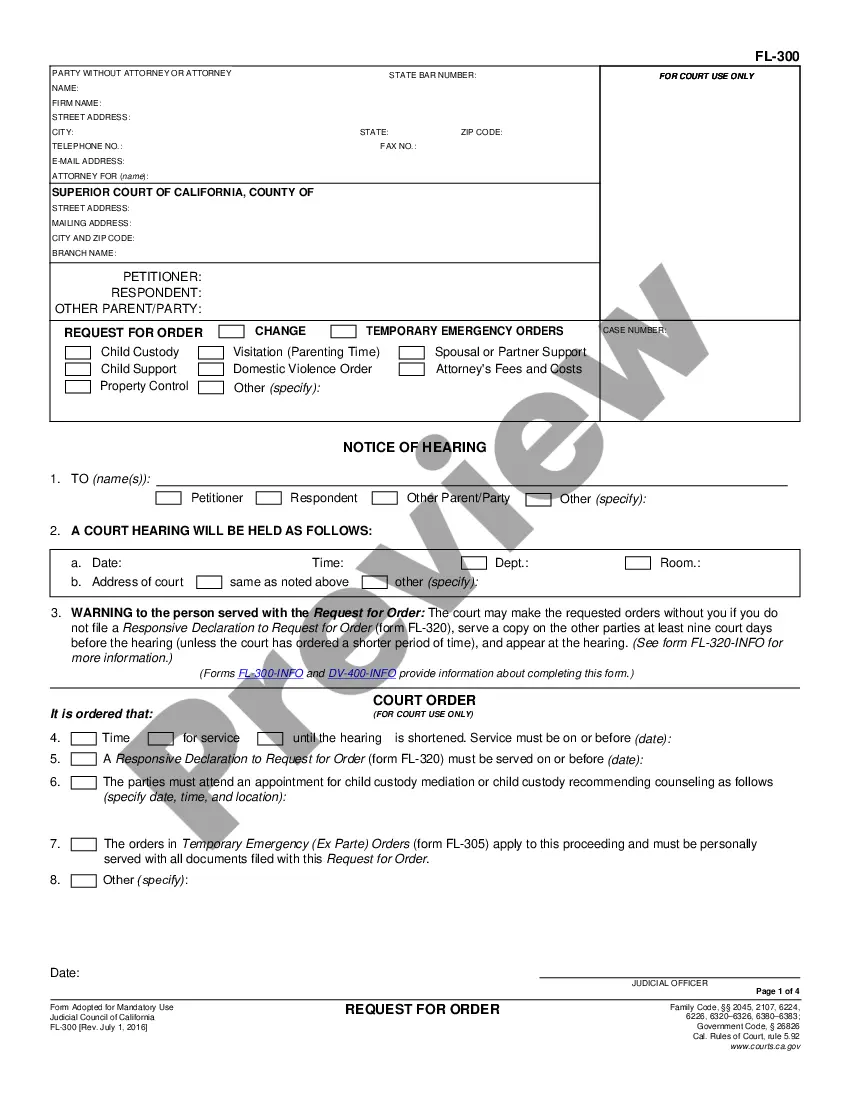

- Step 2. Use the Preview option to check the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. After locating the required form, click the Buy Now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the New York Secured Promissory Note.

Form popularity

FAQ

The required elements of a valid New York Secured Promissory Note include the names of the borrower and lender, the principal amount, and the terms for repayment. Additional elements might encompass interest rates and signatures. Ensuring these components are present is vital for the note's enforceability.

To obtain a copy of a New York Secured Promissory Note, refer to the original issuer. If you are the buyer or lender, you might have received a copy upon signing. If it is lost, consider contacting an attorney or using a legal document platform like US Legal Forms to create a duplicate that meets state requirements.

For your New York Secured Promissory Note to hold legal weight, it must fit particular requirements. These include being in writing, clearly stating the involved parties, specifying the amount, and having a defined repayment schedule. Including a date and appropriate signatures will enhance its validity further.

A New York Secured Promissory Note must meet specific conditions for it to be enforceable. These conditions typically include the maturity date, terms of repayment, and any applicable interest rates. It is also important that both parties understand and agree to the terms to avoid future disputes.

A New York Secured Promissory Note is specifically designed to be backed by collateral. This structure provides lenders with a safety net, as they can claim the asset if repayment does not occur. This contrasts with unsecured notes, which lack this protective feature, highlighting the advantages of using secured instruments in lending.

Enforcing a New York Secured Promissory Note typically involves legal action if the borrower defaults on payments. The lender can claim the collateral specified in the note, which may involve filing a court action or seeking a professional collection service. Utilizing platforms like US Legal Forms can help you understand your rights and streamline the enforcement process.

A New York Secured Promissory Note is backed by collateral, meaning that if the borrower defaults, the lender has the right to claim the asset specified in the note. In contrast, an unsecured promissory note does not have any underlying asset, making it riskier for lenders. This distinction is crucial for borrowers to understand; having a secured note can lead to lower interest rates due to reduced risk for the lender.

The format of a promissory note typically includes a title, the date of the agreement, the names and addresses of both parties, and the principal amount. Additionally, it should specify the interest rate, repayment schedule, and any fees associated with late payments. Using a standard format ensures clarity, so you might want to check resources from US Legal Forms focusing on New York Secured Promissory Notes.

To write a simple promissory note, start by clearly stating the names of the lender and borrower. Next, outline the principal amount loaned, the interest rate, and the repayment terms. It is essential to specify the due date and any consequences for missed payments. Consider using tools like US Legal Forms for templates tailored to a New York Secured Promissory Note.

Yes, a promissory note can be secured by collateral, such as property or other assets. This secured status provides greater assurance to the lender in case of default, as they can claim the collateral to recover losses. Crafting a New York Secured Promissory Note with specific terms on the collateral can enhance protection for both parties.