New York Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Employ the site's easy and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for the account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, review, and print or sign the New York Unrestricted Charitable Contribution of Cash. Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Check the My documents section and choose a form to print or download again. Finalize and obtain, and print the New York Unrestricted Charitable Contribution of Cash with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your personal or business needs.

- Utilize US Legal Forms to obtain the New York Unrestricted Charitable Contribution of Cash in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to find the New York Unrestricted Charitable Contribution of Cash.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

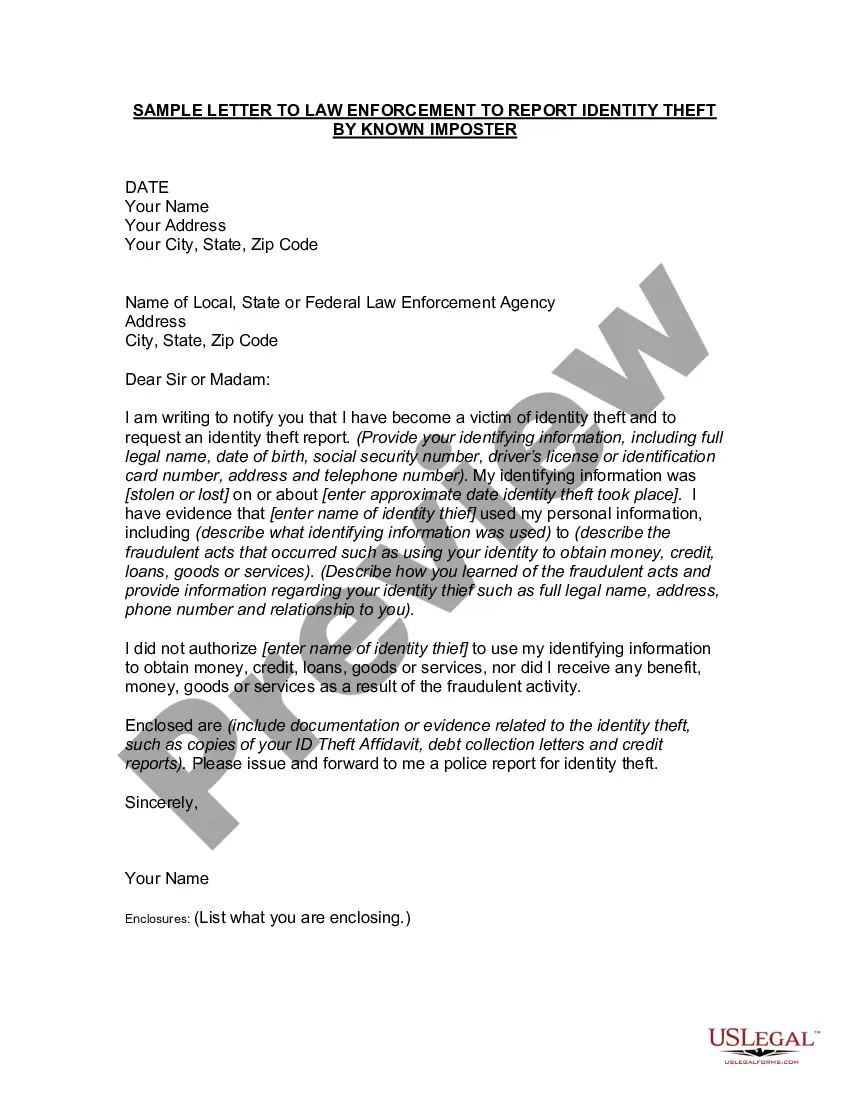

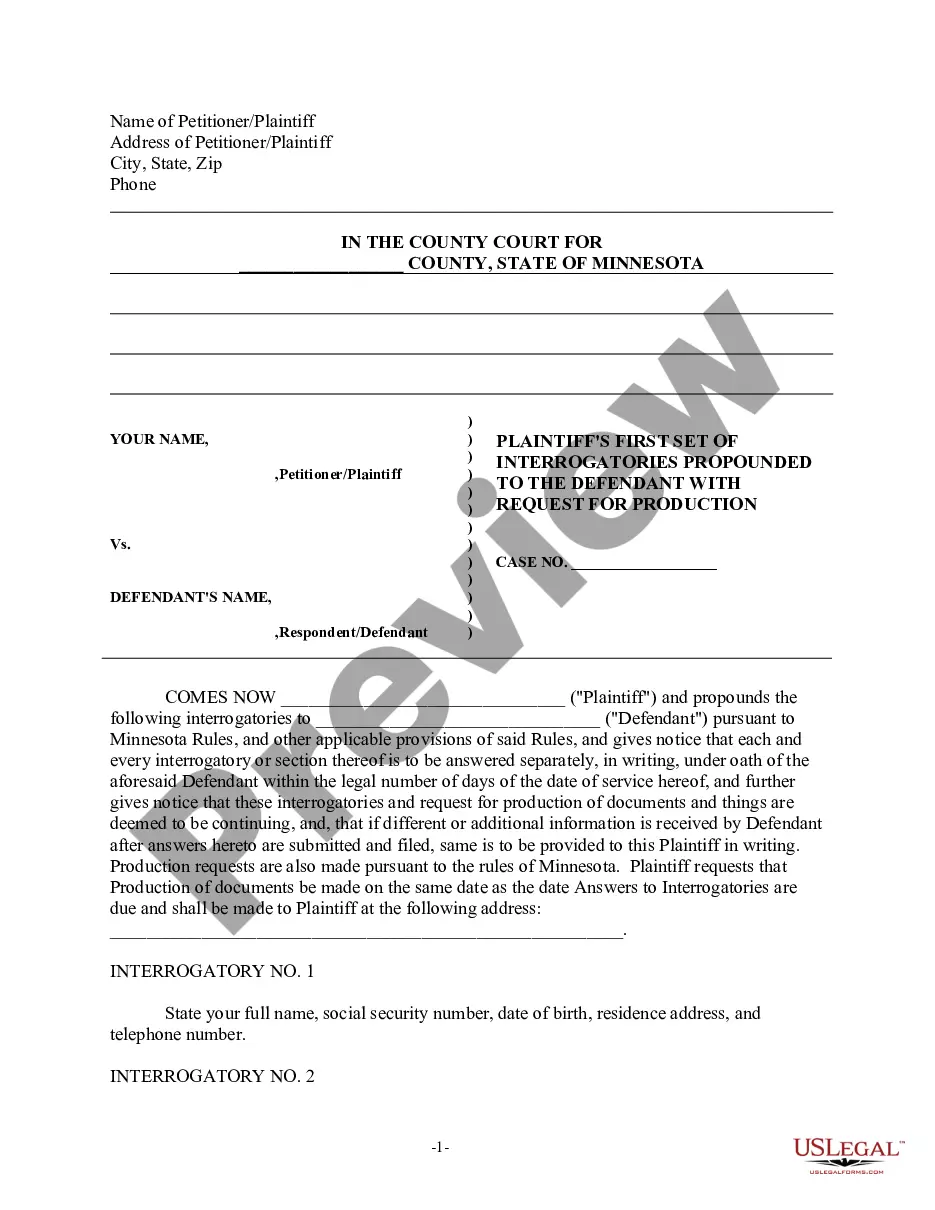

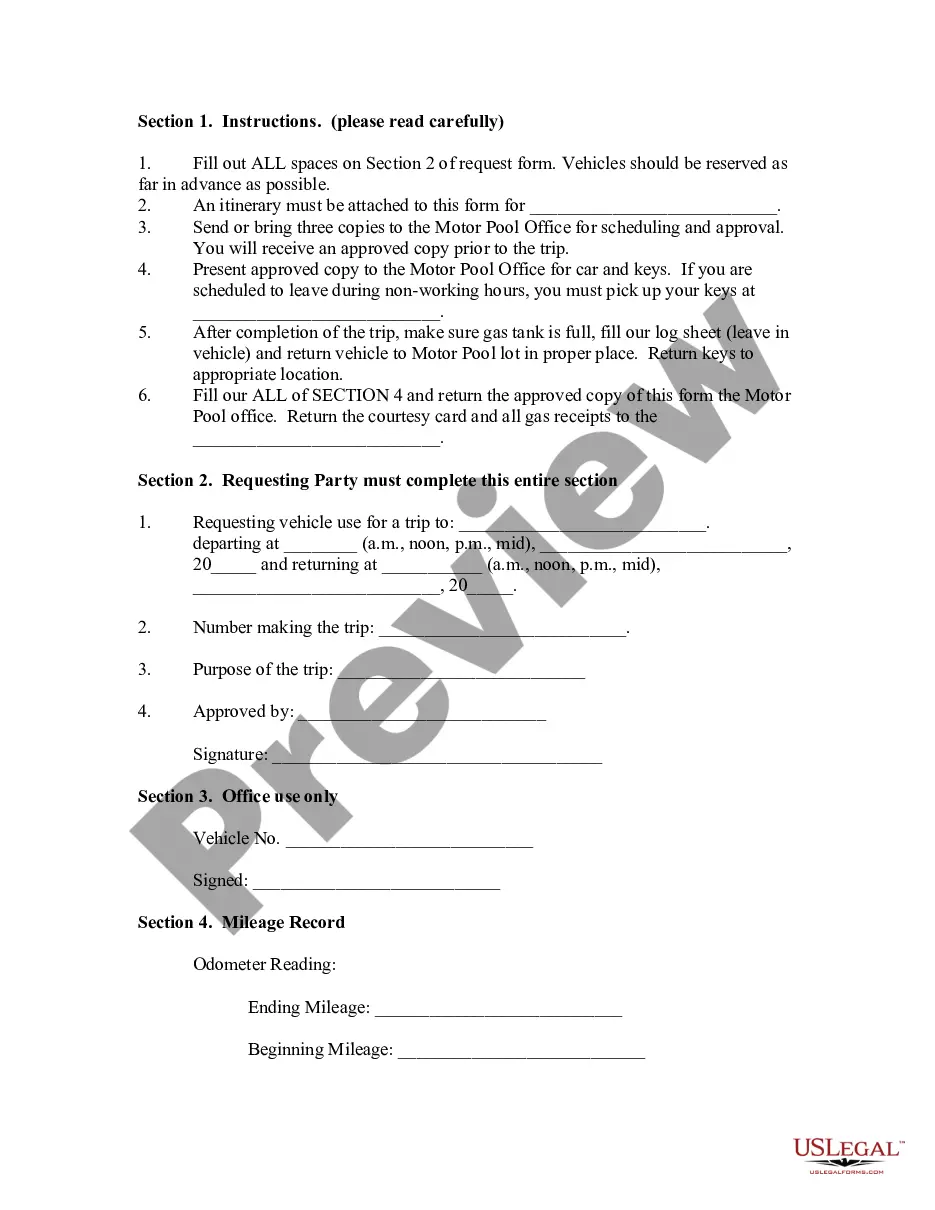

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Your deduction for charitable contributions is generally limited to 60% of your AGI. For tax years 2020 and 2021, you can deduct cash contributions in full up to 100% of your AGI to qualified charities. There are limits for non-cash contributions.

Non-cash donations. The deductible limit for non-cash donations falls between 20% and 50% of your AGI, depending on the type of non-cash donation that's being made. Non-cash donations include the following types of property: New or used clothing or other household items and food. New or used vehicles.

A qualified contribution for purposes of the 25 percent taxable income limit is a charitable contribution made in cash during the 2020 and 2021 calendar years to churches, nonprofit educational institutions, nonprofit medical institutions, public charities, or any other organization described in IRC §170(b)(1)(A).

No cash or non-cash donation is deductible unless the taxpayer has a receipt from the charity substantiating the donation. Since contributions must be made to qualified organizations to be tax-deductible, donations made to needy individuals are not deductible.

All of your church donations are tax deductible, assuming your church meets the 501(c)(3) requirements. But you might not be able to claim them all in one year. If your donations exceed 60% of your Adjusted Gross Income, you will need to claim the remaining donations in future tax years.

Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.

Regular 30% Limitation Non-50% charities include veterans' organizations, fraternal societies, nonprofit cemeteries, and certain private non-operating foundations. Regular 30% contributions are limited to the lesser of: 30% of AGI, or. 50% of AGI reduced by all contributions to 50% charities.