New York Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

Have you ever found yourself in a circumstance where you frequently require documents for either organizational or personal reasons.

There are numerous trustworthy document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the New York Guaranty of Open Account - Alternate Form, which are crafted to fulfill both state and federal requirements.

Once you locate the correct form, click Get now.

Select your desired pricing plan, provide the necessary information to create your account, and complete the payment using PayPal or a credit card. Choose a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New York Guaranty of Open Account - Alternate Form anytime you wish; just access the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Guaranty of Open Account - Alternate Form template.

- If you do not possess an account and wish to start using US Legal Forms, follow these procedures.

- Find the form you need and verify that it adheres to the correct city/region.

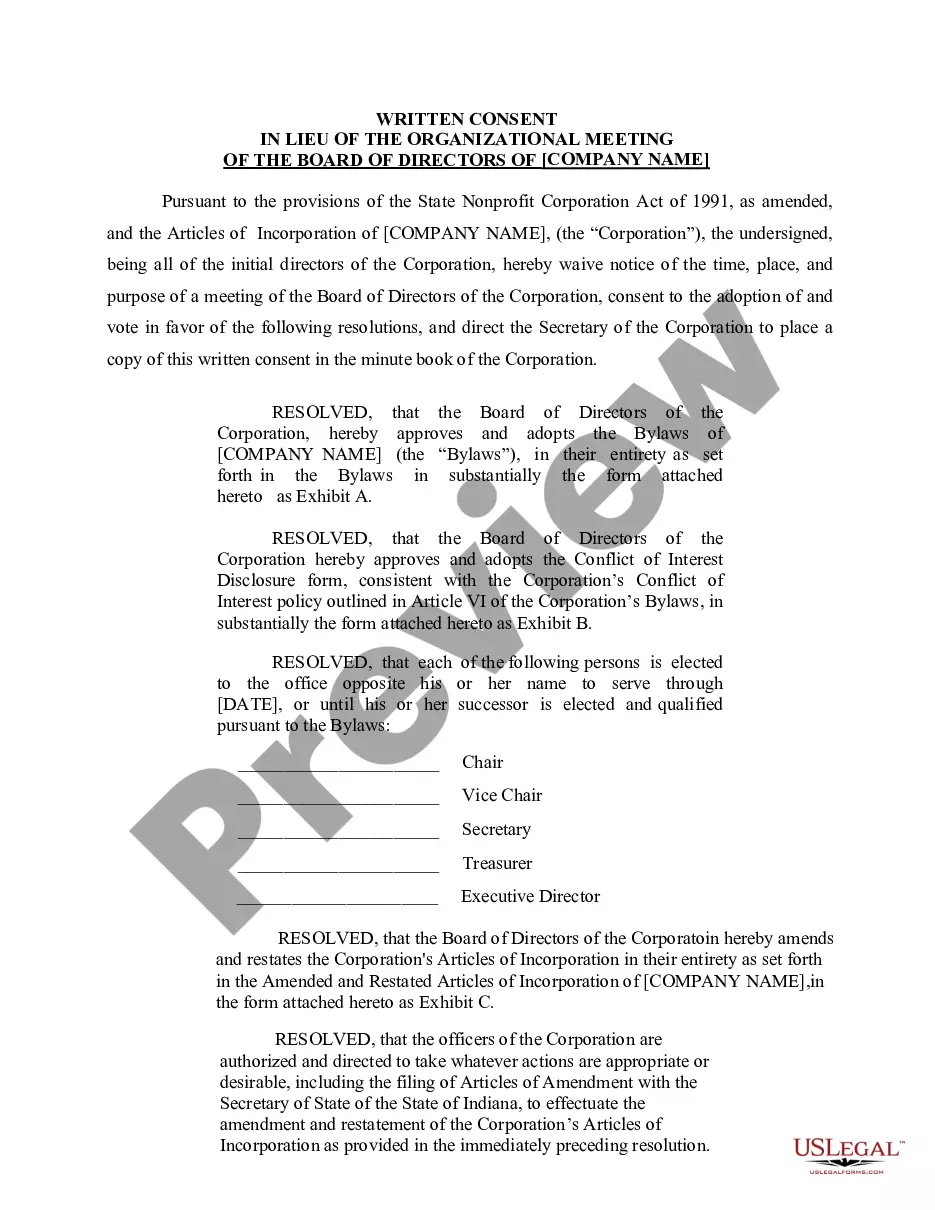

- Utilize the Preview feature to examine the form.

- Read the description to confirm you have selected the appropriate form.

- If the form does not match your requirements, use the Search bar to find the form that meets your needs.

Form popularity

FAQ

In New York City, guaranty law mandates specific conditions for enforceability. The New York Guaranty of Open Account - Alternate Form requires clarity in terms, ensuring both parties understand their obligations. Additionally, it must be in writing and signed by the guarantor for legal standing. Familiarizing yourself with these legal requirements can help you navigate your agreements competently.

There are several defenses that can be used against a personal guarantee in New York. If the guarantor can prove that the guarantee was signed under duress or without proper understanding, this can invalidate the agreement. Additionally, if the underlying debt is not enforceable, such as due to fraud or lack of consideration, the guaranty may also be challenged. Understanding these defenses is critical when dealing with the New York Guaranty of Open Account - Alternate Form.

To write a guarantor's form for a New York Guaranty of Open Account - Alternate Form, start by clearly identifying the parties involved, including the guarantor and the party receiving the guarantee. Next, outline the specific obligations the guarantor will assume. Make sure to include details about the terms, such as the amount guaranteed and the duration of the guarantee. Using a trusted platform like US Legal Forms can simplify this process, providing templates and guidance tailored for the New York Guaranty of Open Account - Alternate Form.

The three common types of guarantees include personal guarantees, corporate guarantees, and bank guarantees. Each serves to provide assurance regarding obligations owed, and they play a significant role in the New York Guaranty of Open Account - Alternate Form. Understanding the differences can help you choose the right type of guarantee for your financial agreements, ensuring that all parties are adequately protected.

A short form guaranty is a simplified version of a guaranty, typically containing essential terms and conditions without extensive legal language. This type of document is particularly beneficial when dealing with the New York Guaranty of Open Account - Alternate Form, as it allows for quick and efficient processing. Businesses favor this format because it speeds up transactions while maintaining the necessary protections.

A form of guarantee refers to a commitment made by individuals or organizations to cover another party’s financial obligations, thereby safeguarding the interests involved. The New York Guaranty of Open Account - Alternate Form serves as a vital tool for creditors because it reduces risk in lending scenarios. It lays the groundwork for smoother transactions, as all parties understand their roles and responsibilities.

A form of guaranty is a written agreement wherein one party agrees to assume responsibility for another party's debt or obligations if that party defaults. In the context of the New York Guaranty of Open Account - Alternate Form, it provides a mechanism for assurance in financial transactions. This type of guaranty helps to establish trust between creditors and debtors by clearly outlining repayment terms.