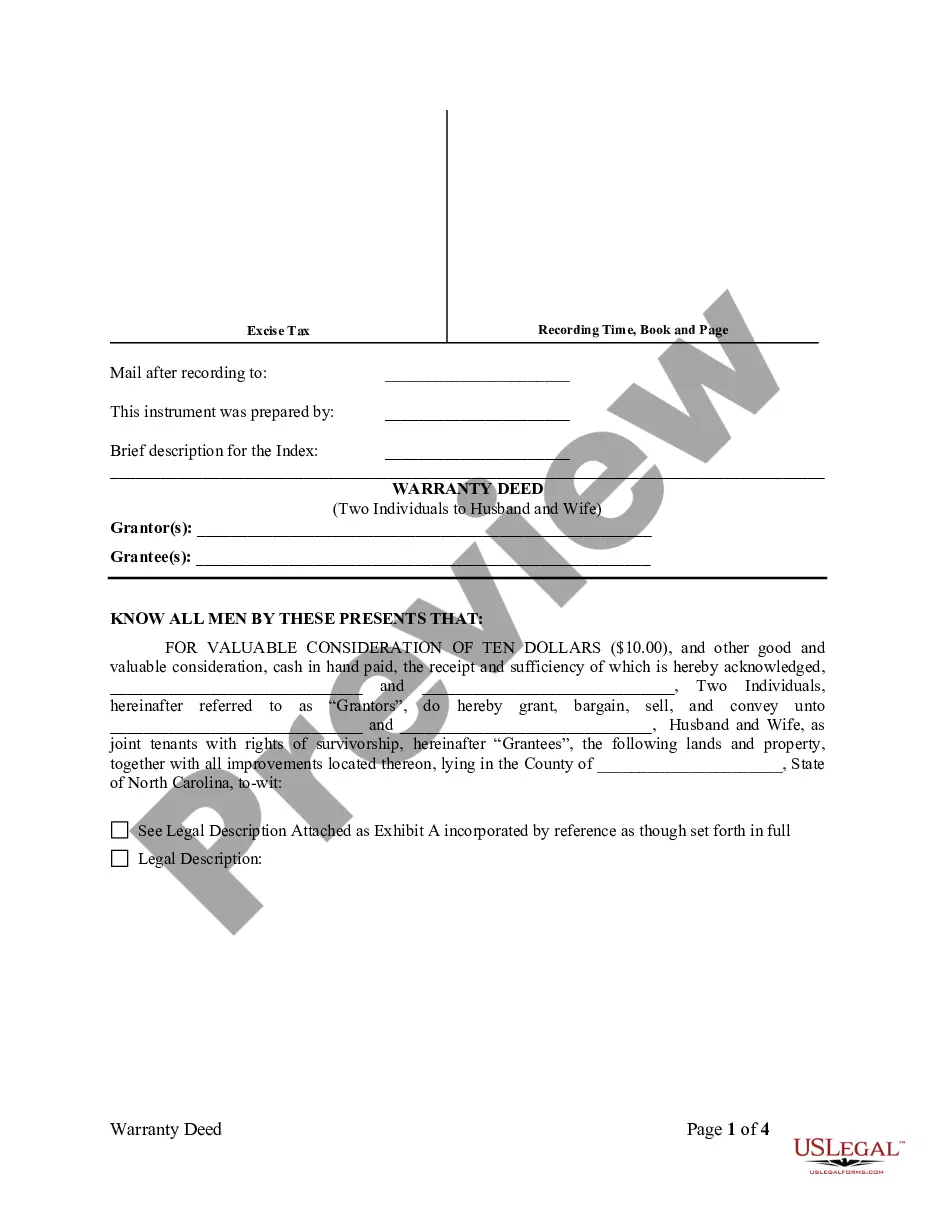

Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Title: New York Notice to Debtor of Authority of Agent to Receive Payment: A Comprehensive Guide Introduction: If you are a debtor in the state of New York, it is vital to understand the Notice to Debtor of Authority of Agent to Receive Payment. This document establishes the legitimacy of a designated agent or attorney to collect payments on behalf of a creditor. In this article, we will delve into the purpose, components, and various types of New York Notice to Debtor of Authority of Agent to Receive Payment. Key Keywords: New York Notice to Debtor, Authority of Agent, Receive Payment, Creditor, Debtor, Documentation, Legal Notice 1. Understanding the Notice to Debtor of Authority of Agent to Receive Payment: — Definition and purpose of thNoticeic— - Importance of acknowledging and abiding by the Notice — Legal requirements and obligations of the debtor 2. The Need for an Authorized Agent: — Role and responsibilities of an authorized agent — Benefits of appointing an authorized agent to handle debt collection — Building trust and streamline payment processes 3. Components of a New York Notice to Debtor of Authority of Agent to Receive Payment: — Creditor's contacinformationio— - Agent's credentials and authority — Debtor's obligations and instructions for payment — Effective dates and duration of the Notice — Consequences of non-compliance 4. Common Types of New York Notices to Debtor of Authority of Agent to Receive Payment: a) General Notice: — Designed for standard debt collection scenarios — Appropriate for individuals or businesses seeking payment b) Notice from Financial Institutions: — Pertains to debts owed to banks, credit unions, or financial institutions — Specific instructions related to payment channels and details c) Notice for Delinquent Taxes: — Applicable when the debtor owes taxes to the state or local tax authorities — Details regarding tax collection methods and payment procedures d) Notice for Outstanding Loans or Mortgages: — Suitable for debtors who have defaulted on loans or mortgages — Emphasizes the agent's authority to collect payment and potential consequences of non-payment Conclusion: By comprehending the New York Notice to Debtor of Authority of Agent to Receive Payment, debtors can navigate debt collection processes effectively. Adhering to the Notice's guidelines ensures a transparent and lawful payment procedure between all involved parties. Remember, it is crucial to consult legal professionals for personalized advice based on your specific circumstances. Key Keywords: Comprehending, Guidelines, Debt Collection, Legal Professionals, Circumstances.