New York Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

Are you presently in a position that requires documentation for possibly business or personal activities nearly all the time.

There are numerous legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms provides thousands of document templates, like the New York Obtain S Corporation Status - Corporate Resolutions Forms, designed to fulfill federal and state regulations.

Utilize US Legal Forms, which features one of the most extensive collections of legal documents, to save time and avoid mistakes.

The service provides professionally created legal document templates that are useful for various purposes. Establish your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the New York Obtain S Corporation Status - Corporate Resolutions Forms template.

- If you lack an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

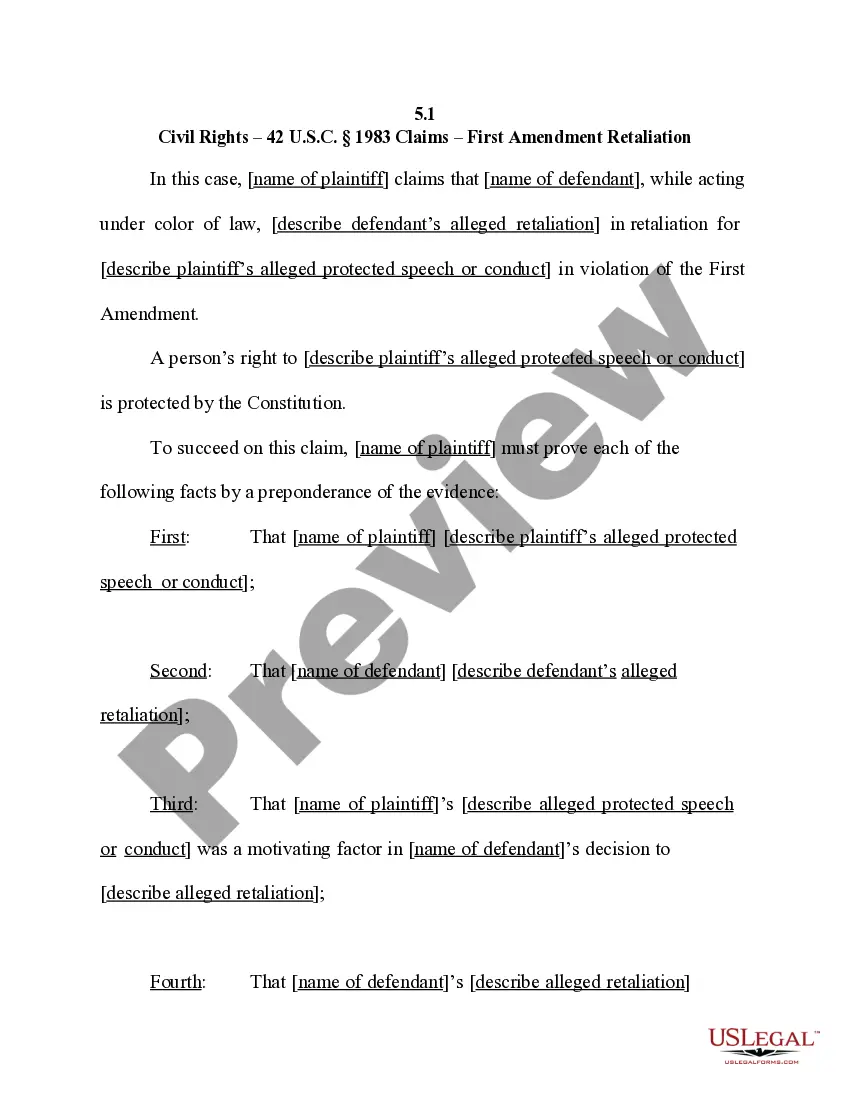

- Use the Review option to verify the form.

- Read the description to confirm you’ve selected the correct document.

- If the document isn’t what you are looking for, use the Search field to find a document that meets your needs and specifications.

- Once you find the appropriate document, click Acquire now.

- Select the payment plan you want, fill in the required information to create your account, and process your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have acquired in the My documents section. You can obtain another copy of the New York Obtain S Corporation Status - Corporate Resolutions Forms whenever necessary. Just select the needed form to download or print the template.

Form popularity

FAQ

To obtain a copy of your S corporation documents, you can request copies from your state’s Secretary of State or Department of Corporations, depending on where your business is registered. Additionally, if your S corporation filed necessary documents with the IRS, you may be able to retrieve those forms directly from their website. It's crucial to ensure you have the correct details to ensure a swift process. For seamless access to Corporate Resolutions Forms and related documents, visit US Legal Forms.

To form an S corporation in New York State, you must first establish a domestic corporation by filing a Certificate of Incorporation with the New York Department of State. Once your corporation is formed, you can elect S corporation status by filing Form 2553 with the IRS. It’s essential to meet specific requirements, such as having eligible shareholders and a limited number of shares, to successfully obtain S corporation status. For guidance on Corporate Resolutions Forms, consider using the resources available on the US Legal Forms platform.

To become an S corporation, you must fill out IRS Form 2553, which serves as the official election to operate under S Corp status. Ensure this form is accurately completed and submitted timely to avoid delays in your S Corporation recognition. This is a vital step in your journey toward successful New York Obtain S Corporation Status - Corporate Resolutions Forms.

To obtain your S Corporation status, you must first file Form CT-6 with the New York State Department of Taxation and Finance. This involves meeting eligibility requirements and ensuring you have all necessary documentation in order. Using platforms like US Legal Forms can help make this process smoother, allowing you to successfully navigate the New York Obtain S Corporation Status - Corporate Resolutions Forms.

To file your NYS CT 3S, you need to send it to the New York State Department of Taxation and Finance at the specified address for S Corporations. Always refer to the form instructions for the most current mailing address. By ensuring timely filing, you can maintain your compliance and benefit from your New York Obtain S Corporation Status - Corporate Resolutions Forms.

Your NYS sales tax form should be mailed to the address indicated in the form instructions. It's important to follow the guidelines to prevent any delays in processing. When you stay organized and informed, you protect the interests of your S Corporation as part of your New York Obtain S Corporation Status - Corporate Resolutions Forms.

The NY CT 3 form must be filed by corporations doing business in New York State. This includes domestic corporations that are electing to be taxed as S Corporations. Understanding your filing obligations is critical in maintaining your compliance and ensuring that you uphold your New York Obtain S Corporation Status - Corporate Resolutions Forms.

Once you complete your New York State tax return, it’s crucial to know where to send it. Generally, you should mail your tax return to the address specified in the instructions for your tax form. Make sure to double-check the mailing address based on the form type to ensure that your return is processed promptly. This process is part of maintaining your status, including New York Obtain S Corporation Status - Corporate Resolutions Forms.

To establish your S Corporation in New York, you need to file Form CT-6 alongside your Articles of Incorporation. In addition, it's essential to maintain proper records and resolutions that outline your corporation’s governance. Utilizing US Legal Forms can simplify your filing process by providing the necessary templates for New York Obtain S Corporation Status - Corporate Resolutions Forms.

To file for S Corporation status in New York, you first need to ensure that your business is eligible. Then, you must complete Form CT-6, which allows you to elect S Corporation status. After preparing the form, submit it to the New York State Department of Taxation and Finance. By following these steps, you're on your way to efficiently New York Obtain S Corporation Status - Corporate Resolutions Forms.