New York Electronic Transmittal of Tax Information (NY ETT) is an online system developed by the New York State Department of Taxation and Finance that allows businesses to submit their taxes electronically. NY ETT allows businesses to transmit tax information directly to the Department of Taxation and Finance, eliminating the need for paper filing. This system helps to reduce paperwork, streamline processing, and save time. NY ETT offers two types of transmission: 1) Bulk Submission File Transmittal, which allows businesses to submit large batches of returns in one transaction, and 2) Single Return Transmittal, which allows businesses to submit only one return at a time. Both methods require businesses to register in the system and create a user profile. Businesses must also provide the necessary information to complete the transmission process, including the tax form, payment information, and contact information. Once a transmission is complete, businesses will receive an electronic receipt that verifies the successful transmission of their returns.

New York Electronic Transmittal of Tax Information

Description

Key Concepts & Definitions

Electronic Transmittal of Tax Information refers to the process through which individual and business tax details are submitted electronically to relevant tax authorities. This includes submitting tax returns, declarations, and supporting documents through digital channels, such as IRS e-filing systems in the United States.

Step-by-Step Guide

- Login to the IRS e-file system using your secure credentials.

- Select the type of tax form you need to submit (e.g., 1040 for individuals).

- Fill out your tax information accurately, reviewing all entries for correctness.

- Attach any required supporting documentation, such as W-2s or 1099s, digitally.

- Review your tax return for accuracy and completeness.

- Submit your tax return electronically and wait for confirmation of receipt from the IRS.

- Save or print a copy of the submission confirmation for your records.

Risk Analysis

- Data Breach Risks: Transmitting tax information electronically can expose data to potential cyberattacks, leading to identity theft or financial losses.

- Technical Failures: Issues such as system outages or software errors might prevent timely filing or cause loss of data.

- Compliance Risks: Incorrectly filed tax returns due to user error or system faults can result in penalties or audits.

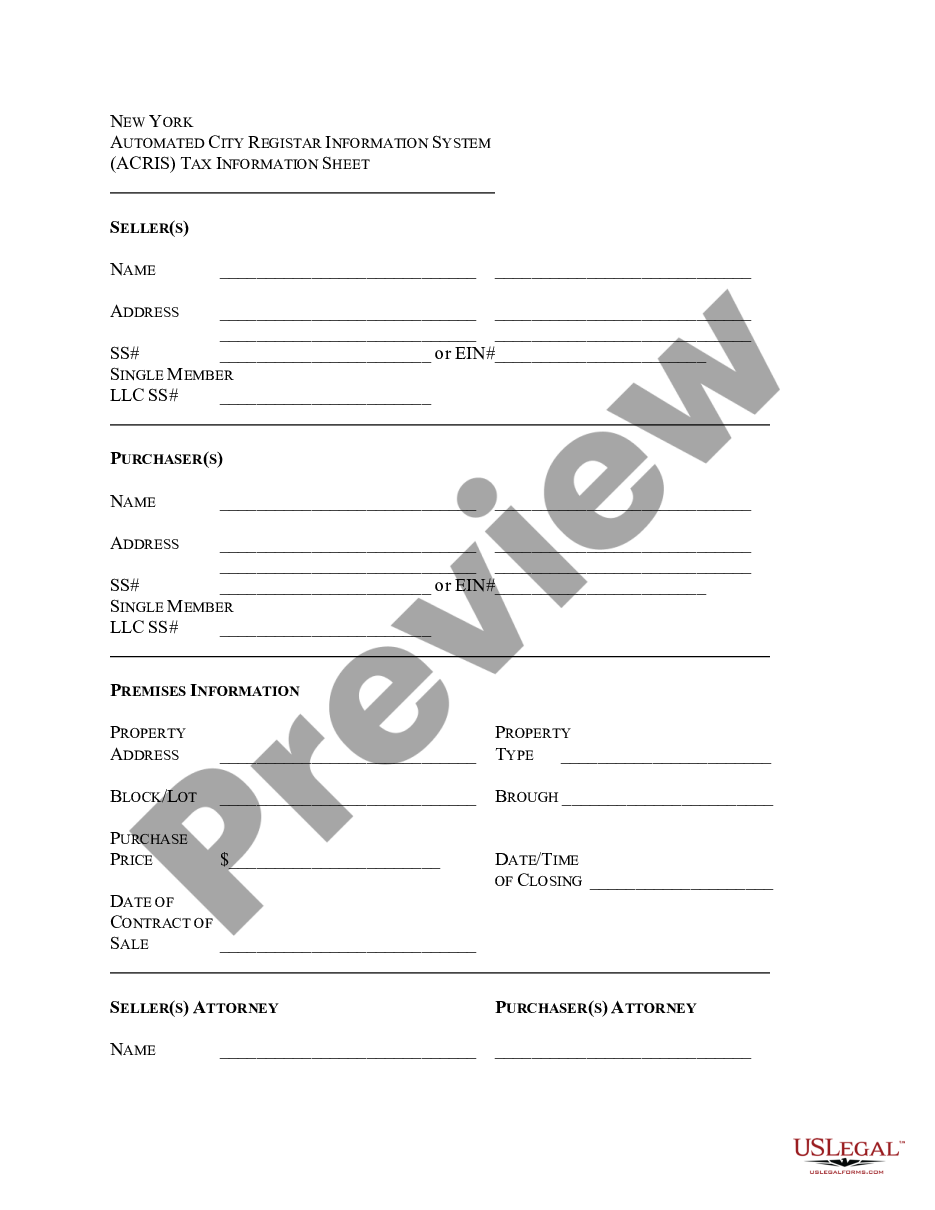

How to fill out New York Electronic Transmittal Of Tax Information?

US Legal Forms is the most easy and profitable way to find suitable legal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with national and local laws - just like your New York Electronic Transmittal of Tax Information.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted New York Electronic Transmittal of Tax Information if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one corresponding to your requirements, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Electronic Transmittal of Tax Information and save it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

You're required to electronically file your return if you meet all three of the following conditions: you use software to prepare your own personal income tax return; and. your software supports the electronic filing of your return; and. you have broadband Internet access.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

A tax return may require a PDF document to be attached to comply with IRS requirements or provide further information about the return. A return that requires a supporting document in PDF form will reject if it is transmitted without the PDF or if the PDF is attached at the wrong place in the return.

Make your check or money order payable to New York State Income Tax. Be sure to write your social security number, the tax year, and Income Tax on your payment. Before mailing in your payment, consider paying online.

The following form types can be e-filed through the MeF Platform: Corporations (Forms 1120, 1120-F and 1120-S) Employment Tax (Forms 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, and 945) 94x Online Signature PIN Registration.

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.