Nevada Agreement for Rights under Third Party Deed of Trust

Description

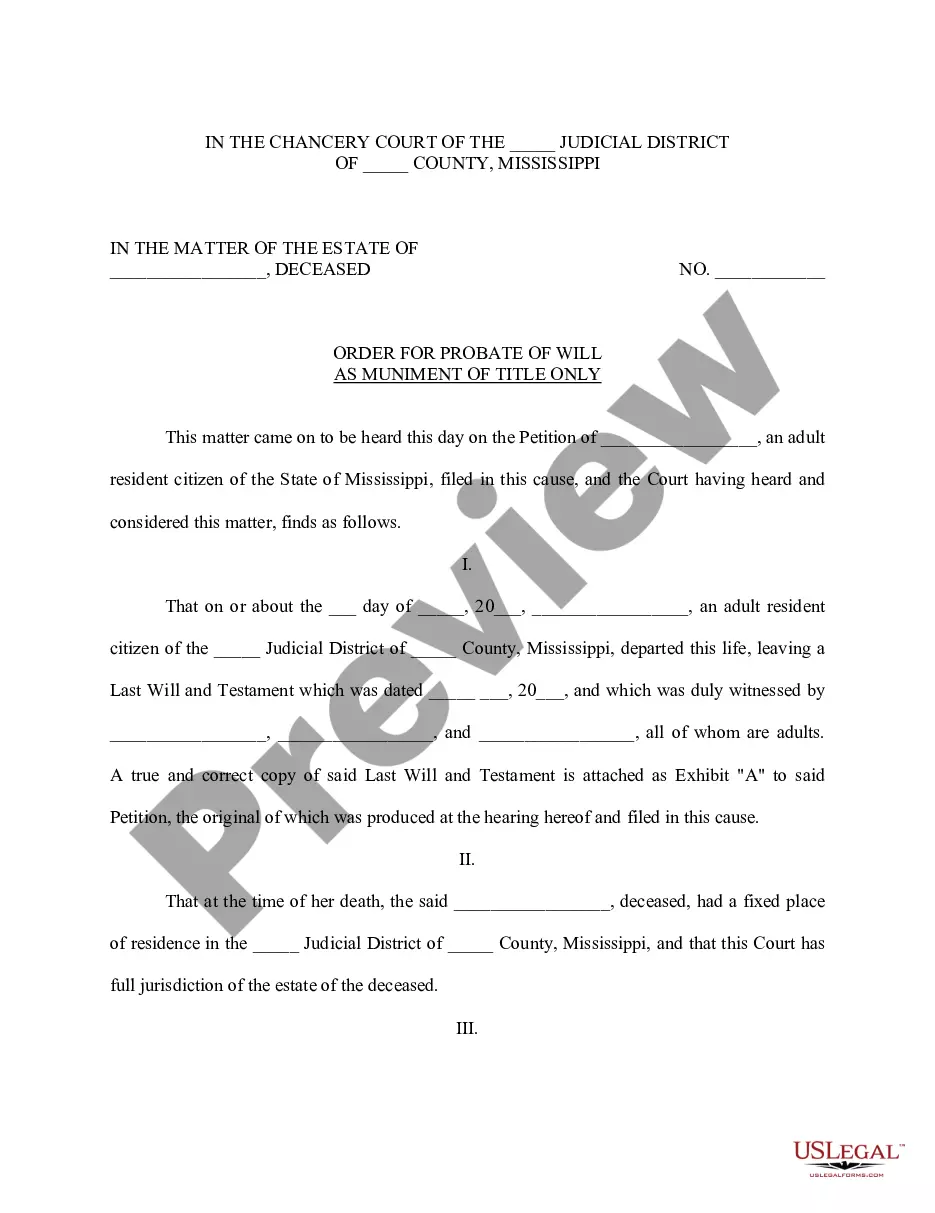

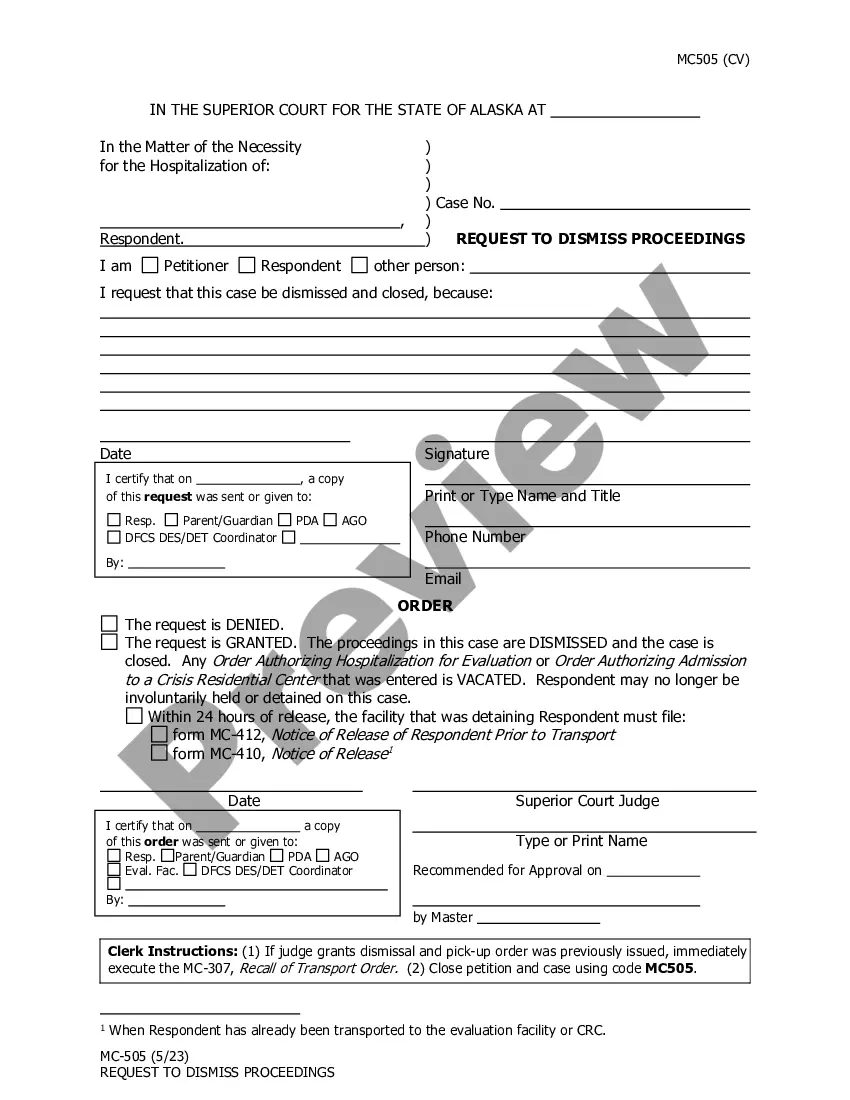

How to fill out Agreement For Rights Under Third Party Deed Of Trust?

If you need to full, obtain, or print authorized file templates, use US Legal Forms, the largest assortment of authorized kinds, that can be found on the web. Use the site`s basic and convenient look for to obtain the files you need. Different templates for enterprise and person functions are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the Nevada Agreement for Rights under Third Party Deed of Trust in just a couple of clicks.

When you are currently a US Legal Forms consumer, log in to your accounts and click on the Acquire key to get the Nevada Agreement for Rights under Third Party Deed of Trust. You can even gain access to kinds you previously delivered electronically inside the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate area/land.

- Step 2. Take advantage of the Preview choice to check out the form`s information. Never neglect to read the information.

- Step 3. When you are unhappy using the develop, use the Look for industry at the top of the display screen to get other versions in the authorized develop template.

- Step 4. After you have discovered the shape you need, click on the Acquire now key. Pick the costs strategy you favor and add your qualifications to sign up for an accounts.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the file format in the authorized develop and obtain it on your gadget.

- Step 7. Comprehensive, change and print or indication the Nevada Agreement for Rights under Third Party Deed of Trust.

Each authorized file template you buy is your own eternally. You have acces to each and every develop you delivered electronically with your acccount. Click on the My Forms section and choose a develop to print or obtain once more.

Contend and obtain, and print the Nevada Agreement for Rights under Third Party Deed of Trust with US Legal Forms. There are thousands of professional and condition-distinct kinds you can utilize to your enterprise or person requires.

Form popularity

FAQ

Nevada law specifies that interested parties (e.g., trustees or beneficiaries) may ask a Nevada probate court to terminate a trust if continuing the trust is no longer feasible or economical. This may occur when: The trust's assets are worth less than $100,000.

A testamentary trust is a specific type of trust that's created as part of a last will and testament. A grantor (the creator of the trust) leaves instructions in their will for a named executor detailing how their assets are managed by a trustee and distributed to beneficiaries.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.

Section 163.556 of the Nevada Revised Statutes authorizes a trustee to decant a trust that has a Nevada situs, is governed by Nevada law, or that is administered under Nevada law.

Generally speaking, a trustee cannot withhold money from a beneficiary unless they are acting in ance with the trust. If the trust does not indicate any conditions for dispersing funds, the trustee cannot make them up or follow their own desires.

If the borrower has land, (or uses the money to buy land), then many lenders request a deed of trust as a condition of giving the borrower the money. In Nevada, lenders like a deed of trust (or ?trust deed?) to give them security in case the borrower defaults.

Irrevocable trusts cannot be modified, amended, or terminated without permission from the grantor's beneficiaries or by court order. The grantor transfers all ownership of assets into the trust and legally removes all of their ownership rights to the assets and the trust.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.