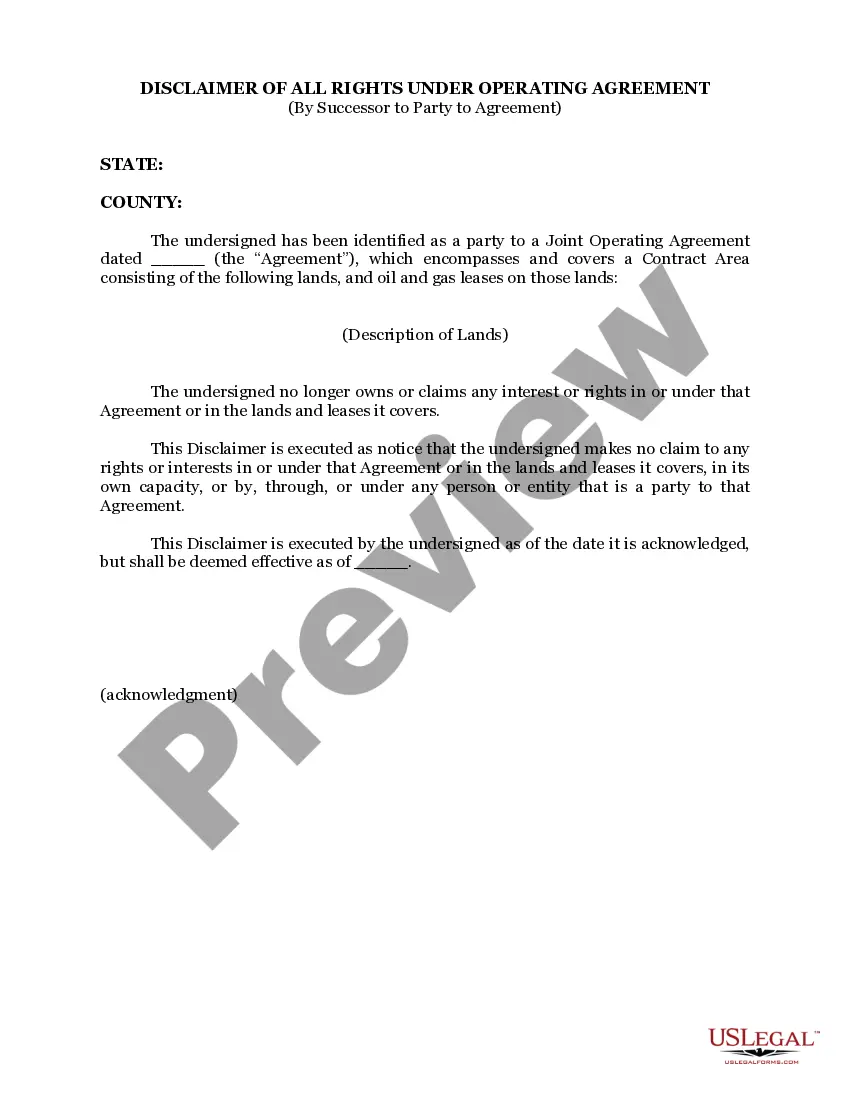

Nevada Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Successor To Party To Agreement?

Choosing the right legitimate papers web template can be quite a have difficulties. Obviously, there are tons of themes available on the Internet, but how would you get the legitimate type you will need? Use the US Legal Forms website. The service gives a huge number of themes, like the Nevada Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement, that can be used for organization and personal demands. All the kinds are checked out by pros and fulfill federal and state requirements.

If you are previously listed, log in in your accounts and click on the Obtain button to get the Nevada Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement. Utilize your accounts to search with the legitimate kinds you might have bought previously. Check out the My Forms tab of your respective accounts and obtain another duplicate from the papers you will need.

If you are a whole new customer of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- First, make sure you have chosen the right type to your area/region. It is possible to check out the form making use of the Review button and study the form information to guarantee this is basically the best for you.

- In the event the type will not fulfill your preferences, make use of the Seach area to discover the right type.

- When you are sure that the form is acceptable, go through the Purchase now button to get the type.

- Select the rates plan you would like and enter in the essential info. Design your accounts and purchase the transaction making use of your PayPal accounts or charge card.

- Pick the data file file format and down load the legitimate papers web template in your product.

- Comprehensive, change and printing and signal the obtained Nevada Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement.

US Legal Forms will be the largest library of legitimate kinds in which you can discover numerous papers themes. Use the service to down load skillfully-created files that stick to condition requirements.

Form popularity

FAQ

Restricted LLCs are LLCs with restrictions on when owners can make distributions. They're often used for estate planning or as an asset vehicle. A Nevada Series LLC is an LLC with one or more divisions (called ?series?) within itself, each with its own liability, assets, and debt.

The annual cost to maintain a Nevada LLC is $350. Annual reports cost $150, while business license renewal fees are $200. Annual reports are due by the end of your anniversary formation. For instance, if you registered your company in March 2021, you must file your annual report by the end of March every year.

Forming a business in Nevada offers a handful of benefits to LLC owners. Nevada LLCs provide numerous tax benefits, strong privacy and asset protection for business owners, operating flexibility, fast registration, and a dedicated court with streamlined processes for resolving business disputes.

Nevada LLC Act states that a Nevada Limited Liability Company should have at least one member or manager. All members of LLC should be 18 years of age or older. An LLC in Nevada will have to provide a list of LLC members within 30 days after it has been formed or registered. This list is also known as the Initial List.

Are Operating Agreements Legally Required in Nevada? No, Operating Agreements are not legally required in Nevada. ing to the Nevada Revised Statutes (NRS) 86.286 Operating Agreement clause, ?A limited-liability company may, but is not required to, adopt an operating agreement.?

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

General Rules for LLC Names Your LLC Name Must Be Unique. You cannot choose a business name in use by any other LLC or corporation in the State of Nevada. ... Your LLC Name Must Not Be Confusable with Another. Business Name. ... Your LLC Name Must Contain Certain Words. ... Your LLC Name May Have Other General Restrictions.

On the state level, Nevada has no personal or corporate net income tax, but your LLC may need to pay a quarterly tax on employee wages, or a commerce tax if earning more than $4 million in gross revenue. Local taxes at the city or county level may also apply.