This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Nevada Correction to Mineral Deed As to Interest Conveyed

Description

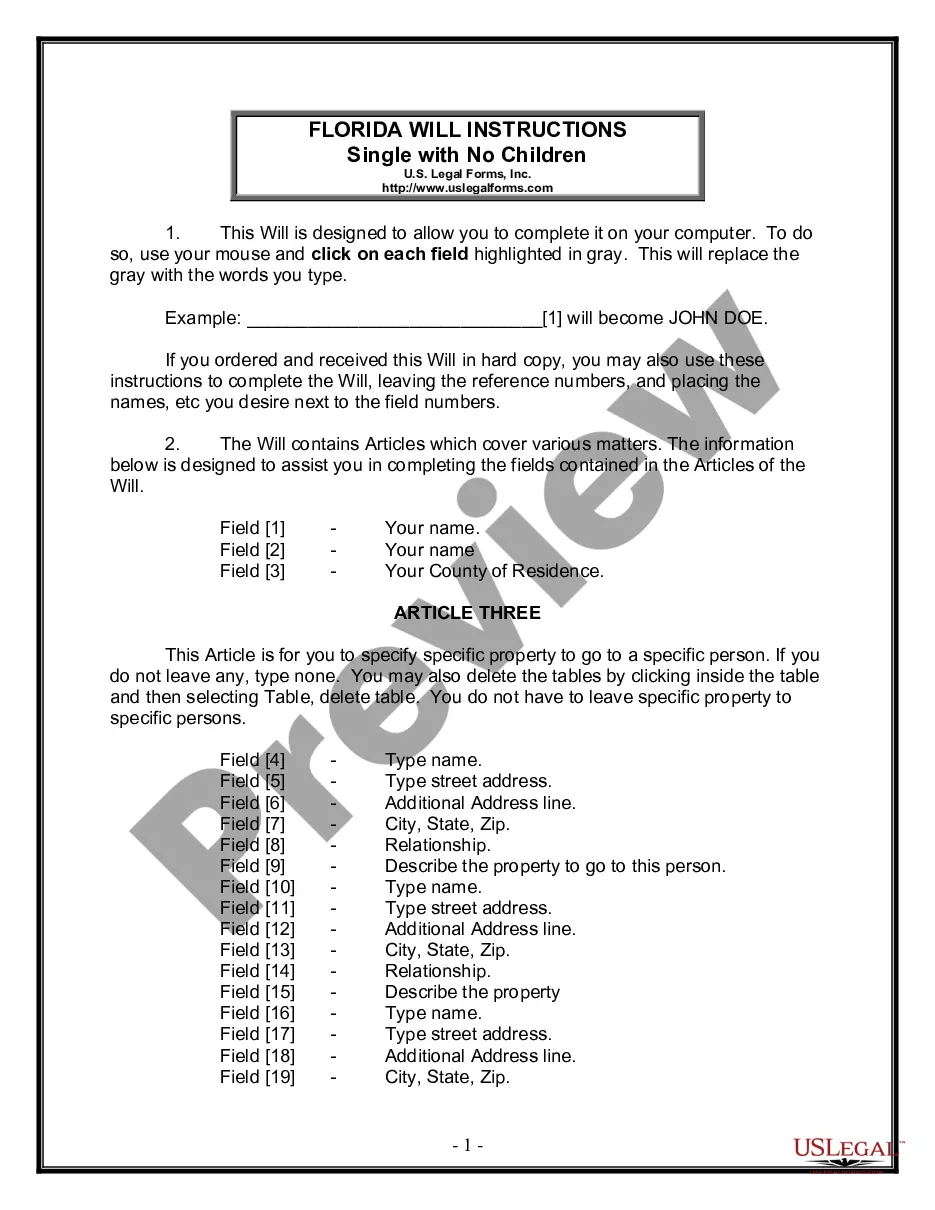

How to fill out Correction To Mineral Deed As To Interest Conveyed?

Have you been within a place where you will need paperwork for both business or person functions just about every time? There are a variety of legitimate record layouts available on the Internet, but finding ones you can rely on is not easy. US Legal Forms delivers a huge number of develop layouts, like the Nevada Correction to Mineral Deed As to Interest Conveyed, which are published to fulfill federal and state specifications.

Should you be previously knowledgeable about US Legal Forms website and have an account, merely log in. Afterward, you are able to download the Nevada Correction to Mineral Deed As to Interest Conveyed template.

Unless you have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for the proper metropolis/state.

- Use the Preview option to analyze the form.

- See the outline to ensure that you have selected the appropriate develop.

- In the event the develop is not what you are seeking, take advantage of the Lookup field to find the develop that meets your requirements and specifications.

- Whenever you get the proper develop, simply click Buy now.

- Pick the prices prepare you would like, complete the specified information and facts to create your account, and purchase the transaction utilizing your PayPal or charge card.

- Choose a hassle-free paper format and download your version.

Locate all of the record layouts you possess purchased in the My Forms food list. You can get a further version of Nevada Correction to Mineral Deed As to Interest Conveyed whenever, if possible. Just select the necessary develop to download or print the record template.

Use US Legal Forms, probably the most substantial assortment of legitimate types, to save lots of efforts and steer clear of blunders. The support delivers appropriately created legitimate record layouts that you can use for a selection of functions. Produce an account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

The Claim Staking Process Conduct land status searches to ensure land is open for mineral entry with no competing claims. Write notice of location(s). Place corner markers and location monument(s) on the ground ing to state statutes. File Notice of Location(s) with appropriate county and pay recording fees.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

There are several factors that can affect the value of minerals, including commodity prices, drilling activity in the area, and lease terms. However, the most crucial factor that can affect the value of mineral rights is the lease royalty rate.

A lode claim can be located over a placer claim once a valid lode discovery is made by either the owner of the preexisting placer claim or by another if invited by that placer claim owner to prospect the claim. The lode over placer issue is covered in detail in Section 11 the General Mining Act of 1872.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Surface rights and mineral rights are two distinct types of property rights. Surface rights refer to the right to own and use the surface of a piece of land, while mineral rights refer to the right to extract minerals and other resources that are found beneath the surface.

Dominance of Mineral Estate This means that the owner of the mineral estate has the right to freely use the surface estate to the extent reasonably necessary for the exploration, development, and production of the oil and gas under the property.

How do you Stake a Mining Claim? Find an area of interest. Your first step will be to determine where to search for mineral deposits. ... Conduct a land status search. ... Map your location and determine your claim type. ... Stake the ground. ... File Notice of Location(s). ... Pay Your Fees.

Producing minerals have one or more active oil and gas wells. Royalty owners are paid royalties on the proceeds from the sale oil, gas, and other minerals that are produced under a specific tract of land.

As of September 1, 2019, the cost for new claims is $225 for lode claims, tunnel sites, and mill sites. This fee breaks down into a $20 processing fee, $40 location fee, and a $165 maintenance fee. This fee must be paid within 90 days of the date of claim location.