Nevada Self-Employed Animal Exercise Services Contract

Description

How to fill out Self-Employed Animal Exercise Services Contract?

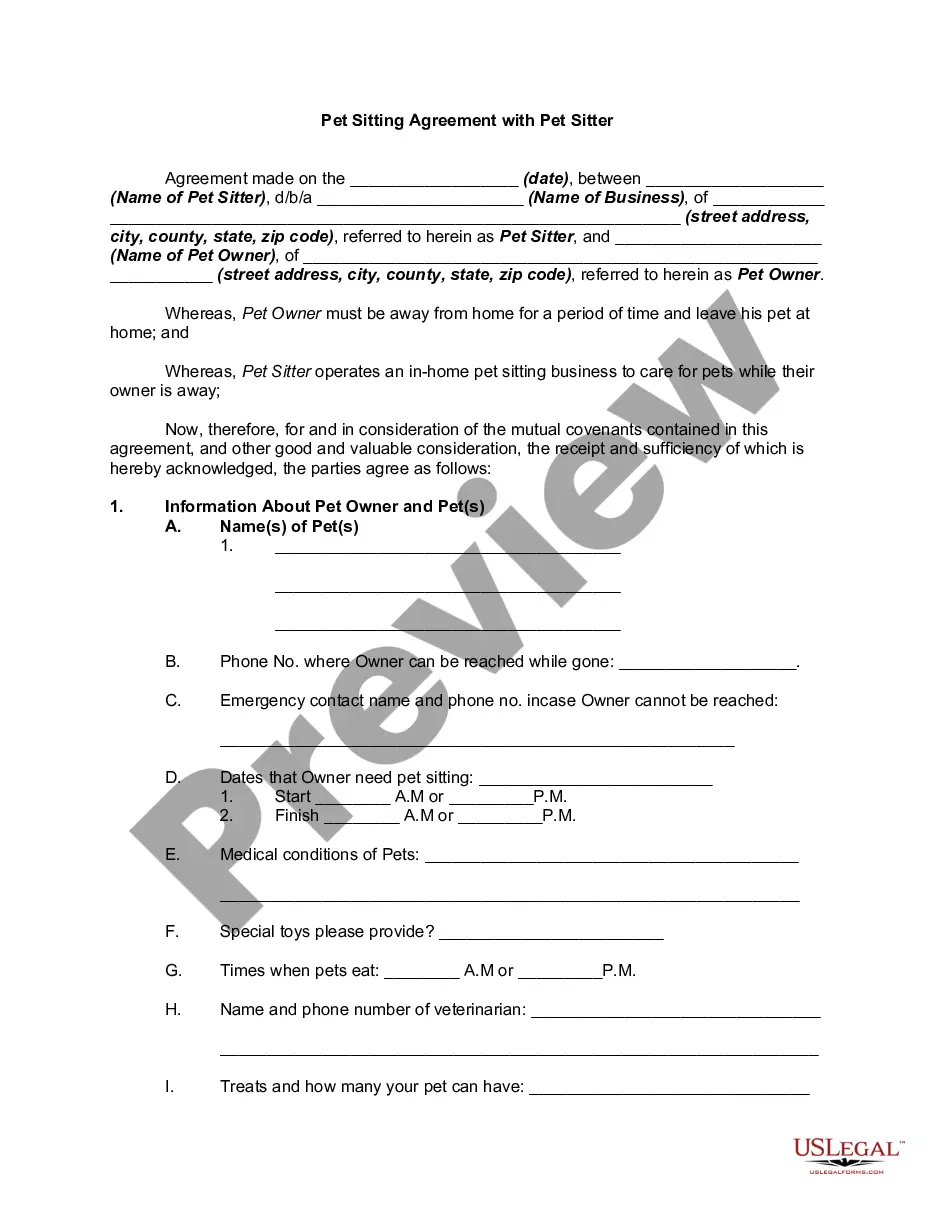

Finding the correct legal document format can be somewhat challenging. Clearly, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the Nevada Self-Employed Animal Exercise Services Contract, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal requirements.

If you are already a member, Log In to your account and click on the Download button to acquire the Nevada Self-Employed Animal Exercise Services Contract. Use your account to browse through the legal forms you may have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the right form. Once you are confident the form is appropriate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the received Nevada Self-Employed Animal Exercise Services Contract.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- Ensure you have chosen the correct form for your jurisdiction.

- Use the Preview button to review the form before purchasing.

- Utilize the Search feature if the initial form does not meet your needs.

- Complete your purchase with your desired payment method.

Form popularity

FAQ

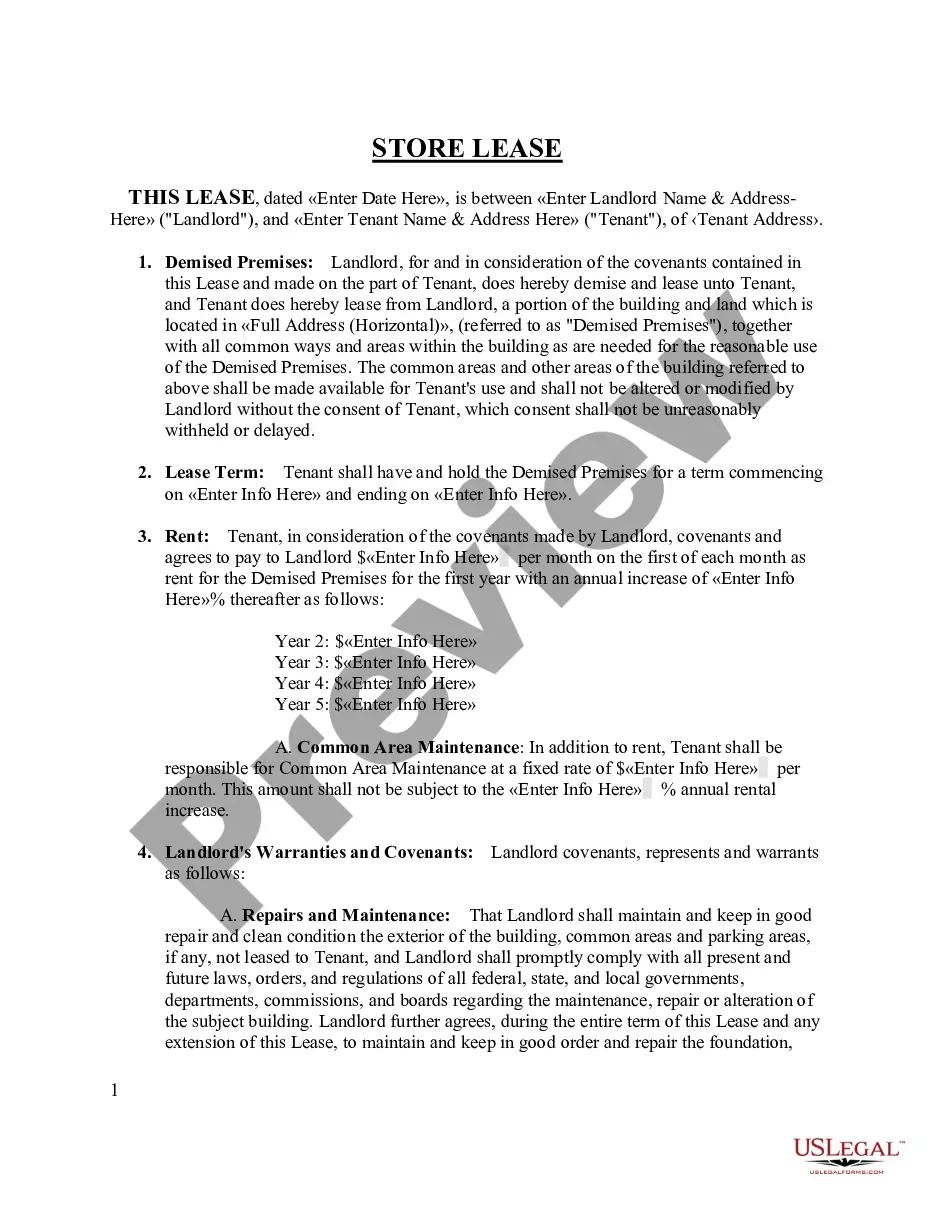

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. When creating your contract, ensure it includes critical elements such as the scope of work and payment terms, especially for a Nevada Self-Employed Animal Exercise Services Contract. However, to avoid potential pitfalls, it is advisable to use templates or seek legal advice to ensure your contract is enforceable and comprehensive.

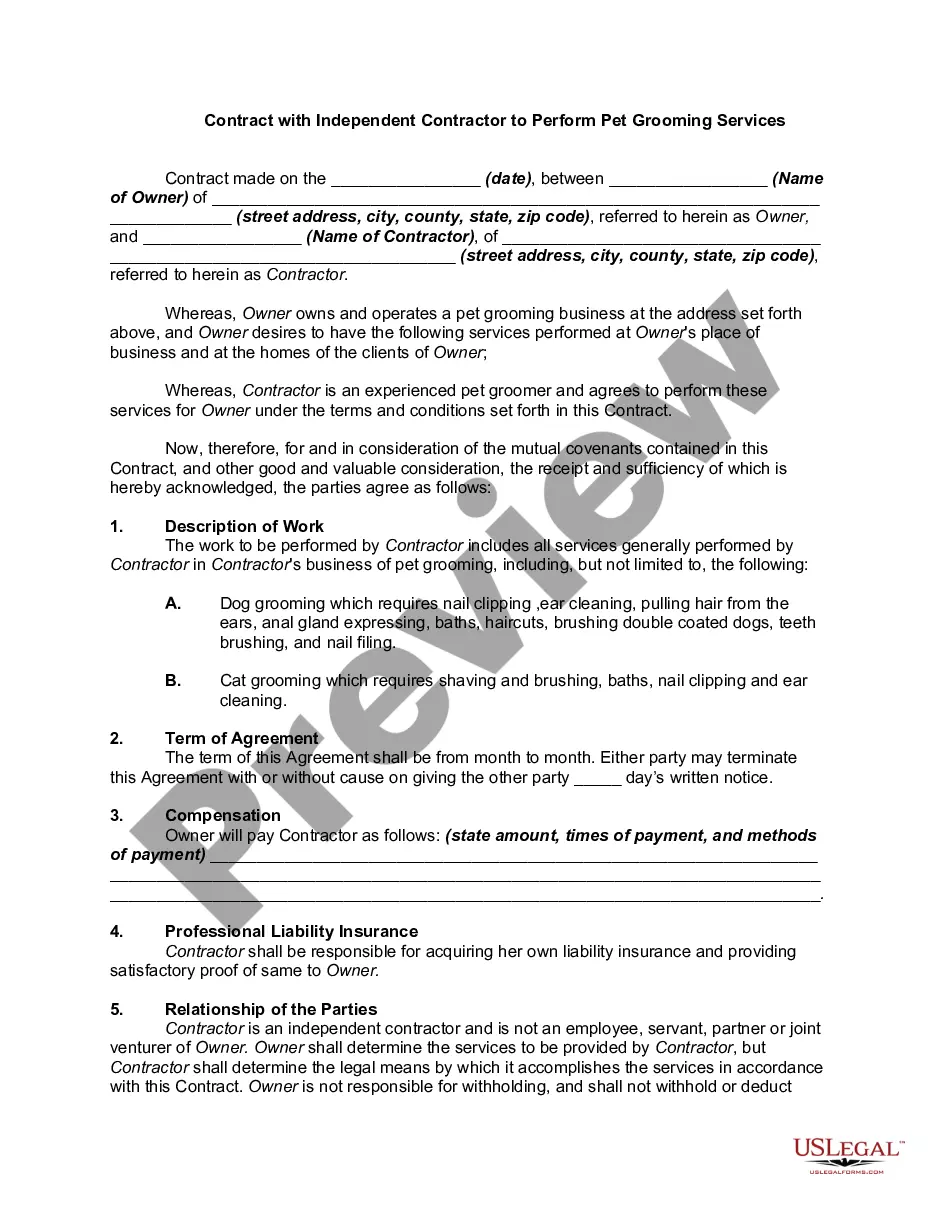

To set yourself up as an independent contractor, start by identifying your niche and target market. Register your business name and obtain any necessary licenses, particularly if you plan on offering services like those outlined in the Nevada Self-Employed Animal Exercise Services Contract. Next, create a professional website and marketing materials to attract clients. Finally, consider using platforms like uslegalforms to generate the contracts you need for smooth business operations.

Yes, having a contract as an independent contractor is essential. A well-drafted contract, such as the Nevada Self-Employed Animal Exercise Services Contract, outlines the responsibilities and expectations of all parties involved. This document protects your rights and provides clarity, reducing the potential for misunderstandings. Always consult with a legal expert to ensure your contract meets all necessary legal standards.

Yes, independent contractors in Nevada often need a business license to operate legally. This requirement helps ensure compliance with local regulations and can enhance your credibility. For those providing services under a Nevada Self-Employed Animal Exercise Services Contract, obtaining a business license is crucial for establishing a professional presence. Check with your local city or county office for specific licensing requirements.

To write an independent contractor agreement, begin by clearly defining the scope of work and expectations for both parties. Include important details such as payment terms, deadlines, and any specific requirements related to the Nevada Self-Employed Animal Exercise Services Contract. Additionally, it is wise to outline termination conditions and confidentiality clauses to protect both parties. Using a template from a reliable platform like uslegalforms can simplify this process.

Absolutely, having a contract is essential for self-employed individuals. A Nevada Self-Employed Animal Exercise Services Contract not only outlines your responsibilities but also protects your interests. It helps prevent misunderstandings and provides a legal framework to resolve disputes, giving you peace of mind while you focus on your business.

Yes, you can work as a 1099 contractor without a formal contract, but this can expose you to risks. Without a contract, it may be difficult to prove the terms of your work or payment agreements. A Nevada Self-Employed Animal Exercise Services Contract provides clarity and legal backing to ensure that both you and your clients are protected.

If you do not have a contract, your rights may be limited, but you still have some protections under Nevada law. You may be entitled to payment for services rendered, even without a formal agreement. However, having a Nevada Self-Employed Animal Exercise Services Contract is highly recommended to secure your rights and outline expectations clearly.

The primary difference lies in the level of control and independence. Independent contractors, unlike employees, operate their own businesses, have flexibility in how they complete tasks, and are responsible for their own taxes. A well-drafted Nevada Self-Employed Animal Exercise Services Contract can clarify this distinction and ensure both parties understand their roles.

In Nevada, independent contractors must adhere to specific legal requirements to operate successfully. They need to obtain necessary business licenses and may be required to register with the state. Additionally, it is crucial to have a clear Nevada Self-Employed Animal Exercise Services Contract to outline the terms of your services and protect your rights.