Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

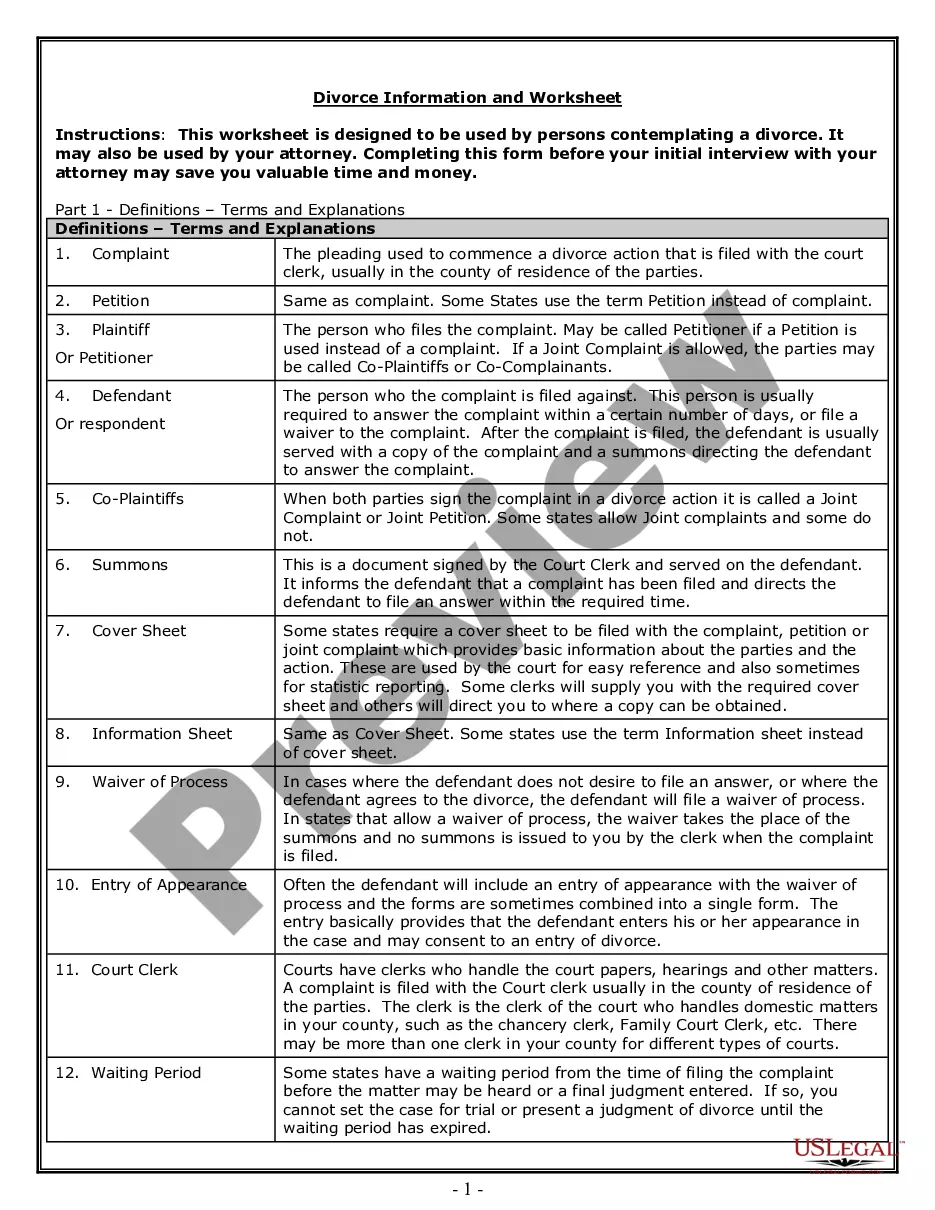

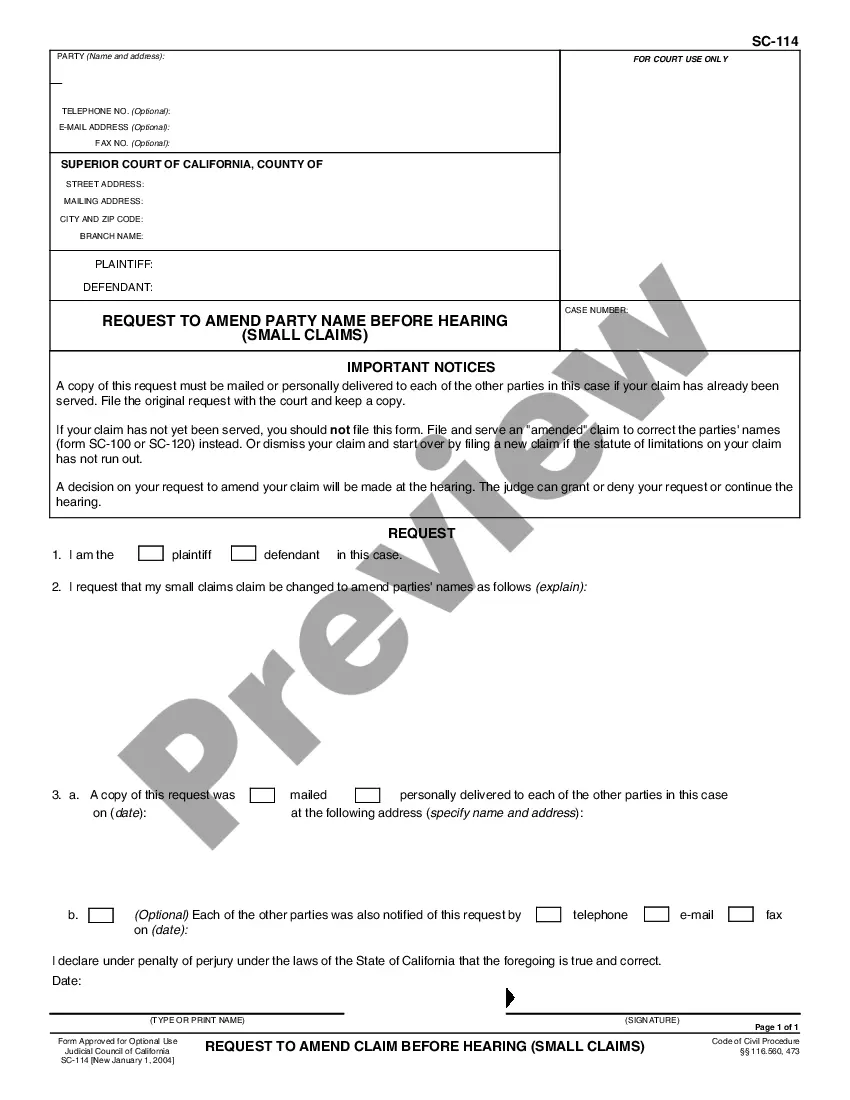

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Nevada Outdoor Project Manager Agreement - Self-Employed Independent Contractor in seconds.

Examine the form summary to confirm that you have selected the correct document.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you have an account, Log In and download the Nevada Outdoor Project Manager Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously stored forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to help you begin.

- Ensure you have selected the right form for your location/region.

- Click the Preview button to review the document's contents.

Form popularity

FAQ

To create an independent contractor agreement, start by outlining the key terms, including payment, project scope, and duration. You can find templates online or utilize platforms like USLegalForms to assist in drafting a professional and compliant Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. A well-structured agreement helps minimize misunderstandings and ensures clarity in your professional relationships.

In Nevada, any individual or business engaging in commercial activities typically requires a business license. This includes independent contractors, freelancers, and small business owners who want to operate legally under the Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. It's essential to check with local authorities to ensure you meet all requirements for licensing.

In most cases, an independent contractor agreement does not need to be notarized to be legally binding in Nevada. However, having a notarized agreement can add an extra layer of security and credibility to the contract. Utilizing a well-drafted Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor can clarify the terms and protect both parties involved.

Independent contractors in Nevada typically need a business license to operate legally. This requirement helps ensure compliance with state regulations while reinforcing your professionalism under the Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. Obtaining a business license is a straightforward process and can make a significant difference in how clients perceive your services.

Yes, registering your business as an independent contractor in Nevada is important for legal recognition and tax purposes. By officially registering, you can better protect your personal assets while operating under the Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. Moreover, registering your business may enhance your credibility with clients and partners.

Legal requirements for independent contractors in Nevada include having the appropriate business licenses, complying with tax obligations, and following any industry-specific regulations. Additionally, ensure that your Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor aligns with state laws. Staying informed about these requirements can prevent legal issues. Utilize USLegalForms for professional guidance and resources to navigate these legal landscapes.

Nevada does not require independent contractors to carry workers' compensation insurance unless they have employees. However, obtaining this insurance can protect contractors from potential liabilities. If you are operating under a Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor, it is wise to consider coverage for added peace of mind. Explore offerings through USLegalForms for tailored insurance solutions.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and responsibilities of both parties. It's essential to include clauses addressing confidentiality, termination, and dispute resolution to protect your interests. When drafting a Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor, precision and clarity are important. USLegalForms provides templates and guidance to streamline this process.

In Nevada, you can typically perform contracts worth up to $1,000 without needing a contractor license. If you exceed this limit, you must obtain the necessary licensing to continue working legally. This requirement is vital for anyone operating under a Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. For more details on obtaining licenses, turn to USLegalForms for comprehensive resources.

In Nevada, an independent contractor operates under a separate contract and has more control over how they perform their work. Employees, on the other hand, work under the direction of their employer and typically receive benefits like health insurance and retirement plans. Understanding these distinctions is crucial when entering a Nevada Outside Project Manager Agreement - Self-Employed Independent Contractor. USLegalForms can help clarify these differences further.