Nevada Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

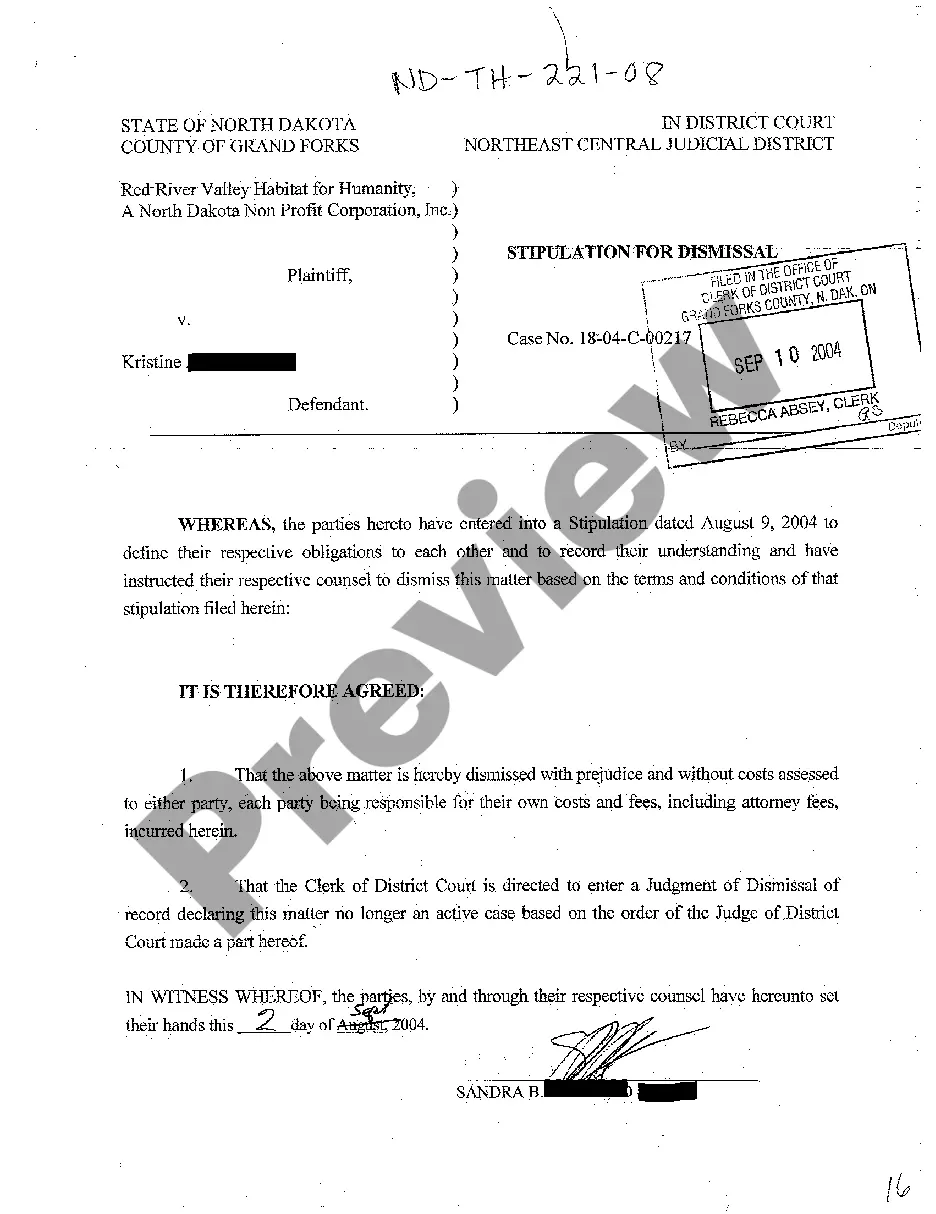

Locating the appropriate authentic document template can be quite challenging. Clearly, there are numerous designs accessible online, but how can you obtain the genuine form you require? Make use of the US Legal Forms website. This service provides a vast array of templates, including the Nevada Stone Contractor Agreement - Self-Employed, which you can utilize for both business and personal purposes. All forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Nevada Stone Contractor Agreement - Self-Employed. Use your account to browse through the legal forms you have previously purchased. Go to the My documents tab of your account and obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and read the form summary to confirm it is suitable for you. If the form does not meet your requirements, use the Search area to find the appropriate form. Once you are confident that the form is accurate, click on the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the received Nevada Stone Contractor Agreement - Self-Employed.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to obtain professionally crafted paperwork that adheres to state regulations.

- Ensure to read the guidelines carefully when navigating the website.

- Always double-check that you have the right document before making a purchase.

- Take advantage of the preview feature to familiarize yourself with the form before downloading.

- Consider your needs thoroughly to avoid purchasing unnecessary documents.

Form popularity

FAQ

Creating an independent contractor agreement involves several important steps. First, clearly define the scope of work, including specific tasks and deadlines. Then, include payment terms and any necessary legal provisions unique to a Nevada Stone Contractor Agreement - Self-Employed. Using a platform like USLegalForms can simplify the process by providing customizable templates that ensure you meet all legal requirements, making the agreement clear and enforceable.

To write an independent contractor agreement, start by clearly defining the parties involved. Next, outline the specific services to be rendered along with payment details and timelines. It's also essential to include any clauses related to confidentiality and non-compete agreements. For convenience, you may consider using platforms like uslegalforms, which provide templates specifically designed for the Nevada Stone Contractor Agreement - Self-Employed.

Filling out an independent contractor form requires careful attention to detail. Begin by providing your personal information and business details in the appropriate sections. Then, accurately describe the services you provide and the payment terms. This thoroughness ensures your Nevada Stone Contractor Agreement - Self-Employed reflects your professional capabilities and establishes clear expectations.

An independent contractor typically fills out several important documents. These may include the independent contractor agreement, tax forms like the W-9, and any permits or licenses specific to the work being done. Completing these documents is crucial for compliance and helps streamline the contracting process, particularly for a Nevada Stone Contractor Agreement - Self-Employed.

Writing a self-employed contract involves several key steps. First, identify the parties to the agreement along with their roles. Then, describe the work to be performed, including timelines and payment conditions. Finally, include sections on confidentiality, dispute resolution, and termination, ensuring your contract aligns with the Nevada Stone Contractor Agreement - Self-Employed.

To fill out an independent contractor agreement, start by clearly stating the names and contact details of both parties involved. Next, outline the scope of work, payment terms, and deadlines. Be sure to specify any additional conditions or requirements relevant to the job. This process helps establish clarity and ensures that both parties understand their responsibilities under the Nevada Stone Contractor Agreement - Self-Employed.

In Nevada, independent contractor laws specify that a contractor must have a written agreement, such as the Nevada Stone Contractor Agreement - Self-Employed, to outline the relationship and responsibilities. This law ensures both parties understand their rights and obligations, reducing the risk of disputes. It is important for contractors to comply with these laws to avoid penalties and protect their business.

In Nevada, individuals can perform up to $1,000 worth of work without a contractor’s license. However, it is essential to check local regulations, as they may have additional requirements. For those looking to engage in more extensive work, a Nevada Stone Contractor Agreement - Self-Employed alongside appropriate licensing becomes necessary to operate within the law.

To write an independent contractor agreement, start by clearly defining the scope of work, payment terms, and deadlines. Additionally, include clauses that cover confidentiality and dispute resolution. Utilizing a platform like uslegalforms can simplify this process, providing you with a template for a Nevada Stone Contractor Agreement - Self-Employed that meets legal standards.

Yes, a contractor is typically considered self-employed. This classification allows them to work for various clients without being tied to a single employer. Leveraging a well-structured Nevada Stone Contractor Agreement - Self-Employed can further emphasize their self-employed status and define the terms of their engagement.