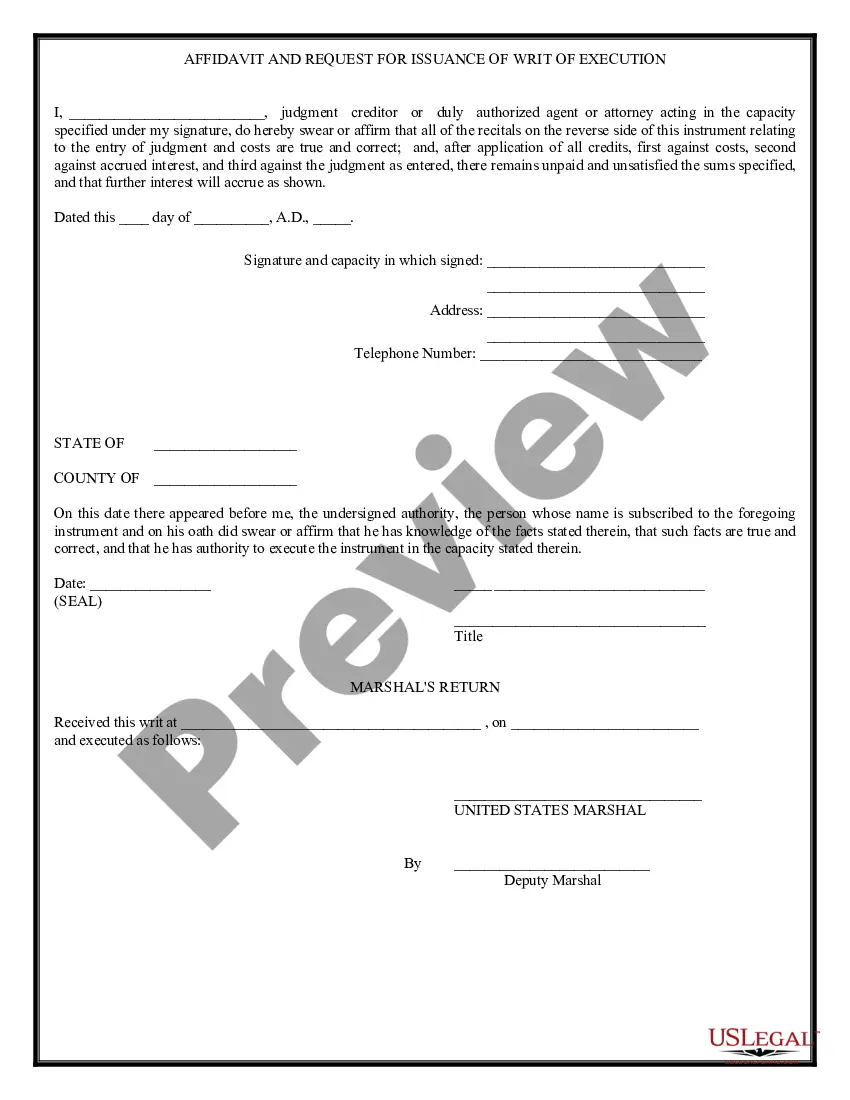

Nevada Writ of Execution

Description

How to fill out Writ Of Execution?

You can commit time on-line looking for the legitimate file design that suits the state and federal specifications you want. US Legal Forms gives 1000s of legitimate forms that happen to be analyzed by pros. It is simple to download or printing the Nevada Writ of Execution from the service.

If you have a US Legal Forms accounts, you can log in and then click the Obtain switch. Following that, you can total, modify, printing, or indicator the Nevada Writ of Execution. Every single legitimate file design you acquire is your own for a long time. To get another duplicate associated with a bought form, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms internet site for the first time, adhere to the straightforward recommendations beneath:

- Initial, make sure that you have selected the proper file design to the region/city of your choosing. Read the form information to ensure you have picked the proper form. If available, take advantage of the Preview switch to look through the file design too.

- In order to discover another edition of the form, take advantage of the Research area to discover the design that fits your needs and specifications.

- When you have found the design you need, simply click Buy now to continue.

- Pick the pricing plan you need, enter your credentials, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to purchase the legitimate form.

- Pick the formatting of the file and download it for your system.

- Make changes for your file if required. You can total, modify and indicator and printing Nevada Writ of Execution.

Obtain and printing 1000s of file layouts making use of the US Legal Forms website, that offers the largest assortment of legitimate forms. Use professional and condition-specific layouts to tackle your small business or personal requirements.

Form popularity

FAQ

What types of income and property are exempt from execution? Under Nevada law, some of the types of income and property that a creditor cannot take to pay a judgment include: Money or payments received pursuant to the federal Social Security Act, including retirement, disability, survivors' benefits, and SSI. Property A Judgment Creditor Can And Can't Take Civil Law Self-Help Center ? self-help ? 2... Civil Law Self-Help Center ? self-help ? 2...

After the judgment is signed by the judge, it must be filed with the court clerk. This is called ?entering? the judgment. (NRCP 58(c); JCRCP 58(c).) Once the judgment is entered, a notice of that entry must be mailed to all parties in the case and filed with the court clerk.

Types of Exemptions Under Nevada Laws Below are some examples of exemptions: Necessary household goods, furnishings, electronics, clothes, yard equipment, and other personal effects up to $12,000 in value. 5% of your disposable earnings or 50 times the minimum wage (currently $362.50 per week), whichever is higher.

If a stay of execution is granted by the court, the execution of the death sentence judgement is suspended temporarily. If appeals are denied, Nevada law also provides details on dissolving the stay and imposes limitations on which courts have further authority to grant a new stay under particular circumstances. NRS 176.491 - Stay Of Execution Following Denial Of Appeal lvcriminaldefense.com ? stay-execution-foll... lvcriminaldefense.com ? stay-execution-foll...

In Nevada, you can write to the court that gave the garnishment order to exempt specific funds or property. To succeed, you must provide evidence and documentation, such as bank statements, tax returns, and receipts, to support your claim under state and federal laws.

CLAIM OF EXEMPTION FROM EXECUTION This form can be used when a judgment debtor (person who owes money) or a third-party is being executed on, and believes the property that might be taken is exempt under Nevada law. This form must be filed within 10 days of when the notice of attachment or garnishment was mailed. Las Vegas Small Claims Forms - Civil Law Self-Help Center civillawselfhelpcenter.org ? forms ? 284-las-... civillawselfhelpcenter.org ? forms ? 284-las-...

Six years How long does the judgment creditor have to collect a Nevada judgment? In Nevada, a judgment will expire within six years from the date it is entered. Overview Of Judgments And Collection - Civil Law Self-Help ... civillawselfhelpcenter.org ? self-help ? over... civillawselfhelpcenter.org ? self-help ? over...

If you already have a judgment, then Nevada law provides legal remedies to obtain assets from a debtor who is unwilling to voluntarily pay. These remedies include bank and wage garnishments. You can also obtain a court order for the judgment debtor to appear for an examination under oath to list assets.