Nevada Nonprofit - Conduct Policies for Board Members

Description

How to fill out Nonprofit - Conduct Policies For Board Members?

You can spend time on the Internet trying to find the lawful record web template that suits the federal and state needs you need. US Legal Forms offers a large number of lawful forms that are reviewed by specialists. It is possible to down load or produce the Nevada Nonprofit - Conduct Policies for Board Members from the support.

If you have a US Legal Forms account, you can log in and click on the Download key. Following that, you can full, change, produce, or signal the Nevada Nonprofit - Conduct Policies for Board Members. Each lawful record web template you purchase is your own forever. To get yet another duplicate for any bought type, visit the My Forms tab and click on the related key.

If you use the US Legal Forms web site for the first time, stick to the easy recommendations beneath:

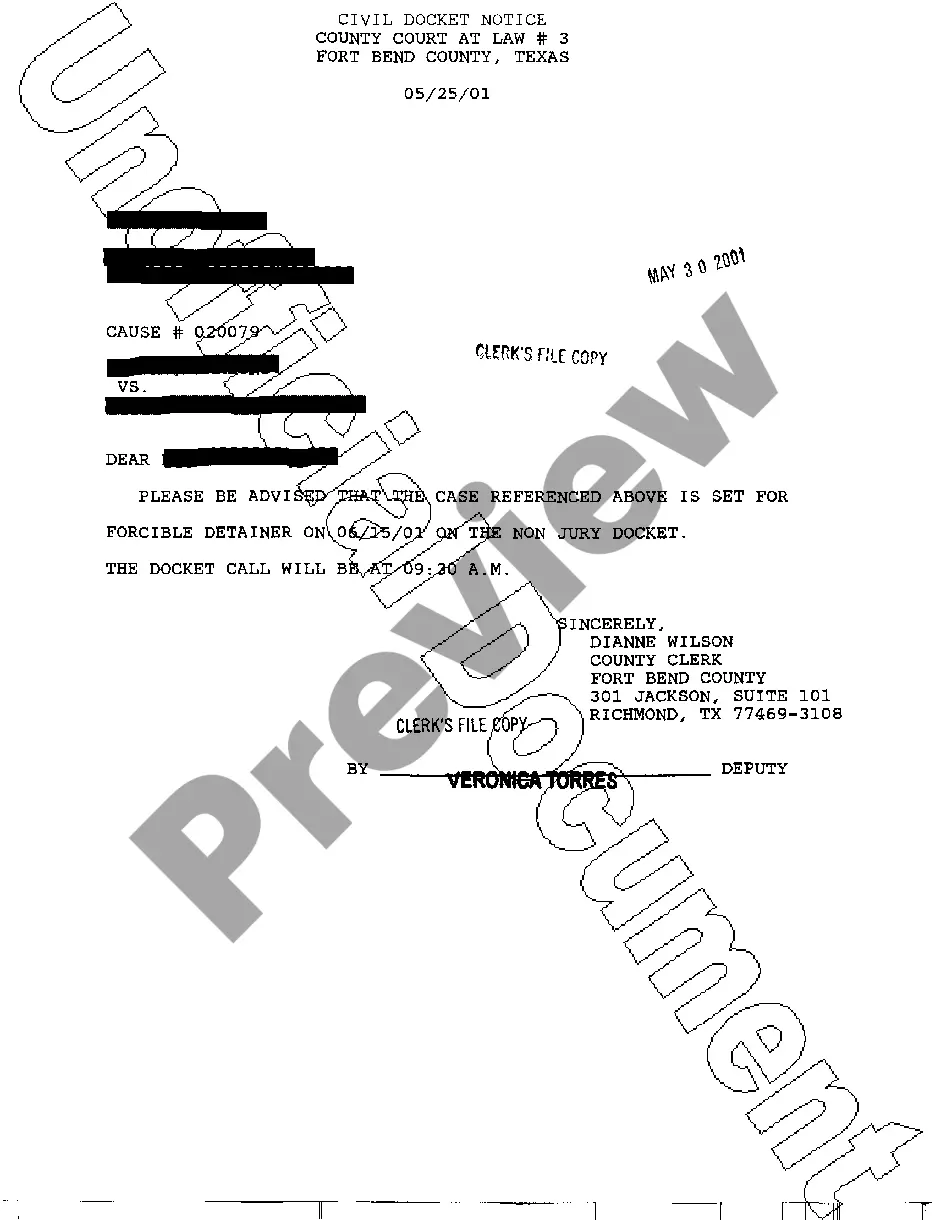

- First, ensure that you have selected the correct record web template to the state/area of your liking. Read the type outline to ensure you have picked the proper type. If offered, use the Review key to look through the record web template as well.

- If you would like get yet another edition in the type, use the Research area to obtain the web template that fits your needs and needs.

- Upon having discovered the web template you desire, click Buy now to carry on.

- Find the pricing program you desire, type your credentials, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your bank card or PayPal account to pay for the lawful type.

- Find the structure in the record and down load it for your gadget.

- Make alterations for your record if required. You can full, change and signal and produce Nevada Nonprofit - Conduct Policies for Board Members.

Download and produce a large number of record themes making use of the US Legal Forms Internet site, which provides the largest selection of lawful forms. Use skilled and condition-specific themes to tackle your small business or personal requires.

Form popularity

FAQ

NRS 82.271 - Meetings of board of directors or delegates: Quorum; consent to action taken without meeting; alternative means for participating at meeting.

Here are 10 common governance mistakes made by nonprofit boards: Failure to Understand Fiduciary Duties. ... Failure to Provide Effective Oversight. ... Deferring to a Founder. ... Failure to Stay in Your Lane. ... Failure to Adopt and Follow Procedures. ... Failure to Keep Good Records. ... Lack of Awareness of Laws Governing Nonprofits.

Recruit Incorporators and Initial Directors You will need at least one, but can have more than one. Directors make up the governing body of your nonprofit corporation and are stakeholders in your organization's purpose and success. You'll want to identify three, unrelated individuals to meet IRS requirements.

Yes! Under well-established principles of nonprofit corporation law, a board member must meet certain standards of conduct and attention in carrying out their responsibilities to the organization.

Starting a Nevada Nonprofit Guide: Choose your NV nonprofit filing option. File the NV nonprofit articles of incorporation. File your Initial List of Officers. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required state licenses.

What it Costs to Form a Nevada Nonprofit. The Nevada's Attorney General's Office charges $50 to file non-profit Articles of Incorporation. A name reservation fee is $25. The fee for your organization's annual list of directors, officers and registered agent is $25.

OVERVIEW OF NEVADA NONPROFIT CORPORATIONS. Nonprofit Corporation. A nonprofit corporation is a corporation formed to carry out a charitable, educational, religious, literary, or scientific purpose. A business organization that serves some public purpose and therefore enjoys special treatment under the law.