Nevada Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc.

Description

How to fill out Sample Asset Purchase Agreement Between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. And WPI Group, Inc.?

It is possible to spend time on the Internet looking for the lawful document format which fits the federal and state specifications you require. US Legal Forms gives a huge number of lawful varieties which can be evaluated by pros. It is simple to acquire or print the Nevada Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc. from my service.

If you already have a US Legal Forms profile, it is possible to log in and then click the Obtain button. Following that, it is possible to full, modify, print, or indicator the Nevada Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc.. Each and every lawful document format you get is yours for a long time. To acquire another version for any obtained kind, go to the My Forms tab and then click the related button.

If you work with the US Legal Forms website for the first time, follow the easy guidelines below:

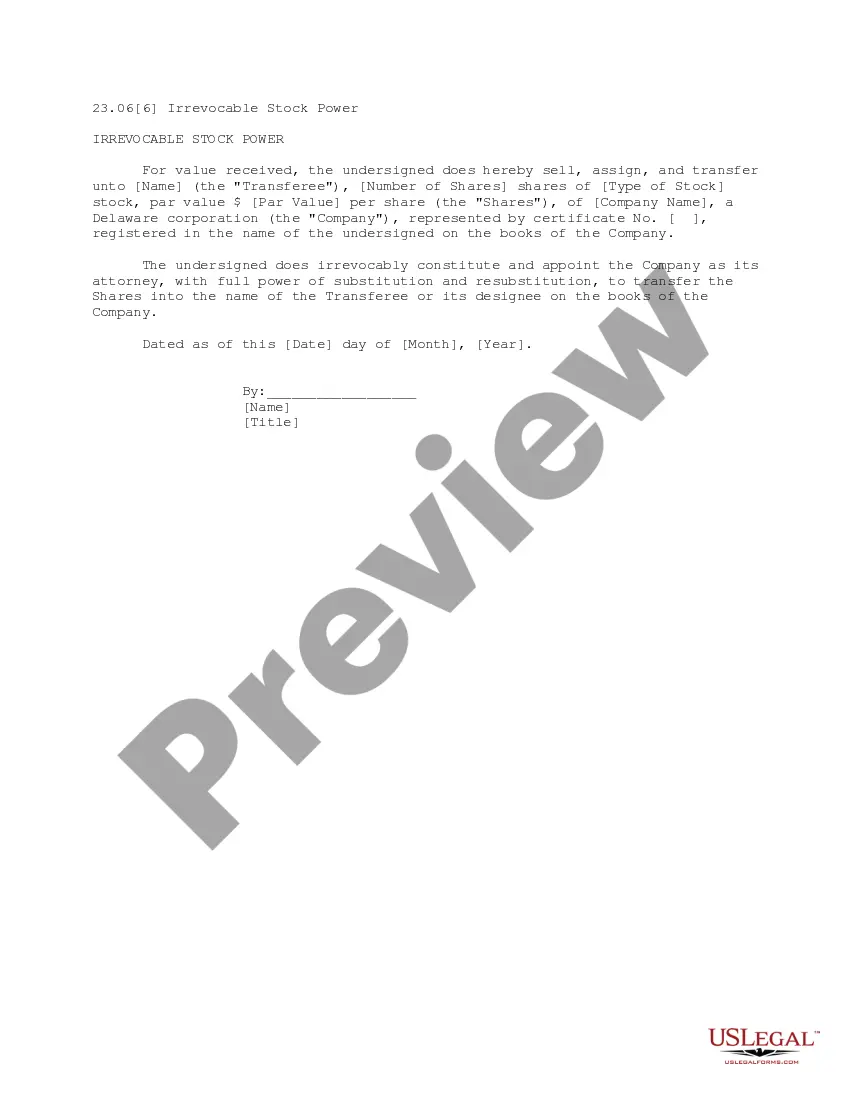

- Initial, make certain you have chosen the best document format to the county/area that you pick. Look at the kind outline to ensure you have picked out the appropriate kind. If available, utilize the Preview button to search with the document format too.

- If you want to find another model of the kind, utilize the Look for discipline to find the format that meets your requirements and specifications.

- Upon having identified the format you desire, click Acquire now to move forward.

- Select the rates prepare you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal profile to pay for the lawful kind.

- Select the formatting of the document and acquire it for your system.

- Make adjustments for your document if necessary. It is possible to full, modify and indicator and print Nevada Sample Asset Purchase Agreement between Warner Power, LLC, Warner Power Conversion, LLC, WPI Power Systems, Inc., WPI Electronics, Inc. and WPI Group, Inc..

Obtain and print a huge number of document templates making use of the US Legal Forms web site, which offers the most important assortment of lawful varieties. Use professional and condition-distinct templates to tackle your small business or specific demands.