Nevada Reorganization of corporation as a Massachusetts business trust with plan of reorganization

Description

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

Are you in the position the place you will need documents for both organization or specific functions virtually every day time? There are a variety of lawful record templates available on the net, but getting ones you can rely is not straightforward. US Legal Forms offers thousands of kind templates, like the Nevada Reorganization of corporation as a Massachusetts business trust with plan of reorganization, which are published to fulfill state and federal needs.

If you are already knowledgeable about US Legal Forms site and get your account, merely log in. Following that, you are able to down load the Nevada Reorganization of corporation as a Massachusetts business trust with plan of reorganization web template.

Should you not provide an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is for the proper city/region.

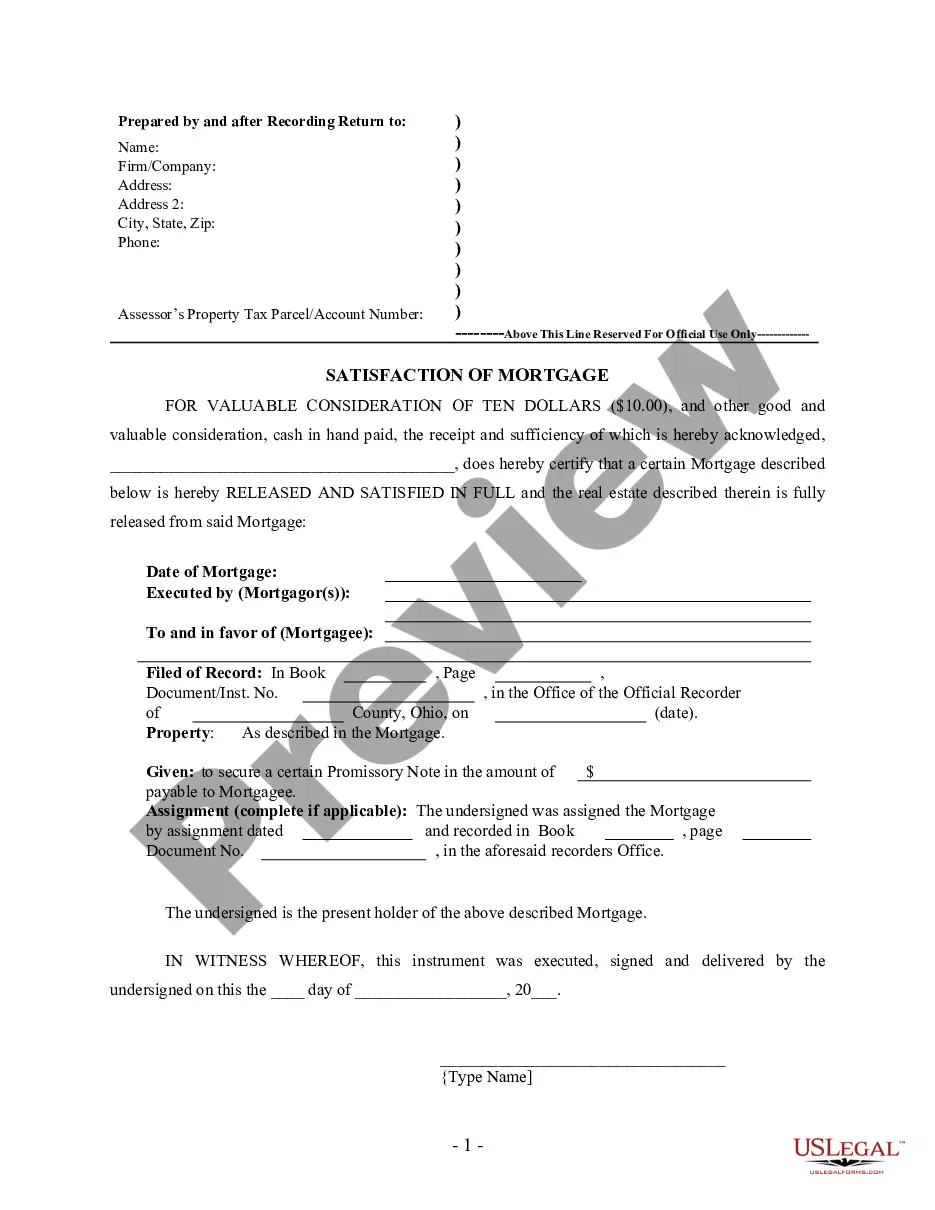

- Use the Review key to review the form.

- Browse the outline to ensure that you have chosen the correct kind.

- In the event the kind is not what you are looking for, use the Search field to discover the kind that meets your needs and needs.

- Once you get the proper kind, simply click Purchase now.

- Opt for the pricing strategy you desire, fill in the desired info to generate your bank account, and pay for an order utilizing your PayPal or charge card.

- Select a practical data file format and down load your backup.

Discover all of the record templates you have purchased in the My Forms food selection. You may get a additional backup of Nevada Reorganization of corporation as a Massachusetts business trust with plan of reorganization anytime, if necessary. Just click on the required kind to down load or print the record web template.

Use US Legal Forms, the most comprehensive selection of lawful varieties, in order to save time and stay away from faults. The support offers professionally made lawful record templates which can be used for a selection of functions. Create your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

The subchapter went into effect in 2020. It gives small businesses that are earning a profit, but having trouble paying their obligations, a simplified process for paying down their debt. Businesses that file under Subchapter 5 can force creditors to accept court-approved repayment plans of three to five years.

6 Benefits of Chapter 11 Bankruptcy for Business Keeping a Business Running During the Bankruptcy Process. ... Automatic Stay of All Creditor Actions. ... Emergency Relief for Operations. ... Possibility of Obtaining Loans at Favorable Rates. ... Treatment of Unexpired Leases and Executory Contracts.

After filing for Chapter 11, the company's stock will be delisted from the major exchanges. Common stock shareholders are last in line to recover their investments, behind bondholders and preferred shareholders. As a result, shareholders may receive pennies on the dollar, if anything at all.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

The plan of reorganization is at the heart of Chapter 11 bankruptcy. The plan for reorganization allows a business or an individual to keep their assets while repaying some of their debts over time. Business owners may also opt to sell some or all of their assets to fulfill debt obligations.

Ingly, the central goal of chapter 11 is to create a viable economic entity by reorganizing the debtor's debt structure. Unlike chapter 7, chapter 11 is not a liquidation of the debtor's assets. Rather, it is a reorganization of existing assets, principally as debt.