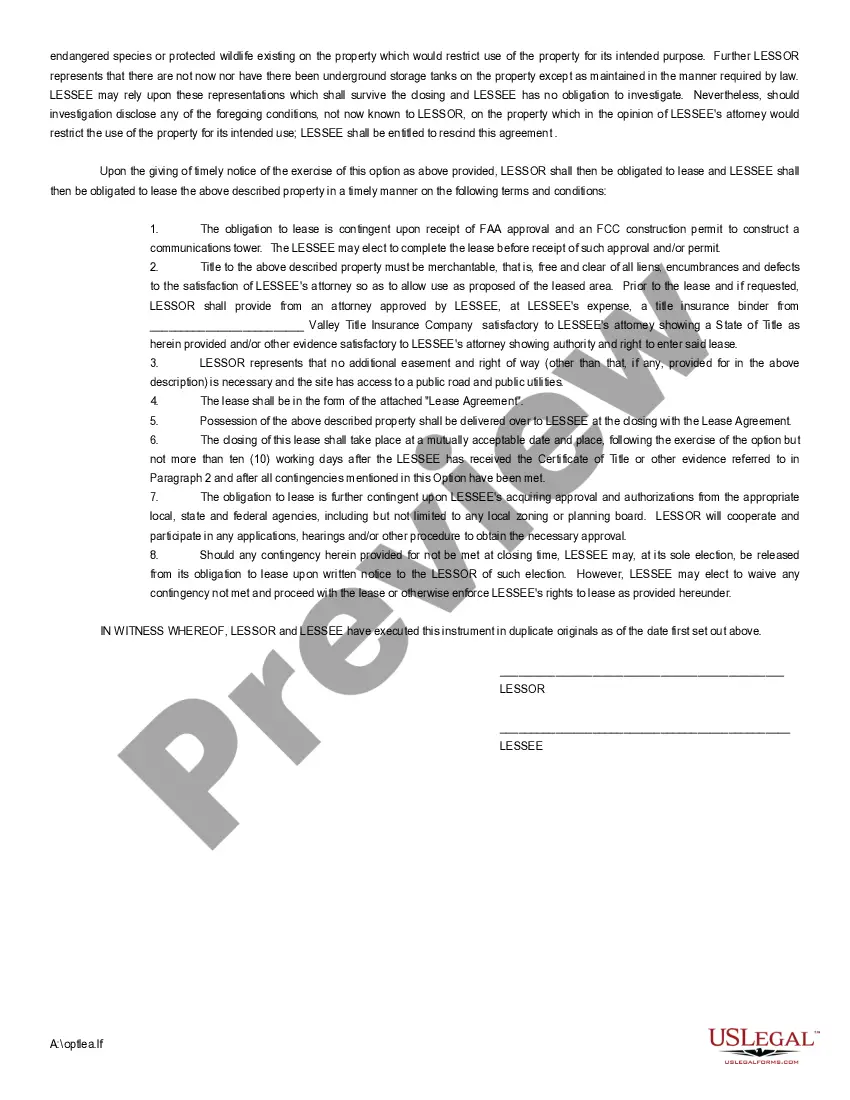

Nevada Option to Lease Real Estate - Long Form

Description

How to fill out Option To Lease Real Estate - Long Form?

Choosing the best legitimate record design could be a have a problem. Obviously, there are a variety of themes available on the net, but how would you obtain the legitimate form you will need? Utilize the US Legal Forms web site. The services provides 1000s of themes, like the Nevada Option to Lease Real Estate - Long Form, that can be used for company and private demands. All the kinds are checked by pros and meet federal and state needs.

In case you are currently authorized, log in to your account and click the Obtain key to obtain the Nevada Option to Lease Real Estate - Long Form. Make use of your account to appear from the legitimate kinds you might have ordered previously. Check out the My Forms tab of the account and have yet another backup of the record you will need.

In case you are a brand new user of US Legal Forms, allow me to share easy recommendations that you should stick to:

- First, ensure you have chosen the correct form for the area/state. You may examine the form utilizing the Review key and read the form description to ensure it is the best for you.

- In the event the form does not meet your preferences, use the Seach field to obtain the correct form.

- When you are certain that the form is suitable, click the Buy now key to obtain the form.

- Select the prices program you want and enter in the necessary info. Design your account and purchase the order making use of your PayPal account or bank card.

- Select the data file format and acquire the legitimate record design to your system.

- Total, edit and produce and indicator the obtained Nevada Option to Lease Real Estate - Long Form.

US Legal Forms may be the greatest local library of legitimate kinds in which you can discover numerous record themes. Utilize the service to acquire expertly-produced files that stick to status needs.

Form popularity

FAQ

THE LEASING PROCESS - LANDLORDSLeasing Appraisal.Appoint Leasing Agent / Property Manager.Sign a Management Agreement (Before or After Tenant is Acquired)

A lease purchase agreement may be attractive to a seller in a competitive market since he is able to lock in a buyer and secure a monthly payment. The seller is typically able to charge a higher rent than he would normally receive in a traditional lease.

Yes, some residential lease agreements need to be notarized in Nevada. While most residential lease agreements between the tenant and landlord do not need to be notarized, there is an exception. If the landlord themselves is not signing the lease, it may need to be notarized.

What is a lease-option-to-buy? A lease-option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.

Unlike a sale agreement with seller financing, a lease-option allows the owner to continue to receive tax deductions as the owner. Interest, taxes, maintenance and depreciation may still be deducted against the rent received.

A lease is a contract outlining the terms under which one party agrees to rent an assetin this case, propertyowned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.

A lease option is a legal agreement that allows you to control a property and generate income from it, with the right (but not the obligation) to buy it later. .

The leasing process explainedLooking for an agent. Appointing a professional property manager to look after your investment property is a smart move.Appointing an agent.Insurance.Marketing the property.Tenant selection.Rental agreements and terms.Condition report.Bond and rent.More items...

The three most common types of leases are gross leases, net leases, and modified gross leases....3 Types of Leases Business Owners Should UnderstandThe Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

Leasing a car is similar to a long-term rental. You'll generally have to make an upfront payment, plus monthly payments, and get to use a car for several years. At the end of the lease, you'll return the vehicle and have to decide if you want to start a new lease, purchase a car or go carless.