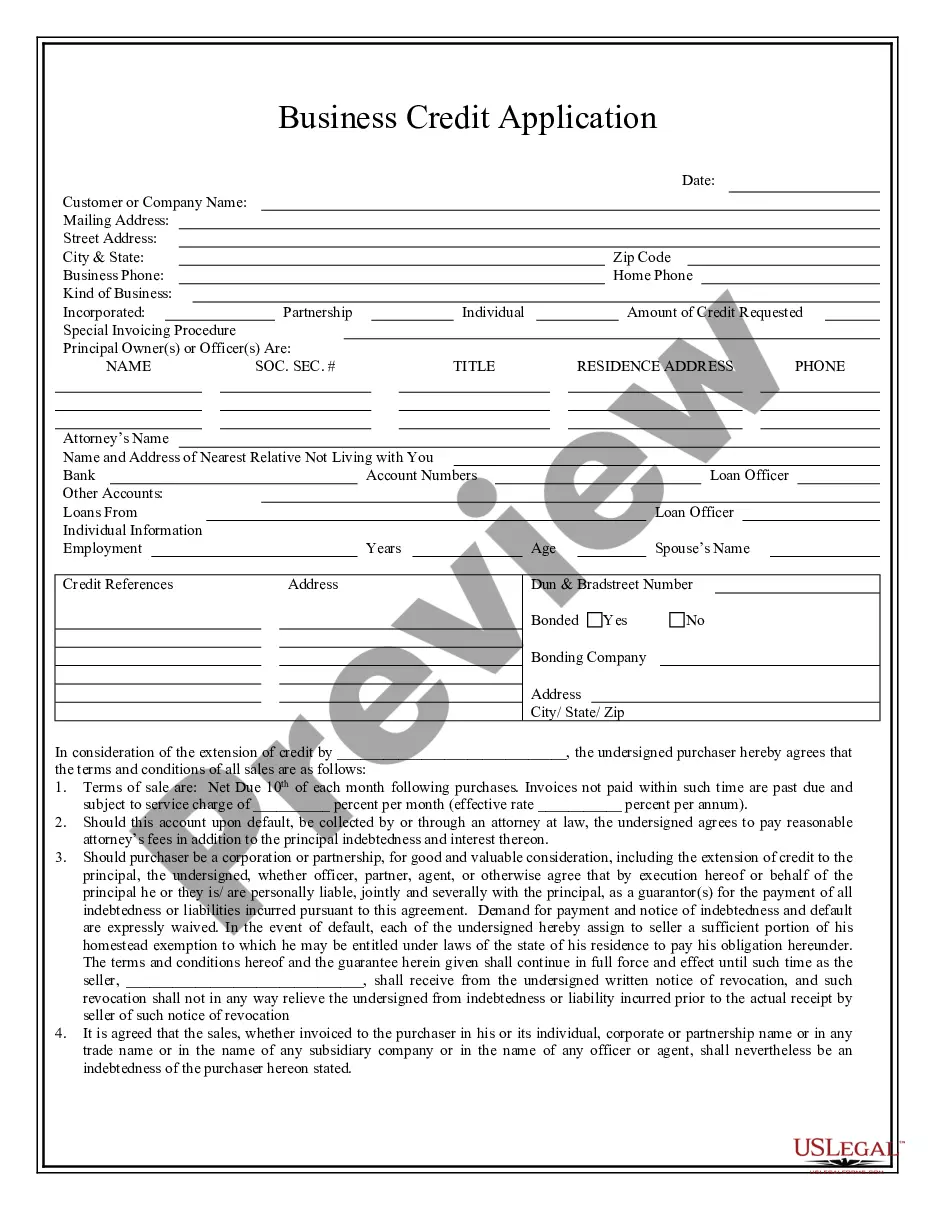

Colorado Business Credit Application

Description

How to fill out Colorado Business Credit Application?

If you're looking for precise Colorado Business Credit Application samples, US Legal Forms is precisely what you require; find documents created and verified by state-authorized attorneys.

Utilizing US Legal Forms not only relieves you from concerns regarding legal documents; you also save time, effort, and money!

And that's it. In just a few simple steps, you obtain an editable Colorado Business Credit Application. Once you set up an account, all subsequent requests will be processed even more effortlessly. With a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form’s page. Then, when you wish to use this blank form again, you'll always find it in the My documents section. Don't waste your time comparing countless forms across different online sources. Obtain precise templates from a single reliable service!

- Commence by completing your registration process by entering your email and creating a secure password.

- Follow the directions provided below to establish your account and locate the Colorado Business Credit Application template to handle your needs.

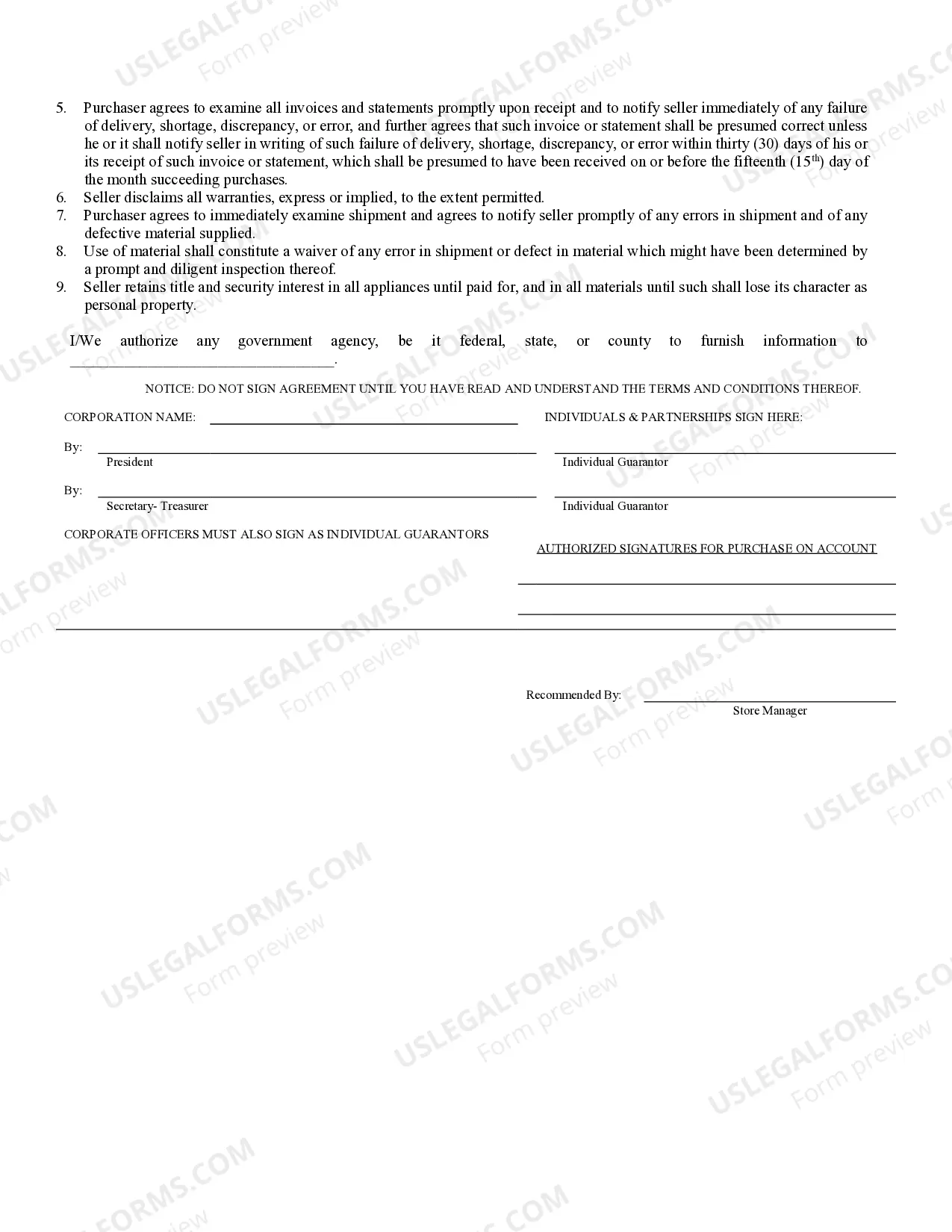

- Utilize the Preview feature or review the document details (if available) to ensure that the template fits your requirements.

- Verify its relevance in your residing state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

Form popularity

FAQ

Business tax credits work by providing financial incentives to reduce the amount of tax a business owes. These credits can be tied to specific activities or investments that further economic development within Colorado. By using the Colorado Business Credit Application, businesses can navigate the requirements and capture the benefits available to them.

To obtain general business credit, start by researching the types of credits available through the Colorado Business Credit Application. This application provides a comprehensive guide to various state programs designed to support businesses. By identifying eligible criteria and submitting your application, you can secure the credits that align with your business goals.

Colorado tax credits work by allowing businesses to reduce their overall state tax liability based on certain qualifying activities and investments. When businesses engage with eligible programs, they can receive credits that significantly lessen their tax burden. Using the Colorado Business Credit Application simplifies this process, ensuring compliance and maximizing potential savings.

The new employee credit in the Colorado enterprise zone is designed to incentivize businesses to hire eligible employees. This credit allows businesses to receive a percentage of wages for new hires working within the designated zones. Utilizing the Colorado Business Credit Application streamlines the process to ensure you maximize your credits while fulfilling the requirements.

The Colorado EV tax credit can amount to a significant reduction on your tax liability, often up to $4,000 depending on the vehicle's battery capacity. This incentive promotes the adoption of electric vehicles and helps align with sustainability goals. To effectively claim this credit, consider using the Colorado Business Credit Application for guidance.

The certificate of enterprise zone tax credits in Colorado is an official document proving that a business qualifies for tax credits based on its location and activities within an enterprise zone. This certificate is vital for attracting investors and for businesses to utilize the Colorado Business Credit Application effectively. By securing this certificate, your business can maximize its tax savings.

Yes, an LLC can obtain a business line of credit, which provides flexible access to funds as needed. To qualify, your LLC should maintain good financial health and have a clear credit history. Submitting a Colorado Business Credit Application can be an effective step in securing a business line of credit, as it allows lenders to review your financial situation and make informed decisions.

The quickest way to get business credit is to get a business credit card and make regular purchases while ensuring timely payments. Additionally, you should register with a business credit reporting agency. Completing a Colorado Business Credit Application will further streamline the process for you, making it easier to access valuable credit options for your LLC.

To obtain business credit for your LLC, start by ensuring your business is legally registered and has an EIN. Next, open a business bank account and apply for a business credit card. With these tools in hand, you can submit a Colorado Business Credit Application, showcasing your business's financial details and payment history to lenders, which can help in building your business credit.

To register your business in Colorado, you need to choose a business name and structure, then file the appropriate formation documents with the Colorado Secretary of State. You will also need to obtain an Employer Identification Number (EIN) from the IRS. Once your business is officially registered, you should consider completing a Colorado Business Credit Application to start building your business's credit profile.