Nevada Employment Form

Description

How to fill out Employment Form?

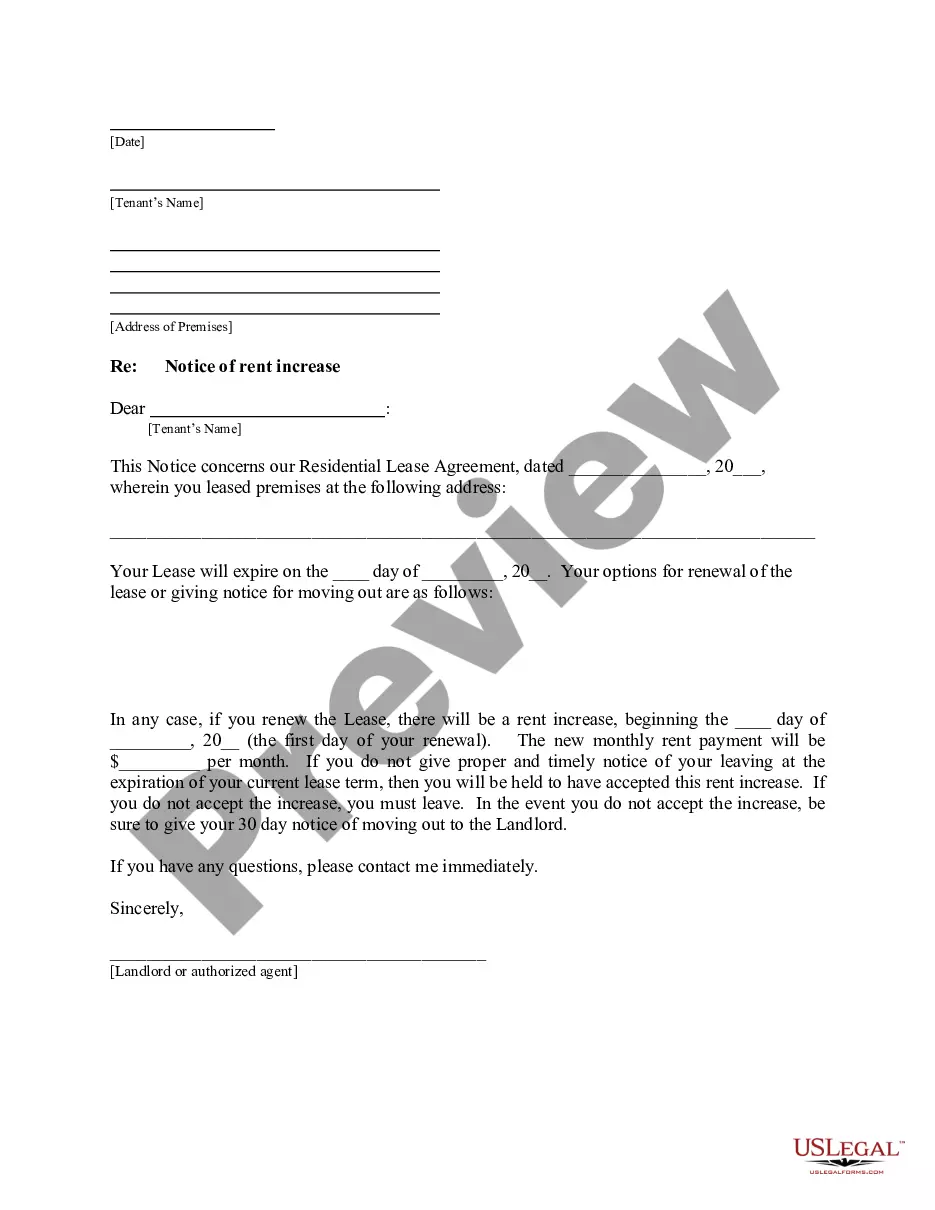

It is feasible to spend time online searching for the legal document template that meets the state and federal requirements you will require.

US Legal Forms offers a vast array of legal templates that are reviewed by professionals.

You can easily obtain or print the Nevada Employment Form from the service.

If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Nevada Employment Form.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased template, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Initially, ensure that you have chosen the correct document template for the region/city of your selection.

- Review the template overview to confirm you have selected the right one.

Form popularity

FAQ

Claimants requesting a backdate must submit a request by contacting the telephone claims center. Claims that are eligible for the backdate will be paid retroactively; this will include any Federal Pandemic Unemployment Compensation (FPUC) payment you may be eligible to receive.

Here are 8 steps a business will need to make when hiring their first employee in Nevada.Step 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.More items...?

PUA filing process State of NVIf you have already established a claim and are receiving benefits, you can still claim weeks up to and including the week ending 9/4/2021.

Individuals needing assistance with filing should contact the PUA claim center at 1-800-603-9681, 775-298-6007, or 702-998-3081, Monday through Friday. Callers are encouraged to call Wednesday through Friday after 10 a.m., as Mondays and Tuesdays are the call centers' busiest days of the week.

The regular UI program offers a waiver from the work search requirement for union workers who meet the following criteria: Claimant is a member, in good standing, of a union with a hiring hall. Claimant must provide union name, and union dues expiration date. Waiver is only allowable for a hiring hall union.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

Employers who pay employees in Nevada must register with the NV Department of Employment, Training, and Rehabilitation (DETR) for an Employer Account Number and Modified Business Tax (MBT) Account Number. Register for an EAN online at the DETR's Employer Self Service site to receive the account number within 2 days.

Individuals needing assistance with filing should contact the PUA claim center at 1-800-603-9681, 775-298-6007, or 702-998-3081, Monday through Friday. Callers are encouraged to call Wednesday through Friday after 10 a.m., as Mondays and Tuesdays are the call centers' busiest days of the week.

At this time payment for PUA claimants who filed their weekly certifications on Sunday, July 4, will be processed on Friday, July 9, and benefit recipients can expect their deposit to be made into their account within three business days. DETR is working with our third party vendor to ensure this will not happen again.