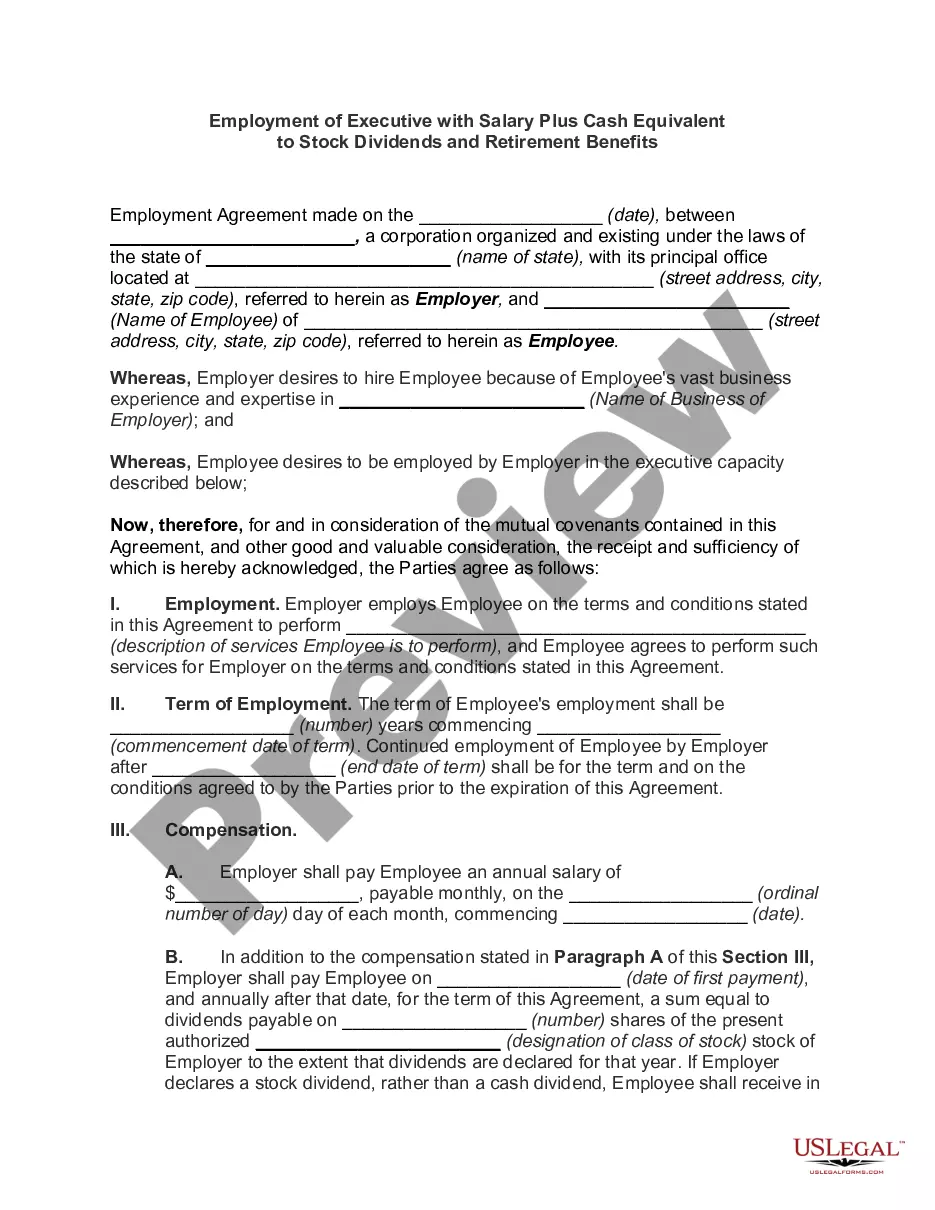

Nevada Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

How to fill out Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

US Legal Forms - among the greatest libraries of legitimate varieties in the States - delivers an array of legitimate record templates you can acquire or print. Making use of the web site, you can find a huge number of varieties for business and individual uses, categorized by classes, claims, or search phrases.You can get the latest models of varieties such as the Nevada Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits in seconds.

If you already possess a subscription, log in and acquire Nevada Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits from your US Legal Forms catalogue. The Download button will appear on every single develop you view. You gain access to all previously downloaded varieties from the My Forms tab of your profile.

In order to use US Legal Forms initially, listed here are straightforward recommendations to help you started:

- Make sure you have selected the best develop to your city/region. Click on the Preview button to review the form`s content. Look at the develop explanation to ensure that you have chosen the proper develop.

- In case the develop doesn`t match your needs, utilize the Look for discipline at the top of the display to discover the one that does.

- In case you are content with the shape, confirm your option by simply clicking the Acquire now button. Then, choose the costs plan you want and provide your qualifications to sign up for an profile.

- Method the purchase. Make use of your credit card or PayPal profile to finish the purchase.

- Choose the structure and acquire the shape on the gadget.

- Make adjustments. Fill up, modify and print and indicator the downloaded Nevada Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits.

Every single template you included with your money does not have an expiry particular date which is your own permanently. So, if you would like acquire or print yet another copy, just check out the My Forms area and click around the develop you will need.

Gain access to the Nevada Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits with US Legal Forms, by far the most considerable catalogue of legitimate record templates. Use a huge number of expert and state-certain templates that fulfill your business or individual demands and needs.

Form popularity

FAQ

Your PERS benefit is not affected by Social Security. However, your Social Security benefit may be affected because you receive a PERS pension. The Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP) are the two Federal Government regulations that may reduce your Social Security benefit.

The cost to purchase service is determined based on two factors: Your average compensation (the monthly average of your 36 highest months of consecutive salary) and your age at the time of the purchase. On average, the cost for a one year purchase is approximately one-third of your annual salary.

All rate changes are effective with the first monthly retirement reporting period beginning on or after July 1, 2023. Regular Members ? will increase from 15.5% to 17.5%.

The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check. Physical checks can be handwritten or printed and require only that your business have a checking account with a bank.

PERS provides secure lifetime retirement benefits to eligible members. PERS was created by the NV Legislature in 1947 and we have grown to serve over 100,000 members and 45,000 benefit recipients. The system's assets are invested for the exclusive benefit of members and beneficiaries of the fund.

Despite salaried employees being employees who receive a fixed salary, regardless of their actual hours worked, some categories who are not considered exempt from overtime, still have the right to additional compensation in Nevada if their work hours surpass the hours their salary accounts for.

Monthly Pension Payment Schedule 01/26/2023. 02/23/2023. 03/28/2023. 04/25/2023. 05/25/2023. 06/27/2023. 07/26/2023. 08/28/2023.

The contribution made by you is on an after-tax basis. The employee contribution to PERS under this plan is 17.5% and the employer contribution is 17.5%. For Police/Fire Members, the employee/employer contribution is 25.75% each.