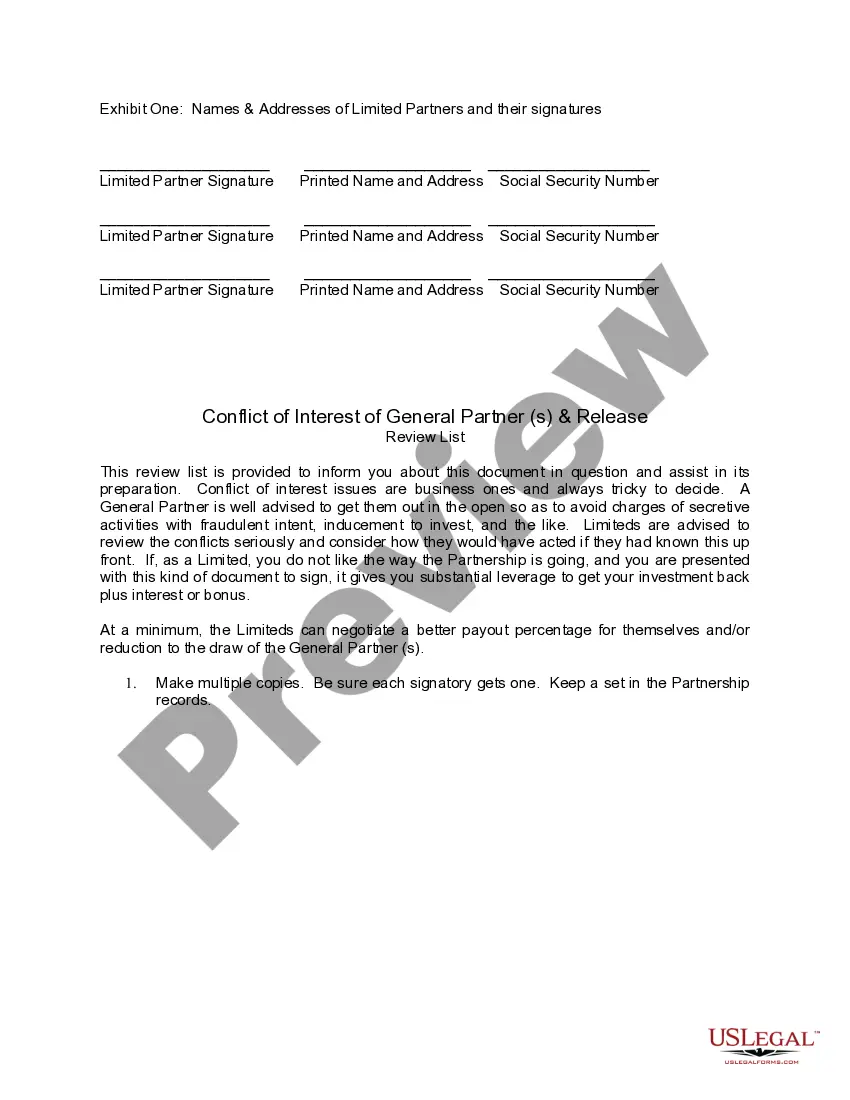

Nevada Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

It is feasible to invest time online searching for the legal document template that fulfills the federal and state requirements you will need.

US Legal Forms offers thousands of legal forms that are vetted by professionals.

You can easily download or print the Nevada Conflict of Interest of General Partner and Release from the services.

First, make sure that you have selected the appropriate document format for the state/region of your preference. Check the form description to ensure you have chosen the correct type.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, alter, print, or sign the Nevada Conflict of Interest of General Partner and Release.

- Each legal document template you obtain is yours permanently.

- To retrieve another copy of the acquired form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple guidelines below.

Form popularity

FAQ

Rule 1.5 of the Nevada Rules of Professional Conduct addresses the requirements for a lawyer's fees. Specifically, it states that fees must be reasonable and based on various factors, including the complexity of the case and the experience of the attorney. When it comes to the Nevada Conflict of Interest of General Partner and Release, understanding this rule is crucial for avoiding potential ethical pitfalls. For individuals navigating these complexities, the USLegalForms platform offers comprehensive resources to ensure compliance and clarity.

That means, absent a specific agreement between the partners and the partnership, a limited partner is treated like a shareholder of a public corporationthat is, a limited partner's right is limited to voting and distribution and must trust that the general partner will manage and operate the partnership in the best

General partner is an owner who has unlimited liability and is active in managing the firm. Limited partner is an owner who invests money in the business, but enjoys limited liability. For example, Kate owns a law firm but her partner Lisa is investing her firm but she does not participated in day to day operations.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

Limited Partnerships are formed when a partner is an investor in a business but is not involved in day-to-day operations. The general partner is responsible for the management of the partnership and the limited partner is generally an investor only. Limited partners are often referred to as silent partners.

Fiduciary duties cannot be waived by agreement. California law recognizes four (4) fiduciary duties: duty of care; duty of loyalty; duty of obedience; and, duty of good faith and fair dealing.

' Depending on the type of partnership, the fiduciary duties may vary. For general partners, the partners have managerial responsibilities and typically owe each other fiduciary duties. On the other hand, limited partners do not have managerial responsibility and often do not owe the same fiduciary duties.

No, a general partner and a limited partner cannot be the same person. Limited partners cannot exist without a general partner. However, a general partner can co-exist with another general partner.

Limited partners are only responsible for the business's liabilities up to the amount of money they invested. The general partners in an LP have unlimited liability. So, if someone sues the business or tries to collect on its debts, the general partners' personal assets can be at risk.

Typically, the general partners in a general partnership or limited partnership participate in the daily operation and supervision of the business. Because of their role in managing the partnership, general partners are usually viewed as having fiduciary duties in both a general partnership and limited partnership.