Nevada Breakdown of Savings for Budget and Emergency Fund

Description

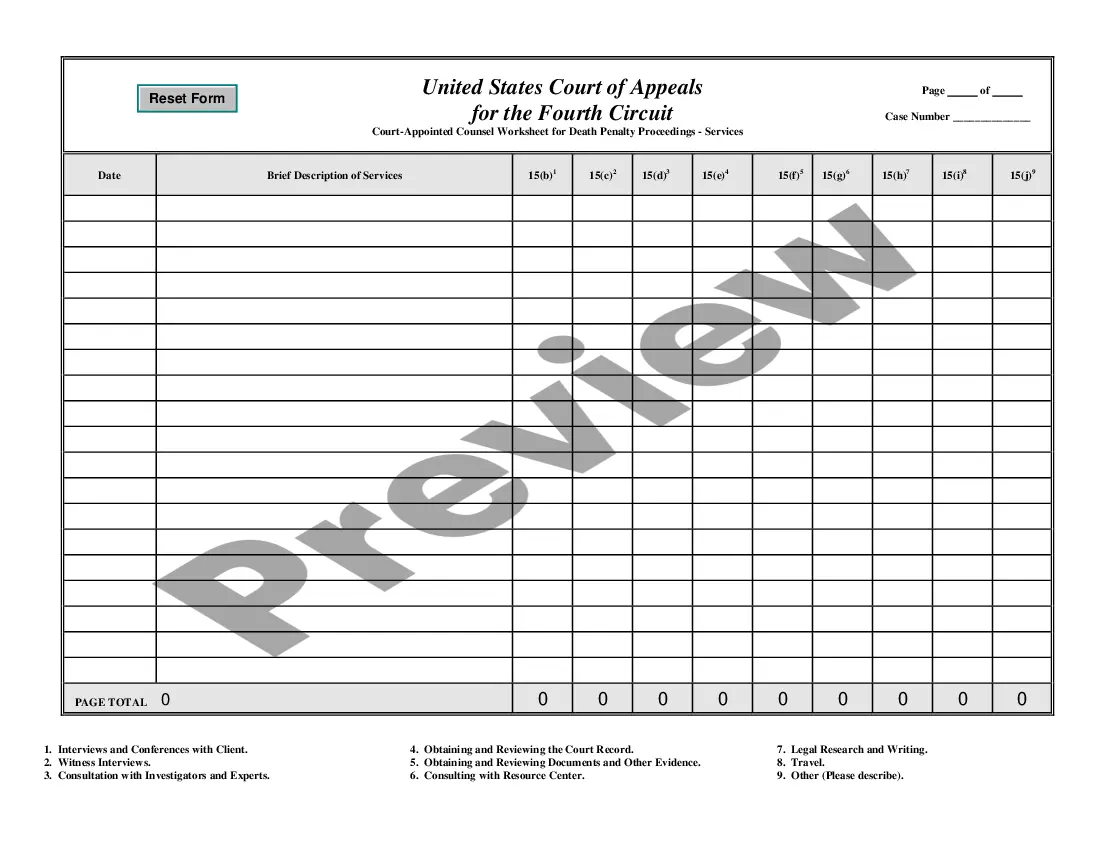

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

It is possible to devote hrs on the Internet searching for the legitimate document web template that fits the federal and state requirements you require. US Legal Forms gives a large number of legitimate types which are analyzed by specialists. You can easily obtain or printing the Nevada Breakdown of Savings for Budget and Emergency Fund from the services.

If you already have a US Legal Forms accounts, you are able to log in and click on the Down load button. Afterward, you are able to total, revise, printing, or indication the Nevada Breakdown of Savings for Budget and Emergency Fund. Every single legitimate document web template you buy is yours forever. To have yet another copy associated with a acquired type, check out the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms web site the first time, keep to the easy instructions below:

- Initial, be sure that you have selected the best document web template for that region/town of your liking. Look at the type description to ensure you have chosen the correct type. If available, use the Review button to appear with the document web template as well.

- If you would like locate yet another model of your type, use the Look for discipline to discover the web template that meets your requirements and requirements.

- Upon having identified the web template you desire, click Buy now to carry on.

- Choose the prices program you desire, key in your accreditations, and sign up for an account on US Legal Forms.

- Total the transaction. You may use your Visa or Mastercard or PayPal accounts to purchase the legitimate type.

- Choose the file format of your document and obtain it in your product.

- Make modifications in your document if needed. It is possible to total, revise and indication and printing Nevada Breakdown of Savings for Budget and Emergency Fund.

Down load and printing a large number of document themes while using US Legal Forms web site, that provides the largest collection of legitimate types. Use skilled and state-particular themes to handle your company or individual requirements.

Form popularity

FAQ

A lot of money experts recommend the 50/30/20 budget, where 50% of your income goes to needs, 30% goes to wants, and 20% goes to savings and debt. I decided to give it a try, but it really didn't work for me it lead to feelings of self-doubt, decision fatigue, and frustration.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

The 50/30/20 budget divides your after-tax income into three separate categories: 50% for needs, 30% for wants and 20% for savings/financial goals. This approach is best for younger, average-income earners who have paid off their high-interest debt.

The 50/30/20 rule is a popular budgeting method that splits your monthly income among three main categories. Here's how it breaks down: Monthly after-tax income. This figure is your income after taxes have been deducted.

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt. By regularly keeping your expenses balanced across these main spending areas, you can put your money to work more efficiently.

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

The 50/30/20 rule budget is a simple way to budget that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings or paying off debt.

Creating a budgetStep 1: Calculate your net income. The foundation of an effective budget is your net income.Step 2: Track your spending.Step 3: Set realistic goals.Step 4: Make a plan.Step 5: Adjust your spending to stay on budget.Step 6: Review your budget regularly.

The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.