Nevada Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

If you wish to acquire, access, or generate legitimate document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Take advantage of the site's user-friendly and efficient search feature to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document template you receive belongs to you permanently. You have access to every form you saved in your account.

Navigate to the My documents section and select a document to print or download again. Compete and finalize, and print the Nevada Release from Liability under Guaranty with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Nevada Release from Liability under Guaranty with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download option to obtain the Nevada Release from Liability under Guaranty.

- You can also find documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have selected the form for your specific state/region.

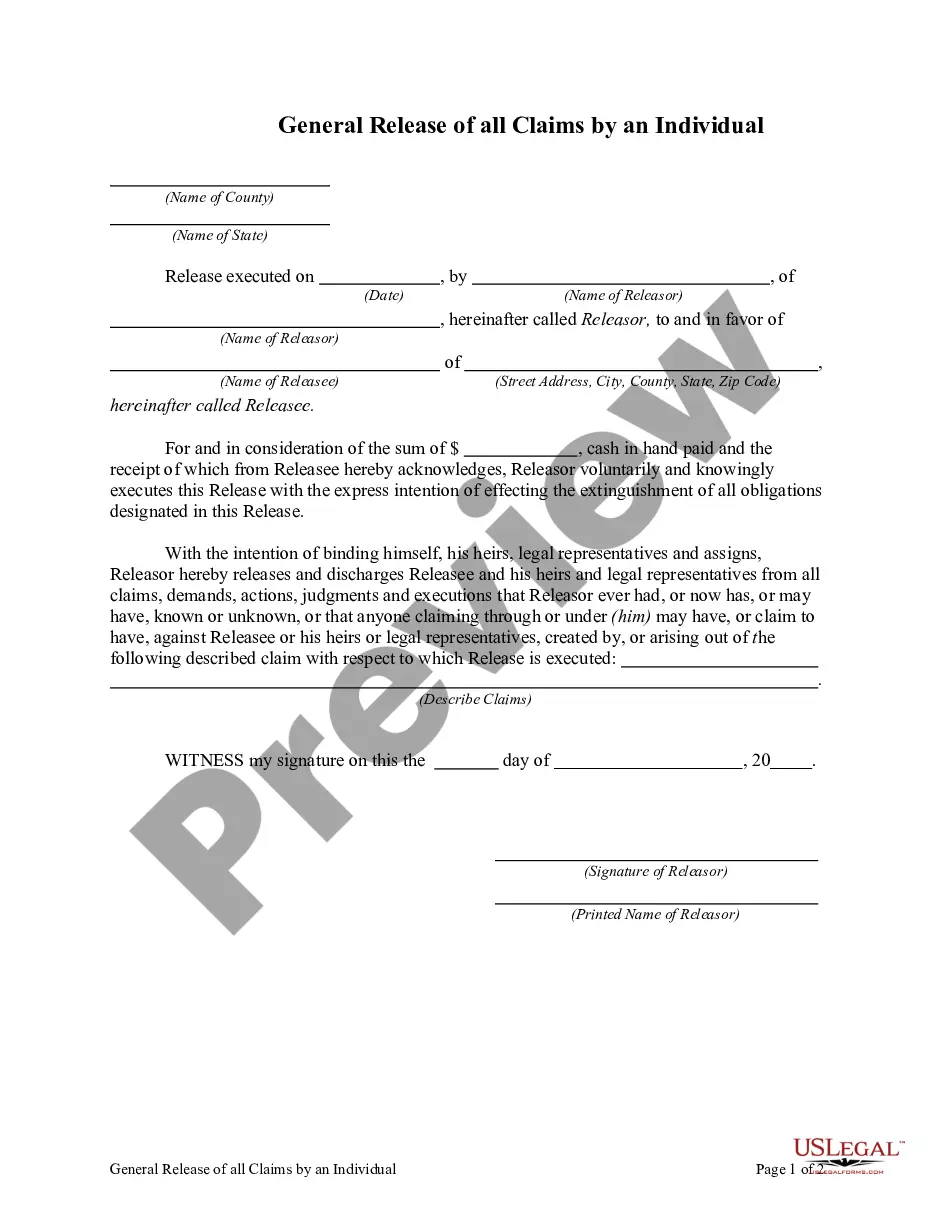

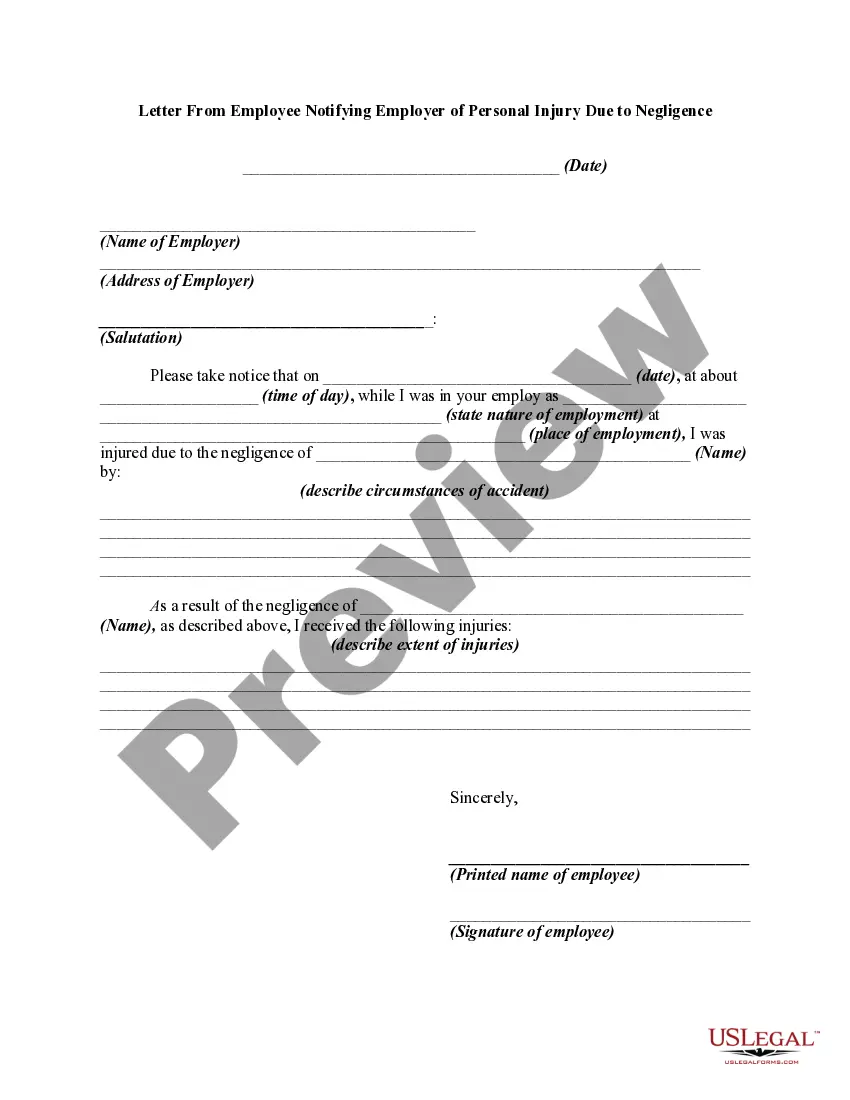

- Step 2. Use the Review option to check the content of the form. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now option. Choose your preferred payment plan and enter your credentials to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Nevada Release from Liability under Guaranty.

Form popularity

FAQ

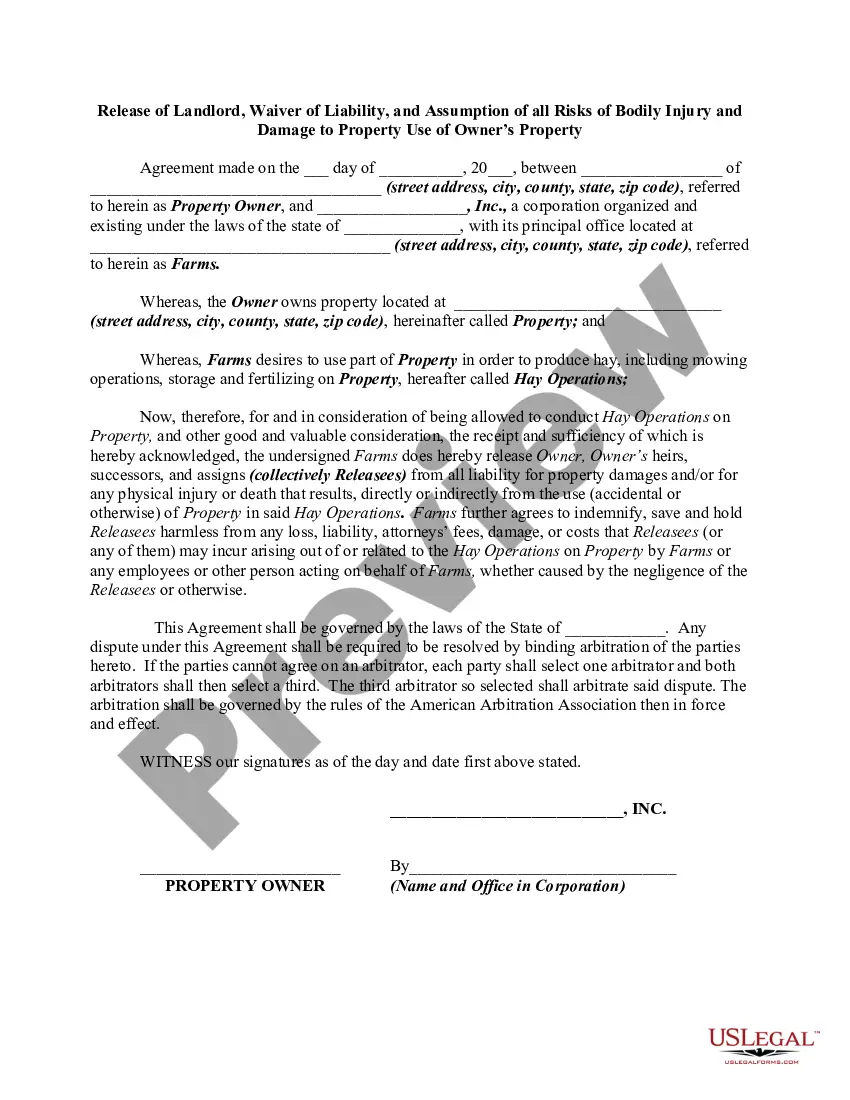

A guarantee is an agreement through which an individual or legal entity undertakes to meet certain obligations, such as paying a third party's debt if the latter defaults.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

If a guarantor contacts the company to revoke the guaranty, best practices indicate that some consideration should be given for release of the guaranty and such release/revocation should be documented in writing by all parties involved.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default.

In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another (usually to pay) by promising to themselves pay if default occurs. At law, the giver of a guarantee is called the surety or the "guarantor".

Discharge of Guarantor by Release of Principal Debtor: Section 134 of the ICA provides that the guarantor shall stand discharged from its liabilities under a contract of guarantee in case of any agreement arrived at between the creditor and the principal debtor, by which the principal debtor is released.

A guarantee can be released by agreementeither be made as a deed or be supported by sufficient consideration. In some cases, when a guarantee is released, the guaranteed party will return the guarantee document to the guarantor.

Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance. Personal guarantees provide an extra level of protection to credit issuers who want to make sure they will be repaid.

A loan personal guarantee is a document that allows an individual, known as the guarantor, to be responsible for loaned money if it is not paid back by the borrower.