Nevada General Partnership for the Purpose of Farming

Description

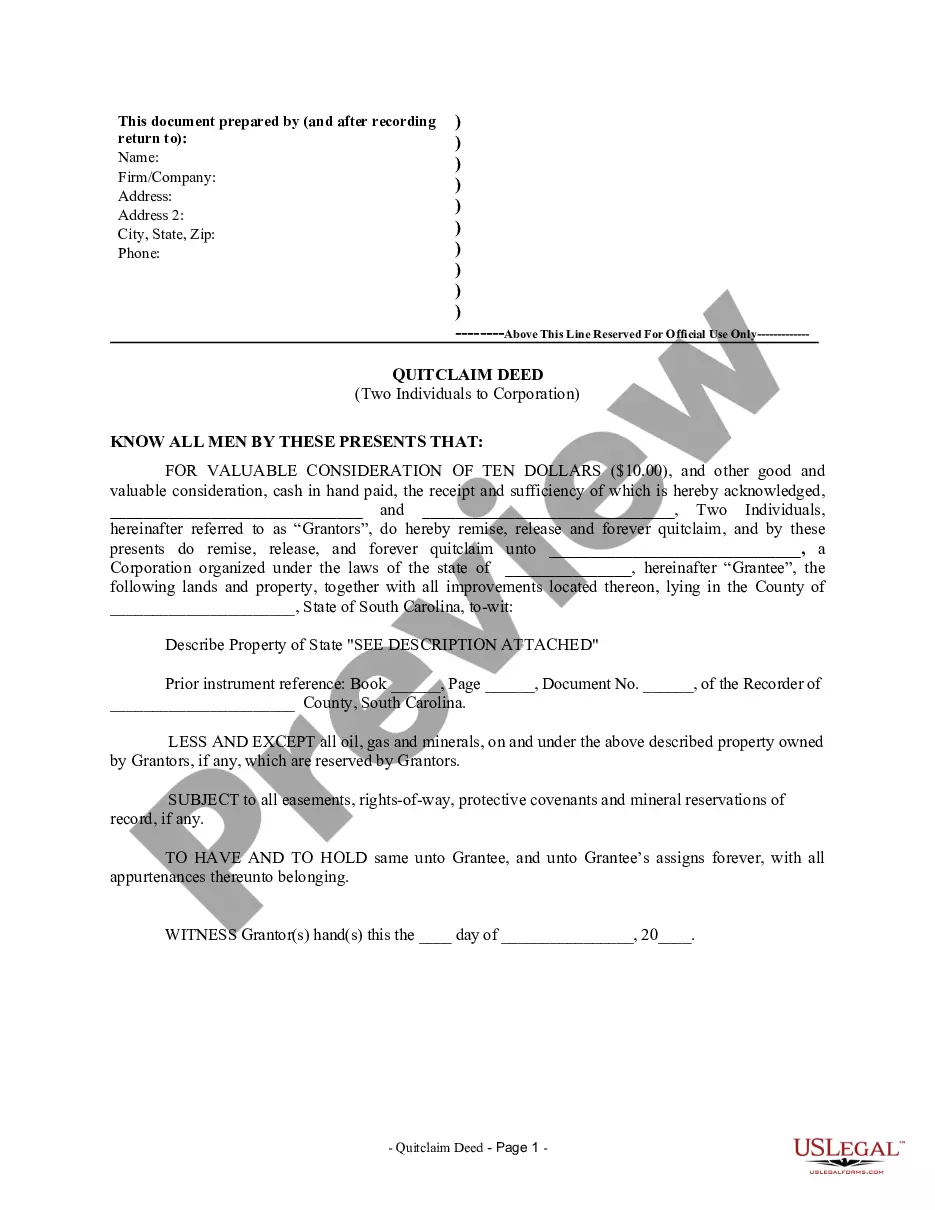

How to fill out General Partnership For The Purpose Of Farming?

If you wish to aggregate, acquire, or produce legitimate document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Leverage the site's straightforward and efficient search to locate the records you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to discover the Nevada General Partnership for Farming with just a few clicks.

Every legal document format you acquire is yours to keep indefinitely. You will have access to every form you have downloaded within your account. Browse the My documents section to select a form to print or download again.

Be proactive and acquire, and print the Nevada General Partnership for Farming with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to retrieve the Nevada General Partnership for Farming.

- Additionally, you can access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form relevant to your city/state.

- Step 2. Utilize the Preview option to review the content of the form. Do not forget to examine the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you desire and enter your credentials to register an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Nevada General Partnership for Farming.

Form popularity

FAQ

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

If you decide to form a partnership in Nevada, there are a few mandatory steps you must go through in order to properly create the partnership.Step 1: Select a business name.Step 2: File trademark on business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

The cost of registration can be up to $200, depending on the state or territory. Other than this, a partnership can be remarkably inexpensive to set up. A partnership is not a separate legal entity, so while the partnership requires its own ABN and must lodge its own tax return, the partnership itself is not taxed.

State law requires that every person or entity doing business in the state of Nevada obtain a business license annually. A business that meets the criteria shall not do business in the state of Nevada without the State Business License. Certain businesses may be exempt from the State Business License requirement.

Sole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

All types of businesses whether based out of commercial space or home-based require a state business license and also a local business license in Las Vegas.

Here are the basic steps to forming a partnership: Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement.