Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms

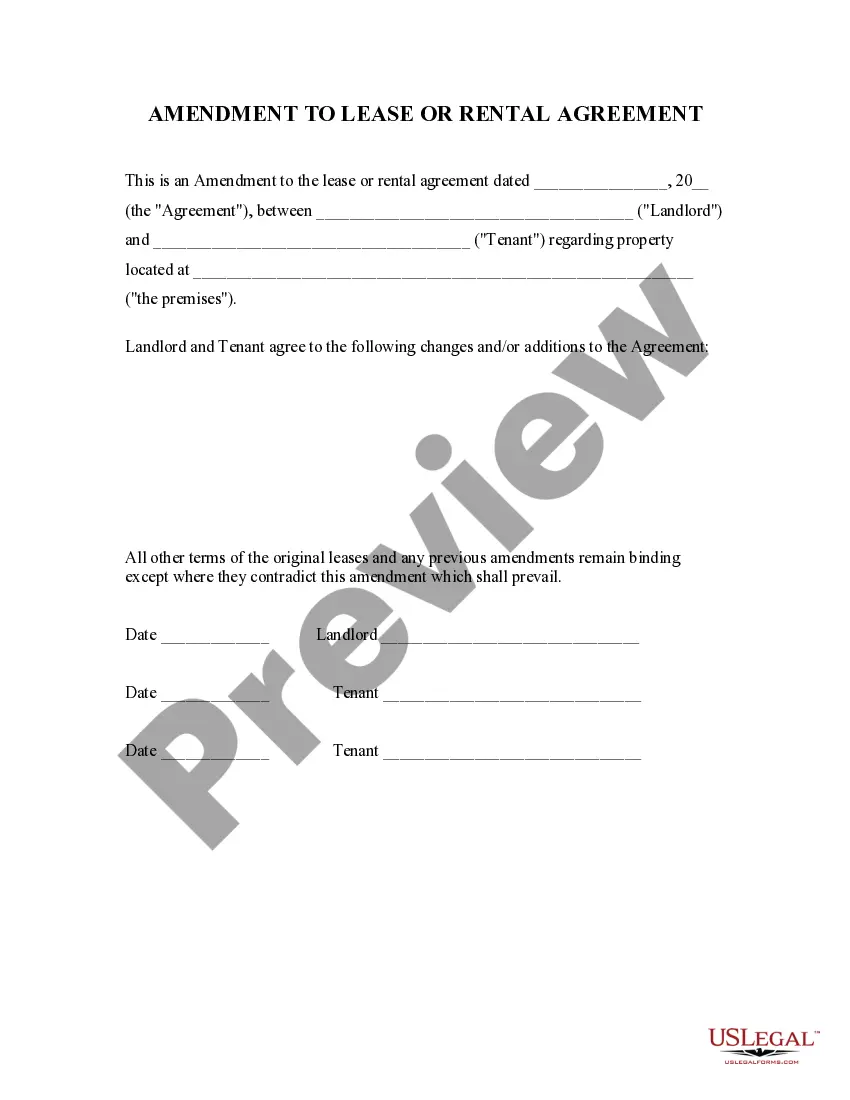

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

Finding the correct valid document format can be challenging. Clearly, there are numerous templates accessible online, but how can you discover the official form you need.

Use the US Legal Forms website. This service offers a vast collection of templates, including the Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms, suitable for both business and personal purposes.

All of the templates are verified by experts and comply with federal and state regulations.

Once you are confident that the form is appropriate, click the Buy now button to acquire the document. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Fill out, edit, print, and sign the obtained Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to retrieve the Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms.

- Utilize your account to search through the legal documents you have obtained previously.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the appropriate form for your state/region. You can review the document using the Review button and read the form description to confirm it is suitable for you.

- If the form does not satisfy your needs, use the Search field to find the correct form.

Form popularity

FAQ

The IRS does not send a formal confirmation letter for extensions after you submit your request, but the confirmation of your submitted Form 4868 or Form 7004 serves as proof. It's crucial to save this confirmation for your records. That said, to help you with your correspondence, a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms can be an excellent reference.

You can obtain a tax extension form, like IRS Form 4868 or Form 7004, from the IRS website or your tax professional. Local libraries and tax assistance offices may also provide copies. Having these forms handy will make your filing process smoother. Additionally, using a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms can enhance your application.

While you cannot retrieve a copy of the tax extension directly from the IRS online, you can check your IRS account for details about your extension. Make sure to keep copies of any forms you submit. For future requests, consider utilizing a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms for clear communication.

Requesting a business tax extension is similar to personal extensions. Complete IRS Form 7004 to obtain an automatic extension of time to file your business tax return. Ensure you check your state requirements, as they may vary. A Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms can also be a useful resource in this process.

You generally do not receive a formal tax extension letter from the IRS once you submit Form 4868. Instead, your submitted form serves as your evidence of extension. If needed, keep the confirmation of your submission for your records. For drafting purposes, a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms might help you format your letters appropriately.

To file for a tax extension in Nevada, complete IRS Form 4868 by the due date of your tax return. This form can be submitted electronically or by mail. Ensure you include any estimated tax payments to avoid penalties. Utilizing a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms can simplify your communication with the IRS.

To ask the IRS for an extension on your taxes, you should complete IRS Form 4868. This form allows you to request a six-month extension to file your tax return. Make sure to provide accurate details and submit the form by the original deadline. For a tailored request, consider using a Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms as a guide.

Yes, you can ask for an extension on your business taxes. To do this effectively, use the Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms as a guide. This letter helps convey your request to the tax authorities properly and assures them of your commitment to filing on time. Knowing how to articulate your needs in a formal request can provide you with the additional time you require.

Filing a business tax extension for your LLC is straightforward. You need to submit the appropriate forms, often accompanied by the Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms. This letter not only communicates your request but also demonstrates your intent to comply with tax obligations. Make sure you check the specific state requirements to ensure successful submission.

Yes, you can request a tax extension online. Using the Nevada Sample Letter for Letter Requesting Extension to File Business Tax Forms simplifies the process significantly. Many tax agencies offer digital options for submitting extension requests, making it easy to manage your paperwork from the comfort of your home. Additionally, utilizing online resources can help ensure you meet all necessary criteria.