Nevada Income Projections Statement

Description

As monthly projections are developed and entered into the income projections statement, they can serve as definite goals for controlling the business operation. As actual operating results become known each month, they should be recorded for comparison with the monthly projections. A completed income statement allows the owner/manager to compare actual figures with monthly projections and to take steps to correct any problems.

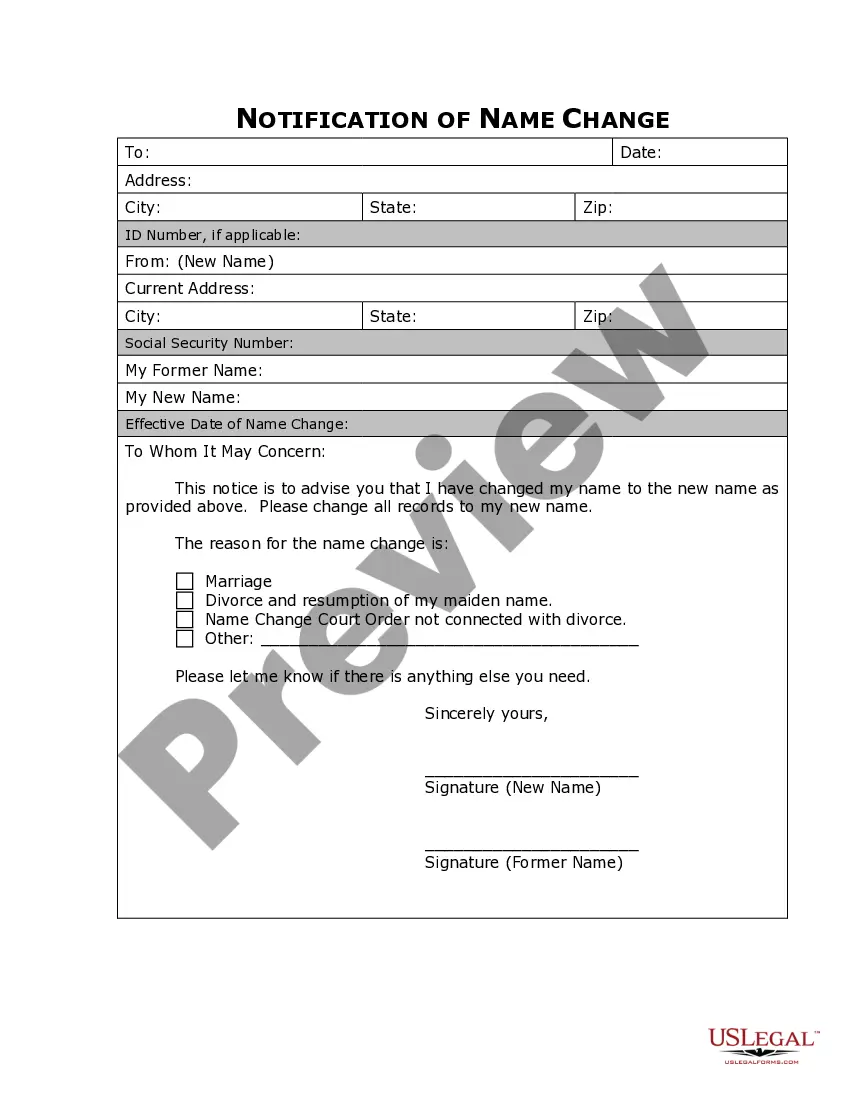

How to fill out Income Projections Statement?

US Legal Forms, among the largest collections of legal documents in the country, offers an extensive variety of legal form templates that you can obtain or create.

By using the website, you will access numerous forms for business and individual purposes, categorized by types, litigations, or keywords. You can quickly find the latest updates to forms like the Nevada Income Projections Statement.

If you already have an account, Log In to download the Nevada Income Projections Statement from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Nevada Income Projections Statement. Every template added to your account has no expiration date and is yours indefinitely. So, if you need to download or create another copy, simply navigate to the My documents section and click on the form you desire. Access the Nevada Income Projections Statement with US Legal Forms, the most extensive library of legal document templates. Take advantage of numerous professional and state-specific templates that satisfy your business or personal requirements and specifications.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview option to review the content of the form.

- Check the form details to confirm that you have chosen the correct document.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are content with the form, confirm your decision by clicking the Buy Now button.

- Select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

An income statement is a financial report that summarizes revenues and expenses over a specific period. For example, if a business generated $100,000 in sales and incurred $60,000 in expenses, the income statement will show a net income of $40,000. Understanding this concept helps when creating a Nevada Income Projections Statement for better financial forecasting.

Writing a projected income statement starts with estimating your revenue for the upcoming periods. Deduct your estimated costs, including expenses related to goods sold and operating expenses. Finally, account for taxes to arrive at your net income. A well-crafted Nevada Income Projections Statement will provide clarity and guidance for future financial decisions.

To make projections of financial statements, begin by gathering historical financial data. Then, analyze trends to identify patterns that can inform future performance. Consider external factors that impact the business, such as market conditions, economic forecasts, and industry benchmarks. Incorporating these insights will help you create a reliable Nevada Income Projections Statement.

Nevada's top revenue sources include gaming taxes, sales taxes, and tourism. The gaming industry plays a substantial role in funding the state, which significantly influences Nevada’s economic landscape. When creating your Nevada income projections, it is essential to consider these sectors as they contribute to the overall financial picture. Utilizing US Legal Forms can assist you in navigating the relevant tax implications associated with these revenue sources.

In Nevada, you do not receive a state income tax return due to the absence of a state income tax. This situation can simplify your financial dealings and budgeting. Consequently, while preparing your Nevada income projections, you can focus on other aspects of your financial strategy. Always be sure to understand the full spectrum of your tax responsibilities in the state.

A TID, or Tax Increment District, in Nevada is a designated area where property tax revenues are generated to fund public improvements. These districts can significantly impact local economic development and planning. If you're considering how such initiatives affect your Nevada income projections, it's vital to stay informed about local TIDs. Using resources like US Legal Forms can help you access relevant information effectively.

Nevada does not have a state tax form for income tax purposes, as there is no income tax. However, other tax forms may be required for property tax or sales tax depending on your circumstances. When dealing with financial documentation, remember that your Nevada income projections will benefit from the simplicity of no state income tax. Keeping clear records can help you make sound financial decisions.

In Nevada, because there is no state income tax, residents do not receive state tax refunds like those in states with income taxes. Therefore, when analyzing your Nevada income projections, this absence of state income tax simplifies your financial returns. However, it is essential to keep track of other refundable taxes that may apply to your situation. Consider using US Legal Forms to stay organized with your tax documents.

Nevada does not require residents to file a state income tax return since there is no state income tax. Thus, Nevada income projections do not include state income tax calculations, making financial forecasting simpler for residents. This can offer more predictability in your annual budgeting. Always stay informed about other tax obligations that may exist, such as property tax or sales tax.

To close your MBT account in Nevada, you need to contact the Nevada Department of Taxation. They will guide you through the process and provide the necessary forms to complete your account closure. Make sure to resolve any outstanding taxes or obligations before you proceed. For further assistance, consider using US Legal Forms for easy navigation through the paperwork involved.