Nevada Building Loan Agreement between Lender and Borrower

Description

How to fill out Building Loan Agreement Between Lender And Borrower?

You are able to invest hours on the web searching for the lawful papers design that meets the state and federal demands you want. US Legal Forms supplies a huge number of lawful forms that happen to be reviewed by experts. You can actually download or printing the Nevada Building Loan Agreement between Lender and Borrower from our services.

If you already have a US Legal Forms bank account, you are able to log in and then click the Down load option. Next, you are able to comprehensive, edit, printing, or indicator the Nevada Building Loan Agreement between Lender and Borrower. Each lawful papers design you purchase is the one you have for a long time. To get an additional backup for any acquired develop, go to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site the first time, adhere to the basic recommendations listed below:

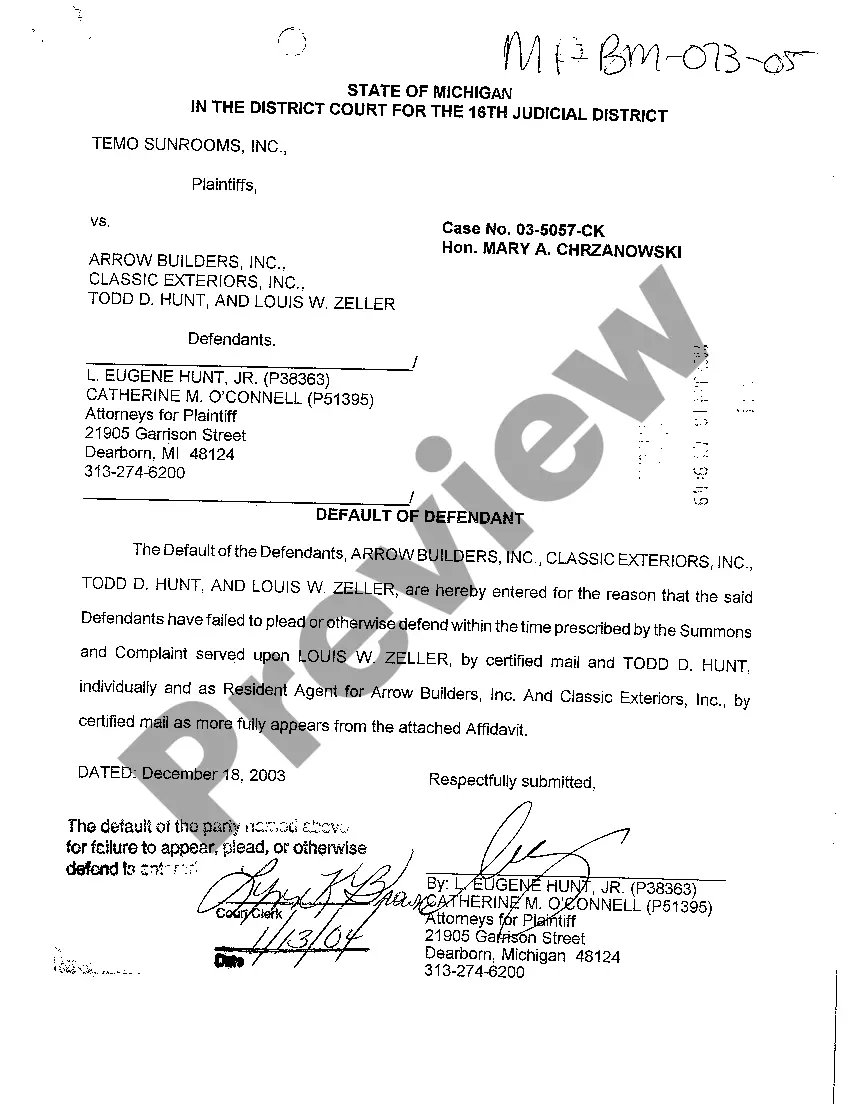

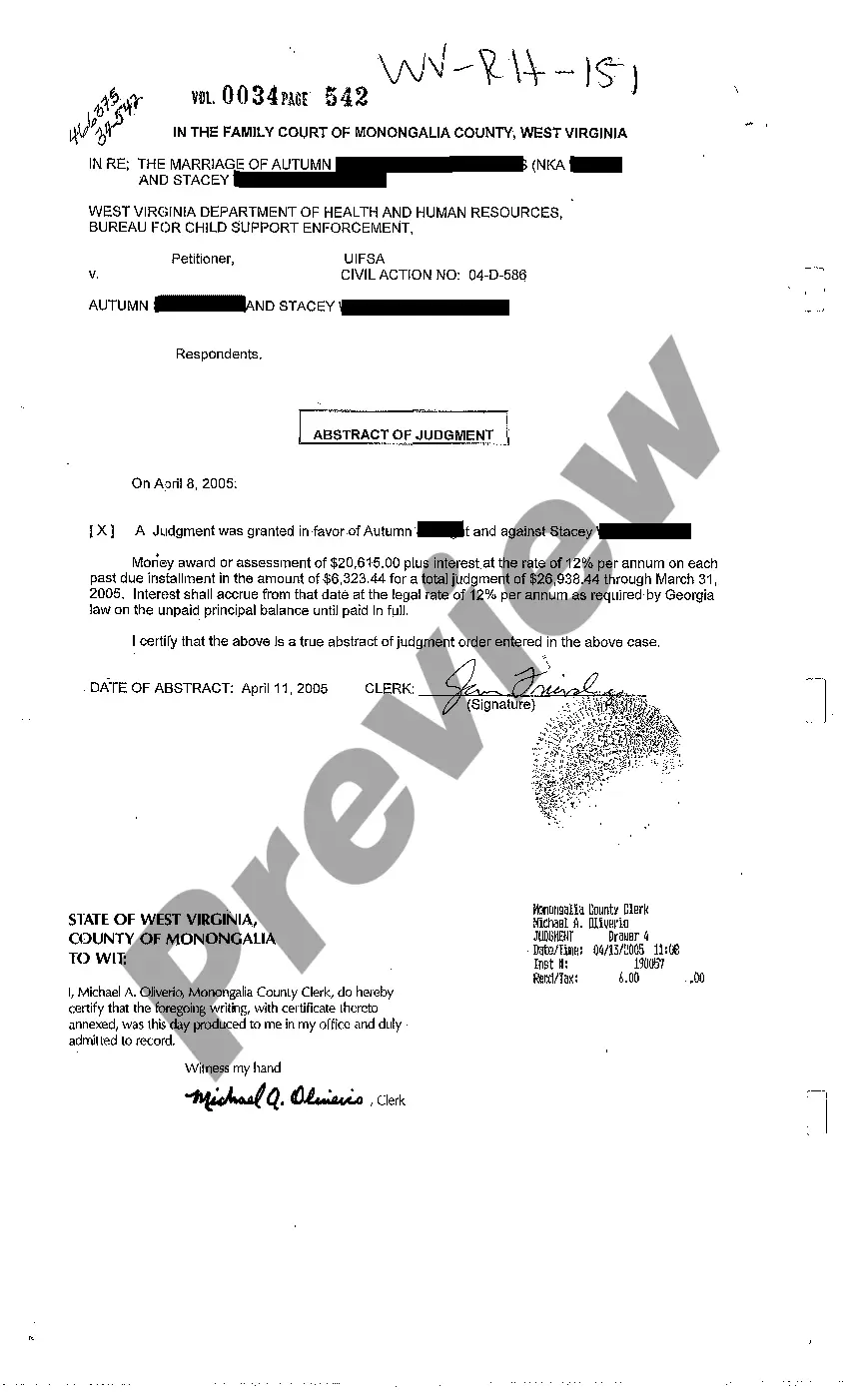

- Initial, make certain you have chosen the right papers design for the area/metropolis of your liking. Browse the develop outline to make sure you have chosen the appropriate develop. If available, utilize the Review option to check throughout the papers design at the same time.

- If you would like locate an additional variation in the develop, utilize the Search discipline to find the design that meets your requirements and demands.

- Upon having identified the design you would like, just click Buy now to move forward.

- Find the pricing strategy you would like, enter your qualifications, and sign up for a free account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful develop.

- Find the file format in the papers and download it in your device.

- Make modifications in your papers if necessary. You are able to comprehensive, edit and indicator and printing Nevada Building Loan Agreement between Lender and Borrower.

Down load and printing a huge number of papers web templates using the US Legal Forms web site, which provides the largest variety of lawful forms. Use professional and express-distinct web templates to tackle your business or specific demands.

Form popularity

FAQ

A loan agreement is a legally binding contract between the borrower(s) and the lender that states the terms of borrowing the loan, including the amount to be repaid, the interest rate, and any other conditions.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

Ing to the Corporate Finance Institute (CFI), an ICA can also be called an intercreditor deed. Thus, as per CFI, an Intercreditor Agreement is a legal document between two or more creditors.

A promissory note is essential in any transaction where money is being lent by a person, bank, company, or other organization to another entity. This document is a contract that protects the lender from the risk of the borrower not paying the full amount agreed to by both parties.

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

A loan agreement (also known as a lending agreement) is a contract between a borrower and a lender which regulates the mutual promises made by each party.